Not too long ago, investors – especially “smart”, fast money – loved plunking money in China, especially during painful drawdowns.

Not this time: according to Bloomberg, global investors have sold China’s blue-chip stocks during the longest stretch of outflows on record, signaling that even the nation’s “blue chip” leaders are falling out of favor as the neverending rout deepens.

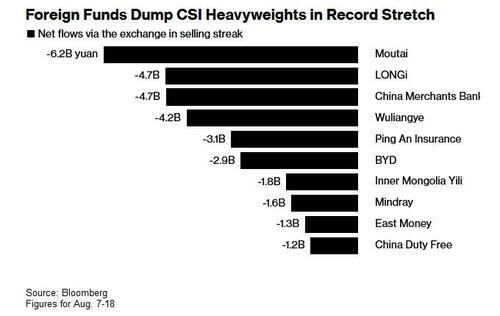

According to the latest flow data on individual stocks available on Bloomberg, foreign investors sold 6.2 billion yuan ($851 million) of liquor giant Kweichow Moutai during Aug. 7-18, making China’s largest liquor maker the most heavily sold stock via trading links with Hong Kong. It was followed by 4.7 billion yuan of selling each for leading renewables stock LONGi Green Energy Technology Co. and major lender China Merchants Bank.

The 10 most-sold stock by foreigners in the latest rout were among the 50 largest ones on the CSI 300. Major distiller Wuliangye Yibin, Ping An Insurance Group of China, and EV maker BYD saw selling of at least 2.9 billion yuan each through Aug. 18.

In total, overseas funds offloaded the equivalent of $10.7 billion in Chinese shares in a thirteen-day run of withdrawals through Wednesday – the longest since Bloomberg began tracking the data in 2016 – as they fled the mainland market. The departures comes as a prolonged housing slump raises the risk of broader financial contagion, making the nation’s equity benchmark among the worst global performers this month with a nearly 8% loss.

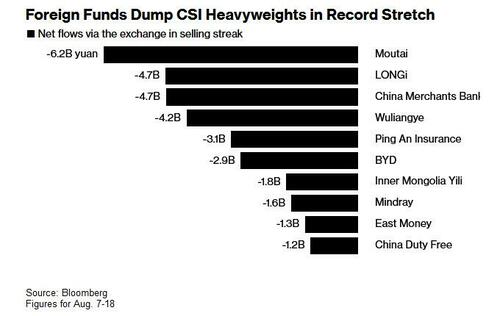

Goldman’s Prime Brokerage group made a similar observation, finding that hedge funds net sold Chinese stocks for 3 straight sessions and in 12 of the 16 days MTD. In cumulative notional terms as seen on the Prime book, this month’s net selling in Chinese equities – onshore and offshore combined – is approaching record levels vs. monthly net flows of the past decade.

Importantly, long liquidations accounted for more than 70% of the notional net selling MTD. This month’s notional long selling already exceeds the levels seen in Aug ’21 and Jul ’15 and is on track to be the largest over the past decade.

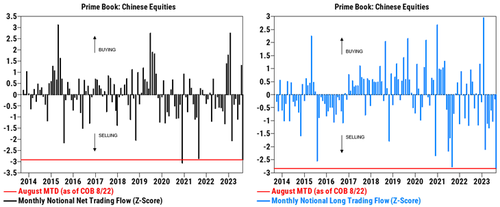

Including the August MTD activity, hedge funds have now reversed all of the cumulative notional net buying in Chinese stocks from Nov ’22 to Jan ’23 (aka “the reopening trade”). Since the start of February, ~56% of the cumulative notional net selling has ben driven by A-shares with the remainder roughly split between H-shares and ADRs.

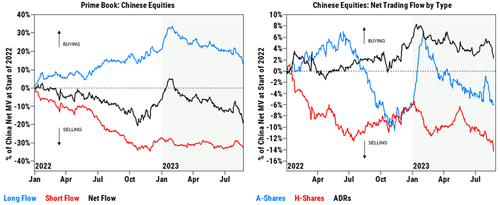

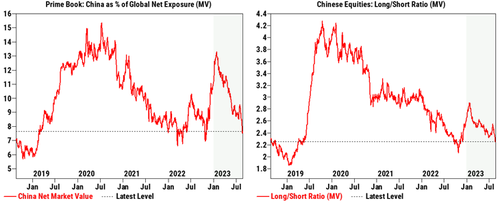

Chinese equities collectively now make up ~7.6% of global net market value on the Prime book, vs. 9.5% at the start of August and 11.2% at the start of 2023, the lowest level since early November and in the 14th percentile vs. the past five years. Aggregate long/short ratio in Chinese equities now stands at ~2.2 (vs. ~2.7 at the start of 2023), also at the lowest level since November and in the 14th percentile vs. the past five years.

The CSI 300 Index is now trading at its lowest since November as optimism of another stimulus following the July Politburo meeting quickly evaporated, even as China’s social mood is turning uglier by the day amid record youth unemployment which is rising by one percent every two months. Foreigners had moved into the market en masse back then, only to leave again now in droves as economic data continue to disappoint and stimulus fails to impress.

A separate Bloomberg analysis showed that emerging market funds have also turned more bearish on Chinese stocks, deepening their average underweight position to almost 100 basis points as of the second quarter from 24 basis points three months earlier. They were overweight by 40 basis points as of end-2022.

The selling streak is showing little sign of cooling, and on Wednesday overseas funds shed another 10.5 billion yuan. A top-performing Chinese macro hedge fund blamed global capital for sinking the country’s stocks, calling them a “bunch of aimless flies” that stir up market volatility. The silver lining is that foreign funds own less than 4% of total A-shares outstanding, according to a report this month from China International Capital Corp. Of course, by the time they are gone, the financial assets of the Chinese population will be worth a fraction of what it is now.

Loading…

https://www.zerohedge.com/markets/hedge-funds-dump-record-amounts-chinese-stocks-longest-selling-stretch-record