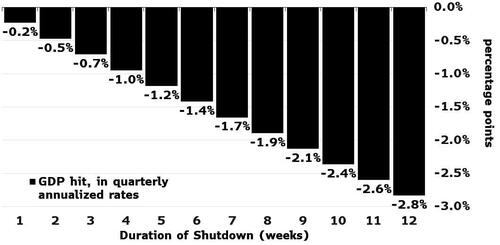

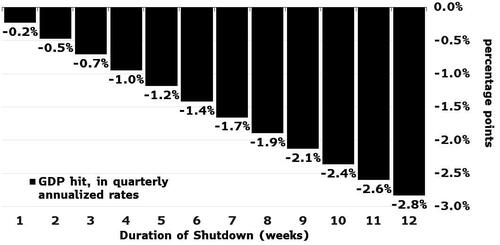

Last week we laid out what the economic consequences of a lengthy government shutdown would likely be, among them a drop in GDP and a spike in the unemployment rate perhaps sufficient to push the US economy into recession, not to mention a halt in most economic data reporting..

… but ahead of the Sept 30 midnight drop dead date, there is still some confusion so let’s recap the main points, the first of which is that a government shutdown should not be confused with the debt ceiling and its potential for a sovereign default.

As JPM writes in its latest shutdown note, if no deal is reached by Oct 1 – which is now certainly the default case – then a continuing resolution is one of the more likely paths, but should a CR remain in place by Jan 1, 2024, then there will be an automatic cut to military/defense spending.

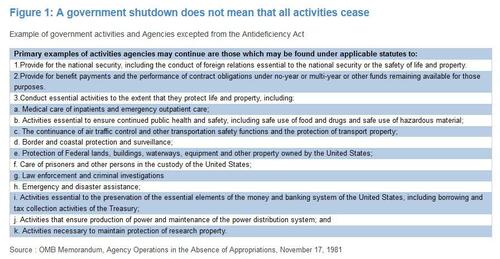

A government shutdown does not actually shutdown all aspects of the government, as many elements are exempted. In addition to the items listed below, JPM assumes that Departments of Defense, Health and Human Services, Homeland Security, State, and the Social Security Administration continue to make payments.

Some more details on the economic impact

- The 5-week shutdown from 2018-19 reduced real GDP by $11bn or 0.3%; $3bn of that $11bn was likely non-recoverable once the government reopened.

- In the past events, the 10Y yield has dropped both ahead of the shutdown (beginning as many as 15 days ahead) and throughout the shutdown.

What about Equities?

JPM’s Mkt Intel desk finds that if you one uses the bank’s sample size of shutdowns lasting more than one business day, the SPX fell 2.5% in the 10 days leading up to the shutdown with Tech and Real Estate the biggest laggards.

- If the shutdown reaches the 10-day mark, the SPX will have rebounded by ~2% led by Cyclicals and Tech the only major sector producing a negative return.

- Once a resolution is reached, the SPX trades up 80bps at the 10-day mark, +3.6% at the 30-day mark, and +5.9% at the 90-day mark.

- 10-day mark: SPX +0.8% and top 3 sectors are Industrials (+2.4%), Staples (+1.9%), and Utilities (+1.3%)

- 30-day mark: SPX +3.6% and the top 3 sectors are Industrials (+5.2%), Healthcare (+4.9%), and Utilities (+4.5%).

- 90-day mark: SPX +5.9% and the top 3 sectors are Tech (+9.8%), Industrials (+8.1%), and Materials (+7.9%).

Finally, courtesy of Bloomberg, here is a summary of what government services would stop on Oct 1, and what would go on:

Not all services would abruptly stop. Medicare payments and efforts to safeguard nuclear weapons would be unaffected. You’d likely still get mail and be able to travel on Amtrak. You wouldn’t, however, be able to get married in DC courts.

Many federal employees are likely to be furloughed, but some will be deemed “essential” and work without pay until the shutdown ends. The last major shutdown in 2018-2019 lasted 35 days.

The Office of Management and Budget has collected agency contingency plans that outline what happens in the event of a shutdown. Here are some highlights:

Labor

Federal Reserve

- Federal Reserve activity would be unaffected, meaning the central bank could still raise interest rates at its next meeting Nov. 1.

Financial Regulators

- The Federal Trade Commission would stop “the vast bulk of its competition and consumer protection investigations.”

- The Securities & Exchange Commission wouldn’t review or approve registrations from investment advisers, broker-dealers, transfer agents, rating organizations, investment companies and municipal advisors.

IRS

- The Internal Revenue Service has yet to release plans for this potential shutdown. Previous plans said the agency would use funds from President Joe Biden’s Inflation Reduction Act to keep employees paid and working. A union representing IRS workers has said new plans are being discussed that would involve some furloughs.

- Businesses and individuals who requested six-month extensions for their tax returns in April are still required to file by Oct. 16.

Emergency Relief

Energy & Environment

- The Interior Department would retain limited discretion to issue permits for energy projects on federal lands and waters when user fees are attached.

- A funding lapse would paralyze other work to develop required environmental analyses for energy projects, highways and other infrastructure.

- The Environmental Protection Agency may be able to continue some IRA-funded activities as well as other exempted work, such as settlement-funded cleanup at some Superfund sites.

- The White House has warned most EPA-led inspections at hazardous waste sites, as well as drinking water and chemical facilities, would stop.

- The Energy Information Administration, which publishes snapshots of US oil inventories and fuel demand, would continue to collect and publish data on schedule — at least initially.

- The National Nuclear Security Administration would focus on “maintenance and safeguarding of nuclear weapons; international non-proliferation activities; and servicing deployed naval reactors.”

- The Nuclear Regulatory Commission would stop licensing, certification and permitting and inspection activities, along with emergency preparedness exercises.

Transportation & Travel

Defense

- Efforts “to defend the nation and conduct ongoing military operations” would continue, but most civilian Defense Department employees would be on furlough.

- Burials and tours at Arlington National Cemetery would continue.

Health & Social Security

- Covid-19 response and research, including vaccine and therapeutic development, would carry on under the Department of Health & Human Services.

- The National Institutes of Health might have to postpone clinical trials for diseases like cancer or Alzheimer’s, according to the White House.

- Medicine-price negotiations could be sent into disarray, as some drugmakers face an Oct. 2 deadline to report data to Medicare for use in determining new prices.

- Food stamps for low-income people, the disabled, and others could be delayed.

- Social Security checks would be delivered, and applications for benefits processed, but people would not be able to verify benefits or replace Medicare cards.

Parks

Housing

- “Nearly all” Department of Housing and Urban Development fair housing work would stop, as would some monthly subsidy programs, including potentially for public housing operations.

- HUD’s work for the Federal Housing Administration’s insured mortgages portfolio and Ginnie Mae’s work in the secondary mortgage market would be unaffected.

Commerce

- Review or issuance of loans under the Small Business Administration would cease, including those for women-owned and service-disabled, veteran-owned small businesses.

- Commerce Department collection of decennial census data probably would continue, as would forecasting and warnings around weather, water, and climate.

Loading…

https://www.zerohedge.com/markets/here-what-stops-and-what-doesnt-when-government-shuts-down-weekend