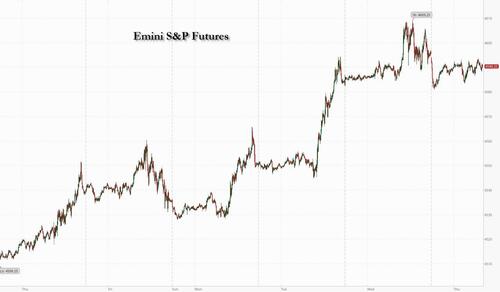

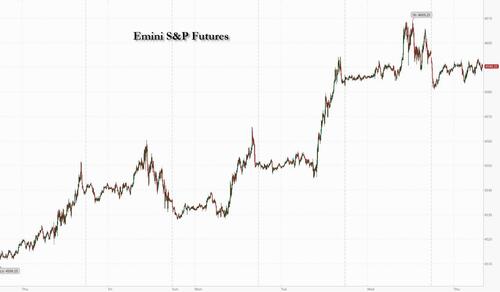

US equity futures are lower as tech stocks struggle after some disappointing earnings updates from the sector. At 7:30am ET, S&P futures are down 0.2% while Nasdaq futures slide 0.8% as Tesla drops 3% in the premarket after Q2 profitability shrank, and Elon Musk said Tesla will have to keep lowering the prices if interest rates continue to rise. Months of markdowns have already taken a toll on automotive gross margin, which fell to a four-year low in the second quarter. Netflix tumbled over 6%, its biggest intraday decline since December, after missing sales estimates and projecting third-quarter revenue that fell short of Wall Street estimates suggesting a crackdown on password sharing and a new advertising tier aren’t yet delivering the sales growth analysts anticipated. The rest of the Magnificent Seven are also lower while premarket bright spots includes airlines and banks. European chipmakers are also on the back foot after a cautious outlook from TSMC. Elsewhere, Treasury yields have climbed across the curve, while the dollar has drifted lower. Gold, oil, iron ore and bitcoin prices all increased. The macro data focus is on Leading Indicators, Jobless Claims, Philly Fed, and Existing Home Sales.

In premarket trading, Taiwan Semiconductor’s US shares declined 2.7% in premarket trading after the main chipmaker for Apple and Nvidia cut its annual outlook for revenue and postponed the start of production at its signature Arizona project to 2025. shares of electric-vehicle makers dropped after Tesla warned of more hits to its already-shrinking profitability, saying it may need to keep lowering the prices of its vehicles. Lucid -1.2%, Rivian -2.1%. Carvana shares rose 1.6%, set for a more muted gain for the massively shorted online used car retailer, which has soared more than 1,000% this year. The rise was tempered as RBC Capital Markets downgraded the stock to underperform from sector perform. Catalent shares rose 8.8% in extended market trading Wednesday after Bloomberg News reported that Elliott Investment Management has built a significant stake in the drugmaker and is pushing for changes to the company’s board. Here are some other notable premarket movers:

- Discover Financial Services slumped 13% in late trading Wednesday after the lender disclosed that it was in discussions with regulators over how it misclassified some of its credit cards.

- Equifax tumbled 5% postmarket Wednesday after the credit reporting agency announces third quarter adjusted earnings per share and revenue forecasts that trailed the average analyst estimate.

- IBM shares dropped 1% in extended Wednesday trading, after the tech company reported second-quarter revenue that missed expectations.

- Netflix shares fell as much as 7.8% in premarket trading after the streaming-video company gave a revenue forecast that missed expectations as its crackdown on password sharing and a new advertising tier aren’t yet delivering the anticipated boost to sales. If the premarket losses hold, Netflix will be set for its biggest drop of the year.

- Tesla shares fell as much as 4.2% in premarket trading as the world’s most valuable carmaker warned that hits to margins are likely to keep coming. Analysts were concerned about pressures on the company’s operating margins as the electric-vehicle maker left the door open to further price cuts in the second half of the year.

- United Airlines climbs 3.1% in premarket trading after narrowing its adjusted earnings per share outlook for the full year, exceeding Street estimates. Analysts reacted positively to the result, noting the boost to the carrier from international travel. Peer American Airlines is also higher in the premarket session.

Traders are hitting the pause button on a blistering rally that has taken the tech-heavy Nasdaq 45% higher this year, outpacing the S&P 500’s 19% rise, on irrational exuberance about the potential for artificial intelligence. Such returns on the back of a handful of tech stocks are “overdone” and may be the precursor to a downturn, Aegon Asset Management strategist Cameron McCrimmon warned. “The breadth of returns on the S&P 500 has become increasingly narrow, driven by a few mega-cap tech stocks on AI optimism, which is a classic sign of an ageing bull,” he wrote in a note adding that a US recession is likely this year as central banks persist in tightening policy, and strangling economies, until inflation returns to their 2% targets.

US Treasuries fell, pausing a rally sparked by speculation that easing inflation would give the Federal Reserve room to wind down its rate tightening cycle. Investors also weighed the potential for agricultural commodities to drive inflation higher. Wheat prices extended their biggest daily surge in a decade on Wednesday after Russia warned that any ships to Ukraine would be seen as carrying arms.

In Europe, European tech stocks including ASML Holding NV slumped after Taiwan Semiconductor Manufacturing Co. cut its outlook. However, gains in mining stocks such as Anglo American whose second-quarter beat helped the Stoxx 600 rise 0.2%. Here are the most notable European premarket movers:

- Anglo American shares gain as much as 5.7% after the precious metals miner reported production for the second quarter that beat the average analyst estimate

- Hikma Pharmaceuticals shares jump as much as 9.4%, the biggest intraday gain since Sept. 28, with Barclays noting the UK-based injectable-drug firm could see a boost after its US rival Pfizer saw one of its factories damaged by a tornado

- Babcock shares rise as much as 11% as analysts welcome the defense outsourcing company’s medium term guidance with a margin of at least 8%

- Saab shares rise as much as 4.3% after the Swedish defense and aerospace group reported second-quarter results that Citi called strong, and raised its full-year sales guidance

- Publicis shares rise as much as 4.7%, after the French advertising group’s organic growth beat expectations and it raised its guidance for 2023 organic revenue growth

- ABB shares rise as much as 3%, reversing an earlier 2% loss, as the Swiss electrical components manufacturer’s 2Q margin beat and improved guidance offset fears of slowing order momentum. The result should lead to consensus upgrades, Citi analyst predicts

- Alfa Laval gains as much as 7%, after the Swedish industrial equipment maker’s order intake in the second quarter impressed, with analysts seeing slight consensus upgrades ahead

- Boliden drops as much as 13% after recording what Morgan Stanley describes as a “wide” operating profit miss, despite the Swedish mining company already having lowered expectations

- Electrolux shares fall as much as 16%, most since 2011, after the Swedish home appliances maker’s 2Q earnings widely missed expectations

- Metso drops as much as 9.4%, the most for the mining-equipment supplier’s shares since March 2022, with analysts highlighting a miss on orders even as profit was above expectations

- Volvo Cars shares fall as much as 7.4%, the most intraday since April 5, after the automaker reported second-quarter operating income that missed analyst estimates

- EasyJet shares fell as much as 3% as investors turned their attention to the remainder of the year after the low-cost airline’s third-quarter results beat estimates

Earlier in the session, Asian stocks traded mixed as Beijing’s latest vow (it’s now a daily thing) to support private businesses failed to provide a significant boost to investor sentiment. The MSCI Asia Pacific Index closed in the red, paring an earlier rise of as much as 0.5%. Tech was the biggest drag as disappointing earnings reports from Tesla and Netflix pulled Nasdaq 100 futures lower. Also, chip giant Taiwan Semi slashed guidance and said it expects full-year sales to decline 10% in USD terms, a bigger decline than the company guided earlier. Japanese benchmarks led losses around the region as the yen strengthened. Hong Kong gauges pared gains while key Chinese measures swung to losses as Beijing’s pledge to treat private companies the same as state-owned enterprises underwhelmed the market. Investors await more concrete support measures after the slower-than-expected second-quarter growth figures.

While Beijing’s latest overture is a positive sign, “the actual impact really takes time to see and the confidence of the private sector can’t be changed overnight,” said Willer Chen, senior research analyst at Forsyth Barr Asia. Benchmarks rose in Taiwan, the Philippines and Indonesia, while South Korea’s Kosdaq small-cap stock index was among the region’s biggest gainers after renewing its year-to-date high. Thai stocks dipped after capping their longest winning streak since the start of the year on hopes the nation will soon have a new premier and government. Japan’s Nikkei 225 was the worst performer after the latest trade data showed weaker-than-expected exports and a wider contraction of imports, although the trade balance returned to a surplus for the first time in almost 2 years. Australia’s ASX 200 was positive with the mining industry underpinned after the world’s largest miner BHP reported higher quarterly iron ore output and with its full-year production at a record high, while the latest jobs data topped forecasts but could also be seen as a double-edged sword with further scope for the central bank to hike rates.

In FX, the Bloomberg Dollar Index is down 0.1%, having pared most of an earlier drop. The Aussie is one of the best performers after jobs data came in better than expected, rising 0.9% versus the greenback. The offshore yuan advanced 0.7% against the dollar and was the best performing currency in Asia after the People’s Bank of China stepped in Thursday, setting its daily fixing of the yuan with the largest bias since November. China’s efforts to revive growth, from cutting rates to closing out a regulatory crackdown on tech firms, have so far done little to support growth in the world’s second-largest economy.

In rates, US Treasuries fell, pausing a rally sparked by speculation that easing inflation would give the Fed room to wind down its rate tightening cycle. US 10-year yields rose 4bps to 3.79 as the US trading day begins with yield curve flatter amid similar price action in many European bond markets and Australia, where strong jobs data sparked bear-flattening. Yields are higher by as much as 7bp at short end, ~3bp at long end; 10-year at 3.79% is back above 50-day average level after closing below it Wednesday for first time since mid-May; 30-year remains below the trendline. Inverted 2s10s curve is flatter for third straight day at -103bp; spread nearly reached -111bp twice this year, the most in decades, coinciding with peaking expectations for additional Fed rate increases. Fed swaps continue to fully price in a 25bp rate hike on July 26 and about a third of an additional quarter-point hike this year. Bunds and gilts are posting minor losses. Focal points of US trading day include 10-year TIPS auction at 1pm New York time.

In commodities, crude futures advance with WTI rising 0.3% to trade near $75.60. Spot gold adds 0.3%. Bitcoin is up 1.3%.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales and the Conference Board’s leading index for June, as well as the Philadelphia Fed’s business outlook for July. Over in Europe, we’ll also get German PPI for June, and the preliminary Euro Area consumer confidence reading for July. From central banks, we’ll hear from the ECB’s Villeroy. Finally, today’s earnings releases include Johnson & Johnson.

Market Snapshot

- S&P 500 futures down 0.1% to 4,590.25

- MXAP down 0.3% to 167.47

- MXAPJ little changed at 528.24

- Nikkei down 1.2% to 32,490.52

- Topix down 0.8% to 2,260.90

- Hang Seng Index down 0.1% to 18,928.02

- Shanghai Composite down 0.9% to 3,169.52

- Sensex up 0.5% to 67,441.99

- Australia S&P/ASX 200 little changed at 7,325.05

- Kospi down 0.3% to 2,600.23

- STOXX Europe 600 up 0.3% to 463.44

- German 10Y yield little changed at 2.43%

- Euro little changed at $1.1207

- Brent Futures up 0.3% to $79.70/bbl

- Gold spot up 0.3% to $1,982.90

- U.S. Dollar Index little changed at 100.21

Top Overnight News

- The yuan jumped after China stepped up its support for the managed currency with a stronger-than-expected reference rate and a change to its capital curbs to lure inflows. The PBOC set its daily fixing at just under 7.15 per dollar, 680 pips stronger than the average estimate in a Bloomberg survey and the largest bias since November. It also adjusted some rules to allow companies borrow more from overseas, opening up the door for more foreign capital inflows. BBG

- Chinese authorities are considering easing home buying restrictions in the nation’s biggest cities, potentially removing a hurdle that has curbed demand in Beijing and Shanghai for years. BBG

- Foreign investors are injecting less money into Chinese equities than into other Asian emerging markets for the first time in six years, as investor optimism about Chinese growth wanes. FT

- British supermarket Asda will on Friday cut the prices of 226 own label products by an average of 9%, adding to a body of evidence that a surge in UK food inflation is on the wane. RTRS

- Josep Borrell, the EU’s chief diplomat, said that the Russian threat against grain ships was “grave” and required more weapons to be sent to Ukraine. FT

- U.S. antitrust authorities issued new guidelines spelling out how they will police proposed mergers, in a move that could provide fresh legal support for the government’s efforts to block deals. WSJ

- TSMC surprised with a cut to its annual outlook for revenue, indicating the global electronics slump may persist. It also postponed the start of production at its signature Arizona facility to 2025, citing a shortage of skilled workers and high expenses. BBG

- The Fed looks set to hike by 25 bp next week for the final time this cycle and hold until at least year-end as prices ease, a survey of economists shows. The median of those surveyed sees the first cut in March. On a potential US recession, 58% expect a crunch within 12 months, down from 63% in June. BBG

- Tesla fell premarket on concern about more hits to its margins. Elon Musk said the carmaker will probably keep cutting prices if interest rates continue to rise and plans to invest more than $1 billion on its Dojo supercomputer by the end of 2024. On the bright side, he said lithium prices are easing. BBG

- Netflix’s global password-sharing crackdown delivered robust subscriber growth in the second quarter, a boon for the company as its rivals struggle with flagging TV businesses and costly pivots to streaming…

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following on from the choppy performance stateside as participants digested the latest data releases, corporate earnings results and performance updates. ASX 200 was positive with the mining industry underpinned after the world’s largest miner BHP reported higher quarterly iron ore output and with its full-year production at a record high, while the latest jobs data topped forecasts but could also be seen as a double-edged sword with further scope for the central bank to hike rates. Nikkei 225 was the worst performer after the latest trade data showed weaker-than-expected exports and a wider contraction of imports, although the trade balance returned to a surplus for the first time in almost 2 years. Hang Seng and Shanghai Comp diverged with Hong Kong lifted by early strength in the property sector after the PBoC eased cross-border funding for firms and financial institutions, while the mainland was lacklustre after the central bank unsurprisingly maintained benchmark lending rates and despite the latest guidelines for the promotion of the private economy.

Top Asian news

- PBoC 1-Year Loan Prime Rate (Jul) 3.55% vs Exp. 3.55% (Prev. 3.55%)

- PBoC 5-Year Loan Prime Rate (Jul) 4.20% vs Exp. 4.20% (Prev. 4.20%)

- PBoC eased cross-border funding through the macro-prudential adjustment parameter for firms and financial institutions which was raised to 1.50 from 1.25, according to Reuters.

- China is reportedly considering mortgage easing to spur buying in the large cities, according to Bloomberg.

- Japanese gov’t cuts its economic growth forecast for the current FY to 1.3% (prev. view 1.5%), consumer inflation 2.6% (prev. view 1.7%) exceeding the BoJ’s 2.0% target.

European bourses are firmer aside from the Euro Stoxx 50 -0.1% and AEX -0.5% following TSMC and subsequent pressure in Chip names, such as ASM International -5.0% and ASML -3.2%; reminder, SAP reports after the European close. Sectors are mostly firmer, with the exception of Tech, featuring outperformance in Basic Resources after Anglo American’s Q2 update with media names also performing well following Publicis. Stateside, futures are diverging with the NQ -0.8% lagging following after-hours updates from TSLA -2.9% and Netflix -6.7% ahead of data and more earnings.

Top European news

- EU trade chief Dombrovskis said he is hopeful of a breakthrough in talks with the US regarding the steel dispute but will not support any US proposal that flouts global standards and said the US will not be able to resolve the dispute through a deal that discriminates against other countries, according to FT.

- German Car Association VDA says the improved supply situation led to increased vehicle availability in H1; VDA adjusts market forecast upward.

- UK average two-year fixed mortgage 6.79% (prev. 6.81%), first decrease since May 27th, via Moneyfacts.

FX

- Aussie rejuvenated as another strong jobs report revises RBA rate hike prospects, AUD/USD back on 0.6800 handle and above hefty option expiry interest.

- DXY drifts amidst mixed fortunes for index components and as 100.000 holds after pullback from 100.500+ peak on Wednesday.

- Yuan rebounds following multi-pronged intervention from PBoC and Chinese state banks, with USD/CNY and USD/CNH off overnight peaks circa 7.1900 and 7.2325 respectively.

- Euro underpinned by a retracement in EGBs and decent 1.1200 EUR/USD expiry, Yen benefiting from export bids and big 140.00 barrier defences, but Sterling sill deflated sub-1.3000 following soft UK inflation data.

- PBoC set USD/CNY mid-point at 7.1466 vs exp. 7.2233 (prev. 7.1486)

- Chinese state banks were reportedly seen selling dollars to prop up CNH.

Fixed Income

- Deeper pullback in debt as UK disinflationary vibes dissipate.

- Bunds down to 133.36 from 133.87 Eurex peak, Gilts retreat from 97.62 to 96.93 before regrouping and T-note nearer base of 112-19+/31 range ahead of IJC, Philly Fed and existing home sales.

- Spanish and French bonds soft after multi-tranche Bono and OAT issuance, but not unduly.

Commodities

- Crude benchmarks are little change following similar APAC trade amid a lack of fundamentals since Wednesday’s US session.

- Ags are underpinned by damage to a Ukrainian port and Russia upping the ante around Black Sea transit.

- Within metals, spot gold is little changed and largely following the USD so far while base metals are supported as sentiment in Europe improves though notes production increases by BHP & Anglo American.

- Ukraine’s largest producer and exporter of sunflower oil – Kernel – could need 12-months to restore Ukraine’s Chornomorsk facilities, via Bloomberg.

Geopolitics

- White House warned that Russia may expand their targeting of Ukrainian grain facilities to include attacks against civilian shipping in the Black Sea, according to Reuters.

- US sanctioned 14 Iraqi banks in a crackdown on Iran’s dollar trade after uncovering that they engaged in money laundering and fraudulent transactions in which some may have involved sanctioned individuals, according to WSJ.

- China’s ambassador to Washington said China’s top priority is to stop Taiwan’s Vice President from visiting the US next month, according to Reuters.

- Belarusian military is to undertake exercises with Russia’s Wagner Group fighters near the border with Poland, according to the Belarusian Defence Ministry. Subsequently, Poland says they are prepared for a number of scenarios.

- Russian Kremlin says Poland’s decision to bolster its border with Belarus because of Wagner’s presence is a cause for concern; calls Poland aggressive and the hostile attitude requires heightened attention.

- IRGC Commander has warned of reprisals to any Co. that is willing to unload Iranian oil from the seized tanker, via Tasnim; would hold the US responsible for such action.

US Event Calendar

- 08:30: July Initial Jobless Claims, est. 240,000, prior 237,000

- 08:30: July Continuing Claims, est. 1.72m, prior 1.73m

- 08:30: July Philadelphia Fed Business Outl, est. -10.0, prior -13.7

- 10:00: June Existing Home Sales MoM, est. -2.1%, prior 0.2%

DB’s Jim Reid concludes the overnight wrap

This week I’m celebrating two anniversaries. It’s my 1st anniversary to my wife, as well as my 5th anniversary at Deutsche Bank. Several people have asked me which is the most important, and whilst I’d like to say it’s the wedding anniversary, my wife managed to leave her wedding ring at a gym class this week and didn’t realise it was gone until she got back home. Well, that’s the story I heard at least. Fortunately, the ring was found safe and returned, so I’m just left to hope my marriage lasts at least as long as my career.

Whilst I hope for a long and happy marriage, markets were also happily extending their gains over the last 24 hours, with the S&P 500 (+0.24%) advancing for a 3rd consecutive day to another 15-month high. In the meantime, the 10yr Treasury yield also fell -3.8bps to 3.75%, having now declined by just over 30bps since its 2023 high on 7 July. Several factors were driving the rally, but the main one was growing optimism that central banks might finally be near the end of their current rate hiking cycle, particularly after some positive numbers on inflation over recent days. That idea then got further support from the latest UK CPI print yesterday, which saw its biggest downside surprise in almost two years. And even though the UK still has the highest inflation in the G7, the fact it came in beneath expectations helped to bolster the idea that global inflation was now durably coming down.

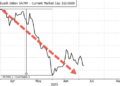

UK markets were the most affected by that release, which showed CPI falling to +7.9% in June (vs. +8.2% expected). It was beneath every economist’s estimate on Bloomberg, and core CPI was also beneath expectations at +6.9% (vs. +7.1% expected). In turn, that downside surprise meant that investors dialled back their expectations for rate hikes from the Bank of England. For example, at the next meeting in a couple of weeks’ time, markets are still fully pricing in another 25bp hike, but they lowered the chances of a larger 50bp hike from 69% to 43% by the close, and down further to 40% this morning. Looking further out, they also pared back their terminal rate forecasts, with markets now much less confident that they’ll take rates to the 6% mark, which had been fully priced in before the release.

That backdrop led to a massive rally among UK gilts, with the 10yr yield down -12.7bps on the day to 4.20%. The front end of the curve saw even larger moves, with 2yr gilt yields down -20.0bps to 4.84%, and at the intraday low they were down more than -30bps, so this was a big reaction. In the meantime, sterling had its worst day in three weeks, weakening -0.74% against the US Dollar as investors expected fewer rate hikes. And the FTSE 100 surged by +1.80%, with property stocks such as Persimmon (+8.29%) and Land Securities (+7.65%) seeing the strongest outperformance.

Elsewhere yesterday, some of the biggest news came after the US close, with earnings releases from Tesla and Netflix leading a downbeat reaction in after-market trading. Netflix missed sales estimates and issued lower-than-expected Q3 guidance, while Tesla’s results showed shrinking profitability with squeeze on margins. That’s meant US equity futures are pointing lower in overnight trading, with those on the S&P 500 (-0.14%) and NASDAQ 100 (-0.46%) moving lower.

Ahead of those earnings releases, US equities had put in a decent performance, with both the S&P 500 (+0.24%) and NASDAQ (+0.03%) hitting fresh 15-month highs. US regional banks outperformed following a number of earnings releases, with their index rising +2.79% on the day (and up almost 30% from its low in mid-May). However, European equities were a bit weaker in general. For instance, although the STOXX 600 rose by +0.26% thanks to the UK outperformance, other indices didn’t do so well, with the DAX (-0.10%) seeing a modest decline.

That European underperformance was evident among other assets classes, with sovereign bonds struggling across the continent. Initially they’d done very well thanks to the UK CPI release, but by the end of the session, yields on 10yr bunds (+5.6bps), OATs (+5.7bps) and BTPs (+6.7bps) had all risen. In part, that was thanks to more negative inflation data from the Euro Area, where the recent core CPI print for June was revised up a tenth to 5.5%. So that echoes what we’ve seen in the US where headline inflation is coming down sharply thanks to energy price declines, but core inflation is proving stickier.

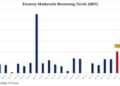

Elsewhere, another important story for inflation was what happened to wheat prices yesterday. They surged by +8.50% after Russia’s defence ministry said that ships heading to Ukrainian ports from today would be considered as potentially carrying military cargo. Other agricultural goods were also affected, with corn (+3.46%) and soybeans (+0.97%) rising on the day as well. That follows the news earlier in the week that Russia was pulling out of the Black Sea grain deal, which had enabled the continued export of millions of tonnes of food from Ukraine. This morning wheat futures are up a further +2.27%, on track for their 6th consecutive daily advance.

Overnight in Asia, equity markets are struggling to gain traction despite a pledge from China to support private businesses. That came yesterday in a joint statement from the Communist Party’s central committee and the state council, which promised to treat private firms equally to state-run firms. In terms of the specific moves, the Hang Seng (+0.26%) is slightly higher after two straight day’s of losses, whereas the the Shanghai Composite (-0.33%) and the CSI 300 (-0.10%) are losing ground. Meanwhile the Nikkei (-1.17%) has experienced a sharper loss, and the KOSPI (-0.18%) is also in negative territory.

In terms of data overnight, there was a strong employment report from Australia, which showed employment growth of +32.6k in June (vs. +15.0k expected), whilst the unemployment rate came in at 3.5% (vs. 3.6% expected). That’s led investors to dial up the chances of another hike from the RBA’s next meeting, which is now seen as a 40% chance, up from 28% previously. Furthermore, 10yr Australian government bond yields are up +8.9bps overnight.

In the political sphere, one story to look out for today are three parliamentary by-elections taking place in the UK. All three are in seats that the governing Conservative Party won at the last general election, but the opposition Labour Party and the Liberal Democrats are looking to make gains. Currently, the Labour Party are polling 20 points ahead of the Conservatives in Politico’s polling average, so the results could give a sense of whether the polls are accurate and if Labour are on track to return to government.

When it came to yesterday’s other data, US housing starts saw a decent fall to an annualised rate of 1.434m in June. That was beneath the 1.48m reading expected by the consensus, and the previous month’s reading was also revised lower from 1.631m to 1.559m. Building permits were beneath expectations in June as well, coming in at 1.44m (vs. 1.5m expected).

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales and the Conference Board’s leading index for June, as well as the Philadelphia Fed’s business outlook for July. Over in Europe, we’ll also get German PPI for June, and the preliminary Euro Area consumer confidence reading for July. From central banks, we’ll hear from the ECB’s Villeroy. Finally, today’s earnings releases include Johnson & Johnson.

Loading…

https://www.zerohedge.com/markets/futures-drop-tech-stocks-spooked-netflix-tesla-taiwan-semi-earnings