It’s not the first time we’ve seen raging “vol up, spot up” action in markets, driven by a “upside chase” stampede as bulls panic buy both stocks and calls amid growing markets FOMO (ironically, driven by retail investors); in fact, one can argue that a meltup in both the vix and stocks has been a trademark feature of every S&P rally (and arguably, a catalyst) since the start of the year (as we observed all the way back in January). But the latest iteration is truly a sight to behold.

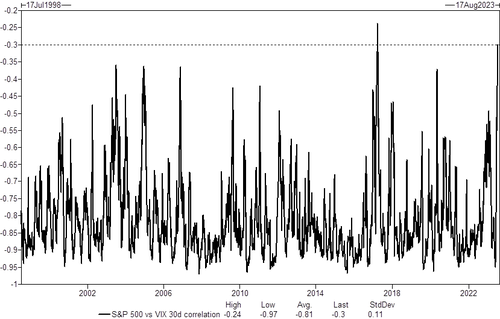

In his Monday EOD note, Goldman trader John Flood observed that amid the “extremely quiet flows” which are especially conducive to meltups and gamma squeezes, “calls have outpaced puts for 35 sessions straight”, including Monday with 22 million calls trading vs 16 million puts. And, picking up where he left off the last time we discussed the surge in the vol up, spot up correlation, Flood said that “we continue to see spot up-vol up with SPX and VIX 30d correlation now at a top 3 high over the last 25yrs.”

Loading…

https://www.zerohedge.com/markets/historic-spot-upvol-chase-amid-multiple-unprecedented-developments-derivatives