Authored by Michael Lebowitz via RealInvestmentAdvice.com,

The Fed’s next rate move and its “higher for longer” policy mantra are predicated on high and sticky inflation. Inflation has fallen nicely from its peak but not enough to sway the Fed to officially pause rate hikes and certainly not enough to begin reducing rates. As they remind us, rate cuts depend on meeting their 2% inflation goal. While unstated, a significant slowdown in economic activity or renewed regional banking problems would also get the Fed to act.

What if we told you that CPI is effectively at 2% now? Would the Fed’s policy stance remain the same?

The following article shares some insight into the CPI inflation report and distortions caused by its most significant contributor, shelter prices.

Might The Market Be Offsides?

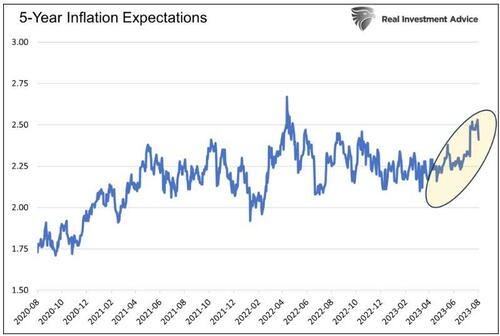

The bond market is starting to worry that the recent decline in prices may be short-lived. As we show below, 5-year inflation expectations have risen since late March. The increase is not overly concerning but is sparking fear amongst some longer-term bond investors that declines in inflation are in the rear-view mirror. They fear we are entering a long period of higher prices. Over the same period shaded below, 10-year UST yields rose from 3.40% to 4.20%.

We understand that the burgeoning budget deficit and associated borrowing needs drive higher yields, but expected inflation rates are equally powerful.

As you read this article, ask yourself, what would Fed monetary policy be if inflation was already at the Fed’s target?

CPI Shelter

Underlying the BLS CPI report is a massive amount of price data. Per Investopedia:

The CPI is based on about 80,000 price quotes collected monthly from some 23,000 retail and service establishments.

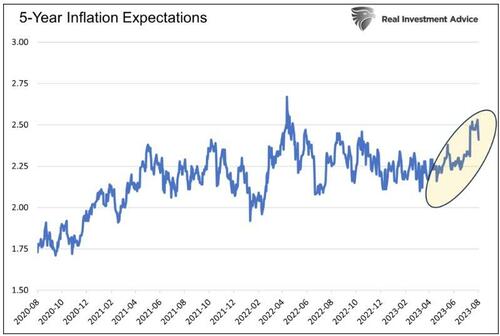

A small subset of the CPI report is shown below. The list is presented in a series of items and groups. For instance, Food and beverages account for 14.376% of CPI. Of that total, Food accounts for 13.531% of the 14.376%, and digging deeper, Food at Home contributes 8.728% of Food’s 13.531%.

Highlighted below are what the BLS deems Housing prices, accounting for 44.384% of CPI. Within Housing, Shelter representing 34.413% of CPI, is the largest sub-group. The two biggest components of Shelter are Rent (7.528%) and Owners Equivalent Rent (OER) at 25.424%.

Rent and OER

Rent or Primary Residence measures actual rental payments. OER, on the other hand, implies a hypothetical rent based on house prices. Both are extremely difficult to measure as every house, apartment, and location is unique. Further, since most houses are not on the market and less than 10% of rentals come up for rent renewal every month, the BLS must normalize the reams of data to create a consistent measure of prices for rent and OER.

As you might suspect, these calculations are exposed to significant inconsistencies and data risks. They also take quite a while to compile, audit, and compute. Consequently, shelter costs in the CPI report tend to lag behind what the private sector provides.

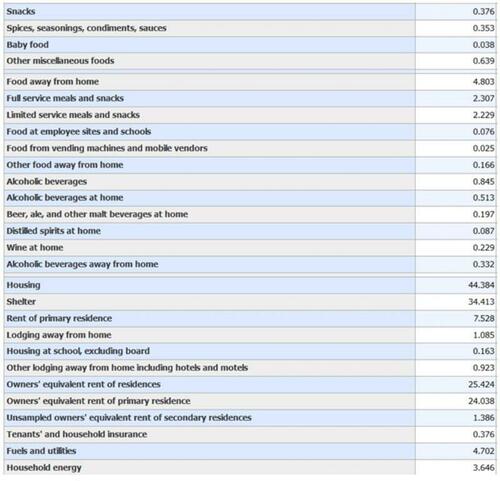

The table below shows some popular home prices and rent indexes. Their most current readings exhibit near zero percent inflation for the last 12 months.

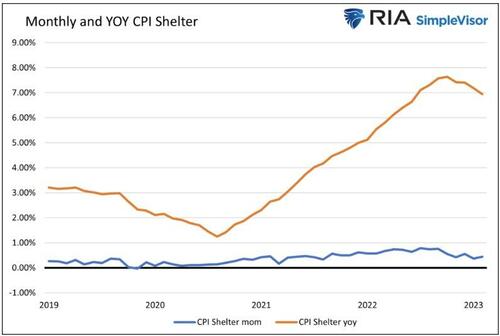

The following graph shows that unlike the non-BLS data above, the change in shelter prices is still high and has only just begun to decline. Most of the indexes above have been falling for the better part of the year.

CPI Excluding Shelter Prices

The CPI-Shelter price should be unchanged for the past 12 months if it was using real-time data. As such, we quantify what CPI would be without shelter prices to highlight how the lag affects the entire CPI number.

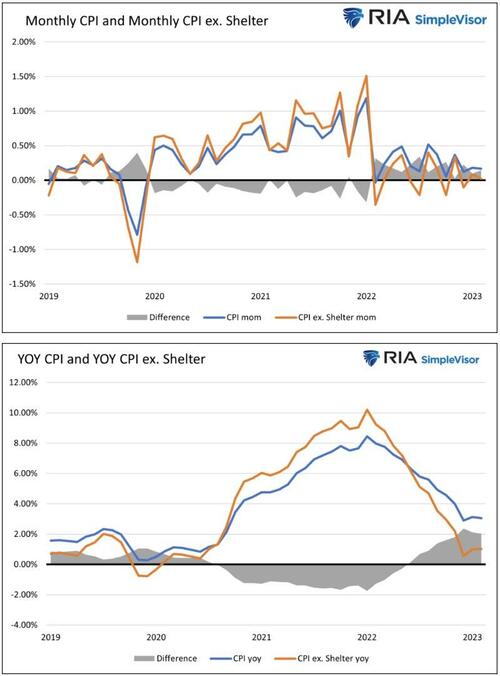

The next two graphs compare monthly and year-over-year CPI with CPI excluding shelter prices.

The last three months of CPI- excluding shelter, have averaged +0.001%. The year-over-year data show CPI, excluding shelter prices, is +1.19%. Compare that to the +3.1% reported last week. Also, note that shelter prices lagged when inflation was heating up. Not surprisingly, they are now lagging with inflation rates normalizing.

CPI with realistic OER and rent prices would be lower than the CPI excluding shelter numbers graphed above. Ask yourself:”What would Fed monetary policy be if inflation was at the Fed’s target?”

What About PCE?

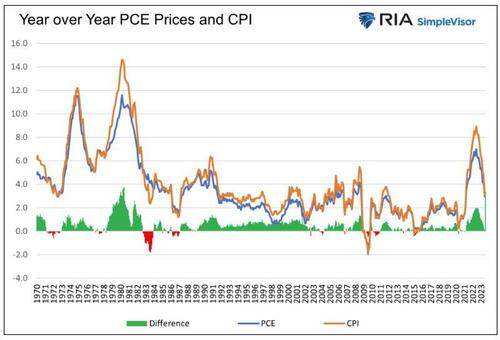

CPI is not the only measure of inflation the Fed uses. Personal Consumption prices (PCE) are equally important. And, unlike our analysis above, PCE prices are still elevated at 3% but like CPI falling quickly.

On average, since 1970, CPI has run half a percent higher than PCE. Furthermore, they tend to track each other closely, with neither index leading nor lagging.

Therefore, might we conclude that CPI and PCE will continue their paths lower when BLS shelter prices catch up to reality?

Summary

This article does not discuss the other 65% of prices used to compute CPI. Obviously, changes in those prices in the aggregate can outweigh the inevitable decline in shelter prices. But if we can presume that the prices of a third of the CPI index have stopped increasing, a significant catchup is enough to more than offset the recent increase in some prices.

If CPI continues to decline rapidly toward the Fed’s 2% target, the Fed will likely stop raising rates, and talk of cutting rates will enter its lexicon. We may be much closer to that day than the Fed, or most investors realize.

Loading…

https://www.zerohedge.com/markets/inflation-already-feds-target