Authored by Mike Shedlock via MIshTalk.com,

Previously, I wrote about new rules on mortgage rates in which the better your credit score, the higher your effective interest rates. This is an update…

New Rule: The Better Your Credit Score the Higher Your Mortgage Rate

Please consider New Rule: The Better Your Credit Score the Higher Your Mortgage Rate

Under the new rules, high-credit buyers with scores ranging from 680 to above 780 will see a spike in their mortgage costs – with applicants who place 15% to 20% down payment experiencing the biggest increase in fees.

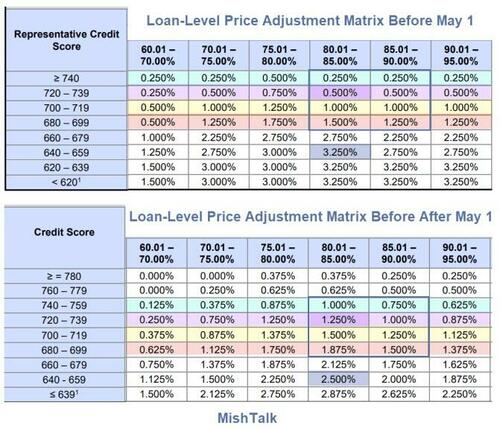

Loan Level Price Adjustments

Mortgage lender Fannie Mae added some new credit score ranges making some before-after comparisons impossible to calculate.

You can find the complete tables on Fannie Mae’s Loan-Level Price Adjustment Matrix page.

My lead chart shifted the columns so they line up making the credit score visualization easier.

Credit Score Matrix

-

Green: > 740

-

Pink: 720-739

-

Yellow: 700-719

-

Orange: 680-699

-

Blue: 640-659

Someone with a credit score 720-739 with a 20% to 25% down payment has a LLPA of 0.50% before May 1 and 1.25% May 1 or later.

That is a whopping three-quarter point difference.

The beneficiaries are those with worse credit ratings. For example, consider a drop from 3.25% to 2.50% for someone with a credit score of 640-659 and a down payment of 20% to 25%.

People will not notice a 75 basis point jump?

I beg to differ.

My 25 basis point example was not quite right

Charts coming up tomorrow.

— Mike “Mish” Shedlock (@MishGEA) April 19, 2023

The idea that people will not notice a three-quarter point hike seems preposterous.

How Many People Are Impacted?

Everyone with a credit score 680 and over is dinged. Everyone with a credit score below 680 is a winner.

This is truly incomprehensible to me. The average credit score is 710 so the average person takes a hit.

More specifically, Experion notes that only 35 percent of consumers have a credit score below 680.

Pandora’s Box

Well, this a Pandora’s Box that, once opened, will usher in all sorts of nightmares

Combine this w/ the recent California Dream For All home buying assistance program (funded by taxpayers) & the Marxist trend towards “to each according to his need” is becoming clearer & clearer

— Adam Taggart (@menlobear) April 19, 2023

The Lower Your Credit Score Strategy

Excellent point by Mike England except change “default” to “late pay” for a few months. https://t.co/uCMZL66n21

— Mike “Mish” Shedlock (@MishGEA) April 19, 2023

Dangerous and Misguided

1/3 This rule to impose fees on homebuyers with high credit scores in order to subsidize access to lower-quality credits is so obviously misguided and DANGEROUS, it makes you wonder what the real objective is here…??

— steph pomboy (@spomboy) April 20, 2023

3/3 And NOW is the time to encourage stretched would-be-homeowners to enter the market??? It’s almost as if they WANT to drown people in negative equity. Or maybe to further enervate the banking system to allow for a larger takeover? I’m honestly lost.

— steph pomboy (@spomboy) April 20, 2023

Is This Screw Job On Mortgage Pricing Even Legal?

Yes, we have graduated income taxes and that is legal. We also have adult prices vs kids prices for numerous things. And we have things like senior citizens days.

But can we legally charge someone more for a loaf of bread if they make too much money? Similarly, can we unjustly penalize people because their credit score is too good?

I don’t know.

But I do know blatant woke stupidity when I see it. Expect someone to file a lawsuit.

California Utilities Seek to Charge People Based On Income, Not Energy Usage

Meanwhile, please note California Utilities Seek to Charge People Based On Income, Not Energy Usage

Under a new utility proposal, monthly bills in California will include a fixed charge based on household income. The proposal is Marxist agenda.

And under this inane proposal people may pay for services they do not use at all. Expect a legal test of this too, assuming the bill passes.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Loading…