By Michael Msika, Bloomberg Markets Live reporter and strategist

Coming off a rough quarter and with clouds hanging over the continent’s economic outlook, stock investors aren’t getting excited about the remaining months of the year, which have historically been strong.

After three consecutive quarters of gains, the Stoxx 600 is set to end the July-September period with negative returns. The peak interest rate narrative has taken a hit as central banks continued to send hawkish messages, with more work likely needed to bring inflation back to the 2% target.

While the Stoxx 600 only experienced modest declines during the quarter, a heavy sector rotation has played out, with investors taking profit on winners from the first half of the year, such as luxuries, tech and travel, while soaring oil propelled energy stocks higher.

“It feels like a storm is coming,” says Freddie Lait, managing partner at Latitude Investment Management. Investors should “avoid very hot sectors or at least take some money off the table.”

The latest Bank of America fund managers survey showed that overall, they are still pessimistic in the near term. Some 63% of European-based investors predicted downside for the market in the coming months, a consequence of monetary tightening as well as earnings downgrades. The cautious view is echoed by strategists who see range-bound returns at best in the last quarter.

That would come as sharp contrast to the historical returns of the Stoxx 600. Seasonality shows that European equities’ perform best over the last three months of the year. October in particular can be volatile, but the benchmark ended with positive returns in 18 of the past 25 years. This year, however, more losses are likely before a potential rebound.

“A bottom for the stock market is likely to happen during the fourth quarter,” says Matthias Born, equity chief investment officer and portfolio manager at Berenberg. “Sentiment is getting more and more negative, flows are going to cash, positioning is low, which could also create a buying opportunity in a similar way to what we saw last October.”

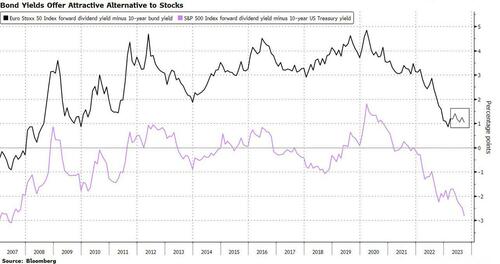

High rates remain a major problem for stocks, as bonds and cash are now offering a very competitive yield and less risk, especially if earnings estimates start to come down. That in turn would pressure valuations, making stocks more expensive than they currently look.

“Amid peak central banks’ hawkishness and downside risks to the economy, bonds are looking more reasonably priced now and increasingly attractive versus equities,” says Barclays strategist Emmanuel Cau. “History shows that yields tend to move lower after the Fed stops hiking rates, and if the low PMIs are indeed a reliable indicator of growth, equities could have catch-down potential” to bonds.

With no clear signs of recovery, economic surprises in Europe remain negative, while composite PMI has been in contraction since June. Still, earnings are showing resilience, providing a floor to equities, according to Cau. He expects earnings to determine the trajectory of the broader equity market, rather than the direction or the level of rates.

“Europe is facing macro headwinds with anemic growth and stubborn inflation,” says Andrew McCaffery, global CIO at Fidelity International in his third quarter view. “Activity is slowing and the outlook for equities is cloudy.”

Loading…

https://www.zerohedge.com/markets/it-feels-storm-coming-gloom-2023-confronts-upbeat-end-year-history