By Ven Ram, Bloomberg Markets Live reporter and strategist

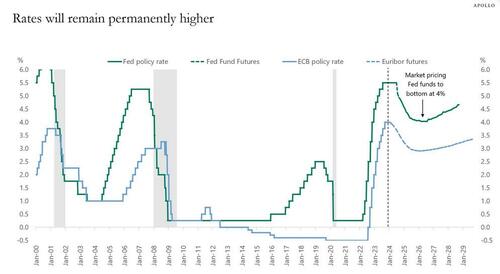

Treasuries at the back end of the curve may find it hard to keep extending their rally from last week as the Federal Reserve pushes into the last lap toward its inflation target.

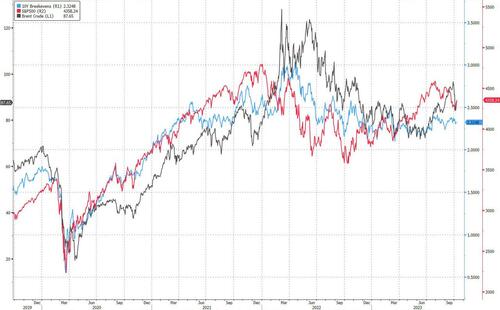

For four months now, the US economy has seen successive readings in which headline inflation has been 3%-something, with the last two creeping up toward 4%.

And with Brent crude nudging past $90 a barrel again and threatening to spiral away on the back of tensions in the Middle East, the risk to inflation is clearly on the upside.

Federal Reserve Chair Jerome Powell takes the floor of the Economic Club of New York this week, and he would probably say rates in the US are restrictive enough and that the central bank will wait for its cumulative rate increases so far in this cycle to funnel through to the economy even as policymakers are willing to do more if needed to quell inflation.

By all measures, the Fed’s most ambitious policy tightening in decades, you would think, ought to have been felt by now in the real economy. After all, the Fed can boast of a ex-ante real policy rate of 290 basis points, which by almost any yardstick represents a sharply restrictive regime. Yet, the labor market is still tight and the jobless rate is around levels where the news is as good as it gets.

One key reason: if the economy is going to be resilient and if artificial intelligence is going to spur growth in productivity, the neutral rate — the rate that doesn’t stoke inflation while keeping the labor market steady — may be tipped higher. Quite tellingly, expectations about price pressures as represented by forward inflation swaps haven’t moved an iota lower since the Fed started raising rates.

Which is why the dash toward duration hasn’t paid off yet. In a world where inflation is 3.7% and biased upward perhaps, it’s not too hard to envisage a 10-year yield around 4.7%. That is indeed far grimmer than it appeared just a few months ago.

Loading…

https://www.zerohedge.com/markets/if-inflation-37-and-oil-rising-treasuries-cant-rally