Ahead of last month’s expiry, we quoted Goldman’s derivative guru Brian Garrett who corrected predicted that the market had felt like a coiled spring (“tightest 1 month hi/low band in years”) and – lo and behold – 4 few weeks later and the market has soared more than 200 handles higher, trading at the highest level since early 2022.

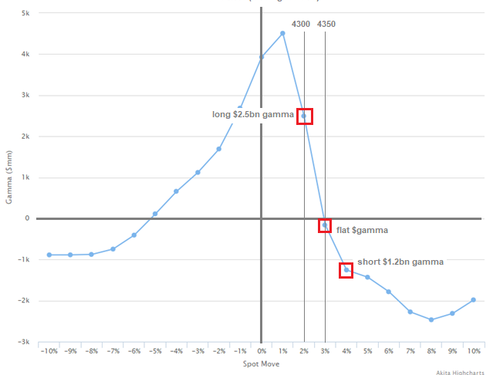

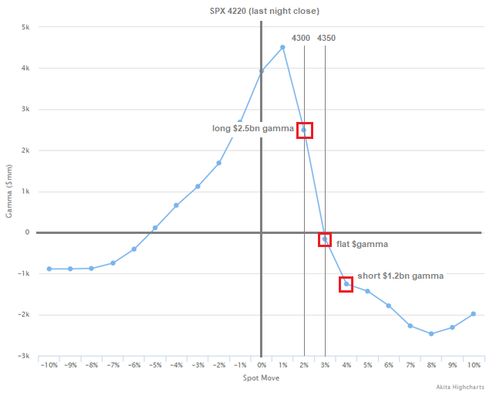

Fast forward to today, when in his latest opex discussion (available to pro subscribers here), the Goldman trader looks at what may happen next and writes that a lot of heavy lifting has happened and with SPX ripping north of 4200 in a very short period of time, “there is VERY little option gamma to potentially trade against this market momentum.” Indeed, as we warned last week, dealers are long left tail and “not long” right tail, especially after today’s June expiry.

Loading…

https://www.zerohedge.com/markets/goldman-trader-who-correctly-called-meltup-today-we-are-seeing-extremely-rare-setup