“…there remain vulnerabilities in the system of MBF [market-based finance], which could crystallise in the context of the current interest rate volatility…and pose risks to financial stability.“

Those are the somewhat ominous words from a recent Bank of England report, that highlighted one of the bigger vulnerabilities of the global financial system being a US hedge fund trade that is staging a comeback after nearly blowing up the Treasuries market in 2020.

The report comes two months after we highlighted the fact that the familiar systemic crisis ghost has made a surprise re-appearance: the trade that led to the repo crisis in Sept 2019 and also brutally exacerbated the crisis of March 2020 when for several days the Treasury market had zero liquidity, is back and is looking to blow up a whole new generation of clueless rates traders.

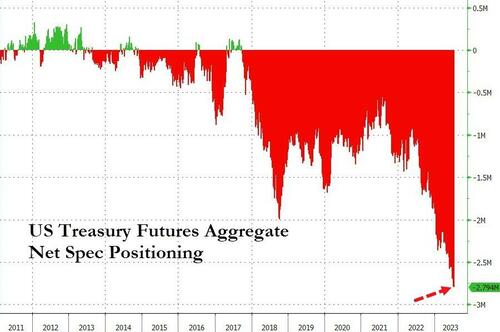

That’s right: the Treasury cash-futures basis trade, which as we profiled in detail in March 2020, led to record losses among the pair-trading hedge fund community, and prompted the Fed to inject trillions in liquidity into the market to avoid a catastrophic collapse (and where the covid pandemic and crash conveniently served as a perfect “just in time” decoy to allow Powell to do just that), has returned according to BBG’s Garfield Reynolds who notes that “the recent surge in leveraged positions betting that Treasury futures will fall … smacks of so-called basis trading.“

The trade, a variant of which first claimed LTCM and its roster of Nobel-prize winning idiots back in 1997, earns tiny nominal returns (when all goes according to plan) so funds use cash borrowed from the repurchase agreement market to leverage up positions and juice their wagers. The problem is that when not everything goes according to plan, the blows up are absolutely epic since this is the same strategy that led to career-ending losses on investors in March 2020, drying up liquidity not just in Treasuries but also in other money markets key to the smooth functioning of the financial system.

Similar to mid-2019 and early 2020, the current environment favors buying the cash bonds and selling futures against them, thanks to strong asset-manager demand for the derivatives and an increased public supply of Treasury securities as the Federal Reserve sheds its holdings.

The problem is that such basis trading distorts how speculators respond to economic data, making it harder for other investors to read signals from the bond market as a guide to the US outlook.

And this week, the BoE added its voice to the growing concerns over the potential exposure to this trade, saying the risks associated with these trades have mostly not been tackled by regulators.

“Vulnerabilities remain in the system of MBF. For instance, over recent months, leveraged hedge funds have built up large positions in US Treasury futures, which market intelligence suggests are relative to bonds or swaps. If these markets were to move sharply, deleveraging these positions could further amplify stress.

These risks, and other underlying vulnerabilities in the system of MBF identified by the FPC and financial stability authorities globally, remain largely unaddressed and could resurface rapidly.“

In other words, the massive short-positioning in futures is not simply traders betting that bond prices fall, it is dominated by ‘arbs’ holding long cash bond positions against the short futures – in the hopes of hoovering up those pennies in front of the liquidity steamroller.

The last time this shitshow exploded – in March 2020 – The Fed was forced to step in to prevent the doom loop, and, as The FT reports, since then there have been lots (OFR) and lots (BIS) and lots (FSB) and lots (IMF) and lots (Pimco) and lots (NY Fed) of postmortems.

“There was a point in time when we were wondering if the bond market would really ever function again,” says Nick Maroutsos, co-head of global bonds at Janus Henderson, an investment group.

“If it continued for a couple of weeks, we were thinking we were looking at doomsday.”

It’s not just the Bank of England, since as we reported in May, officials in the US at the SEC and The Fed have questioned prime brokers about the basis trade.

“Further action is needed by international and domestic regulators to increase the resilience of market-based finance,” the BOE said.

“Given the underlying risks remain significant and could resurface, completing this policy work and implementing it across jurisdictions is urgent.”

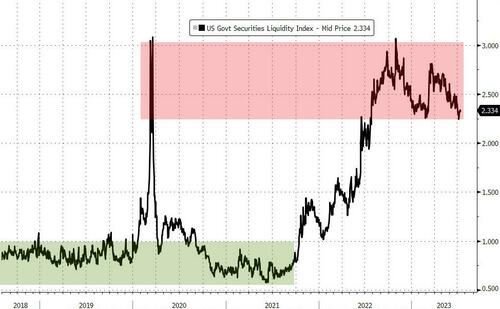

As shown below, a Bloomberg index of Treasury-market illiquidity has been hovering near levels last seen at the peak of the pandemic for the better part of the past year. This means that a sudden spasm in the basis trade would lead to catastrophic results at a far faster pace.

Source: Bloomberg

While this topic tends to go right over most people’s heads, the bottom line is simple enough: wrong-way bets on Treasury futures – inspired by a record pile up in a popular if deadly basis trade – are near the highest they’ve ever been (open interest in the pivotal five-year futures is at a record), while liquidity has almost never been worse.

“In particular, the recent sharp transition to higher interest rates and currently high volatility increases the chance that vulnerabilities in [the market] could crystallise and pose risks to financial stability.”

In other words, the Bank of England has a point – brace!!

Loading…

https://www.zerohedge.com/markets/ghost-crisis-past-re-appears-bank-england-warns-financial-stability-risks-treasury-basis