A slew of positive labor market data (and an upside surprise for ISM Services – even though Services PMI slipped) was just enough ‘good’ news to be bad for markets… all markets.

US labor market data has serially surprised to the upside in recent weeks. So much so in fact that in the face of The Fed’s tightening, the jobs data is now at its most positive since 2012…

Source: Bloomberg

Small Caps were clubbed like a baby seal today as the entire US equity complex was dumped on the good jobs news. After Europe closed, the machines managed to lift the majors well off their lows with Nasdaq and The S&P leading the rebound. However, they all ended lower on the day…

Notably, there has been a regime shift in the stock market’s response to higher rates with Defensives outperforming Cyclicals…

Source: Bloomberg

For context, the 2Y yield is unchanged since right before SVB’s collapse… and the S&P is up around 400 points…

Source: Bloomberg

Treasury yields were higher across the curve today but the action was very mixed with the belly underperforming and the wings (2Y and 30Y ending up the least ugly horse in the glue factory)…

Source: Bloomberg

The 10Y yield broke back above 4.00% and 2Y yield smashed back above 5.00% running the stops above pre-SVB cycle highs before fading back lower…

Source: Bloomberg

Intraday, the 2Y yield reached its highest since July 2006…

Source: Bloomberg

The yield curve immediately crashed back near its most inverted levels of the cycle. But that didn’t last long as the short-end was bid and the curve actually ended steeper on the day…

Source: Bloomberg

The 30Y mortgage rate surged this week to its highest since November…

Source: Bloomberg

The dollar ended marginally higher after fading back from the huge gappy spike after the jobs data…

Source: Bloomberg

Bitcoin kneejerked higher overnight (topping $31,500) before reversing all those gains and some, testing back below $30,000…

Source: Bloomberg

Gold puked back near last week’s lows…

Oil prices ended marginally higher after puking on the jobs data then ramping on inventory draws…

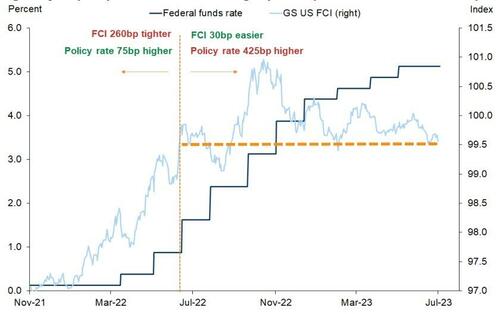

Finally, Goldman’s Tony Pasquariello dropped a totally striking chart earlier this morning. Essentially, he explains, financial markets had front-loaded the Fed tightening cycle.

Financial conditions are in the same place today as they were when the target rate was just 0.75% (before the Fed started blasting away in 75 bps clips).

The moral of the story here: the long and variable lags of tighter policy may not be SO threatening anymore (famous last words, we know).

Loading…

https://www.zerohedge.com/markets/good-job-news-sparks-bad-news-battering-bonds-big-tech-banks-bullion-bitcoin