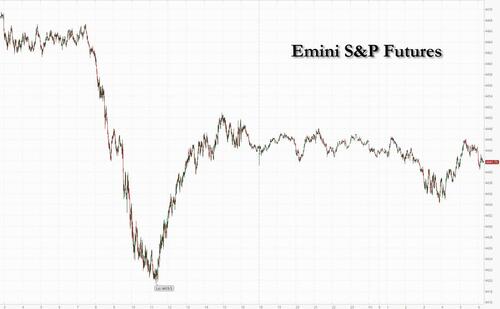

Stocks were subdued as investors prepared for the June jobs report to gauge if they will confirm the blowout ADP print and back new bets for more Fed interest rate hikes which sent yields soaring on Thursday, slamming risk assets. US equity futures reversed earlier losses and traded unchanged after Thursday’s losses in the S&P 500 and Nasdaq 100 benchmarks sparked by stronger-than-expected ADP private payrolls data. As of 6:30am, emini S&P futures were down 0.1% while Nasdaq 100 futs dropped 0.2%. European stocks erased earlier declines of as much as 0.5% to trade flat, but were still on course for their worst week since the middle of March. MSCI Asia Pacific Index declined 1.6% to the lowest since June 2, as strong hiring data in the US renewed monetary tightening worries and investors awaited major stimulus measures from China. Treasury yields extended their ascent, with the 2Y rising back over 5.00% after nearly hitting 5.10% on Thursday while 10Y yields traded around 4.06%, after yesterday’s jobs data sent a gauge of global bond yields soaring to the highest since 2008.

In pre-market trading, Alibaba Group rose, tracking gains in Hong Kong after Reuters said Chinese authorities will wrap up a probe on Ant Group Co. as soon as Friday with a fine of more than $1.1 billion, a move that will bring an end to a prolonged regulatory probe into the Chinese fintech giant. Here are some other notable pre-market movers:

- Bloom Energy rises 2.1% as RBC Capital Markets initiated coverage of the power generation equipment maker’s stock with a recommendation of outperform, saying the company is positioned for strong growth and improving profitability through the end of the decade.

- Levi Strauss drops 7.3% after the clothing company’s reduced full-year adjusted earnings-per-share forecast missed estimates. Analysts flagged pressure from the US wholesale business, noting that it led to the outlook downgrade.

- Gorilla Technology shares jump 51% after the video data and tech analytics company signs a $270m, three-year security contract with the Egyptian government.

- KLA Corp.’s rating was cut at KeyBanc Capital Markets to sector weight from overweight as the semiconductor capital equipment maker’s stock price exceeded the brokerage’s prior target. The shares fell almost 1% in postmarket trading Thursday.

Stocks slumped on Thursday after traders added to bet of more rate hikes as ADP Research Institute data on Thursday showed US companies added the most jobs in more than a year in June. Friday’s US nonfarm payrolls and unemployment reports will be key to any more revisions in rate-hike expectations after the ADP numbers prompted a spike in Treasury yields. Our payrolls preview note can be found here, and below is a snapshot of expectations by bank

- 270,000 – Morgan Stanley

- 260,000 – Wells Fargo

- 250,000 – Societe Generale

- 250,000 – Goldman Sachs

- 235,000 – HSBC

- 225,000 – Barclays

- 200,000 – Deutsche Bank

- 200,000 – JP Morgan Chase

- 190,000 – Credit Suisse

- 175,000 – UBS

- 170,000 – Citigroup

“One thing is for certain: given yesterday’s moves, a mild upside surprise is already in the price,” Julien Lafargue, chief market strategist at Barclays Private Bank, said in a note. “Should the NFP send a similar message as the ADP figure, the market will gain confidence that the well-anticipated recession is being pushed back and that the Fed may need to be more aggressive.”

On Thursday, bonds were sold on rising fears inflation will continue to hold north of the Fed’s 2% target, requiring policymakers to raise rates even further. The US selloff was mirrored elsewhere with Bloomberg’s index of global government bonds hitting levels last seen in the financial crisis.

European stocks erased earlier declines of as much as 0.5% to trade flat, but were still on course for their worst week since the middle of March. The Stoxx Europe 600 Index was 0.1% higher: miners and chemicals outperformed while utilities and media stocks were the biggest laggards as investors awaited key US jobs data later in the day that may provide further insight on the trajectory of interest rates. Just Eat Takeaway.com NV shares slumped after analysts at Exane and JPMorgan Chase & Co. turned bearish on the food-delivery company. Persimmon was among UK homeowners trading lower after Halifax said house prices are falling at their fastest annual pace since 2011. Here are some of the most notable movers:

- Clariant shares pare early losses to rise as much as 4.3% after the firm cut its 2023 sales forecast. Citi says the profit warning was largely expected by the market following negative updates from peers. Other chemical firms rise, BASF gains as much as 3.1%

- SES-Imagotag rises as much as 41% after short seller Gotham City Research issued a new report criticizing the governance and accounting of the French maker of electronic pricetags for store shelves, a report that failed to send the stock further down. Shares still remain well below levels seen before Gotham City’s first report.

- Airbus shares rise as much as 1.3% after the planemaker said it delivered 72 aircraft in June, the most in any month so far this year; Citigroup calls June data strong and Jefferies highlights a solid performance last month.

- Sulzer shares rise a much as 3.7% after the Swiss pump maker increased full year guidance as strong order momentum continued in 2Q.

- Shares in ASML, from which Samsung sources chipmaking tools, dropped as much as 1.8% as Samsung Electronics fell after it reported its biggest decline in quarterly revenue since at least 2009.

- Coloplast shares fall as much as 5.7% after the Danish health-care products firm signed agreement to buy Kerecis, an Icelandic company specializing in biologics wound care, for as much as $1.3b, in a transaction expected to be financed via an equity capital raise.

- Just Eat Takeaway shares fall as much as 9.2% after both Exane and JPMorgan turned bearish on the food-delivery company before second-quarter results, due to potential weakness in order volumes. Peers Deliveroo and Delivery Hero also declined as Exane cut ratings to underperform.

- OSB Group shares drop as much as 21% in their worst day since April 2020, after the lender said that it will take a hit of £160m to £180m in the first half of 2023 as customers refinance their mortgages earlier amid higher interest rates.

Asian stocks were mostly lower amid spillover selling from global peers including in the US. The MSCI Asia Pacific Index declined as much as 0.9% to the lowest since June 2, as strong hiring data in the US renewed monetary tightening worries and investors awaited major stimulus measures from China. Benchmarks in Australia and South Korea lead losses in the region. Samsung Electronics is the biggest drag on the MSCI Asia gauge, sliding as much as 2.5%, after quarterly operating income tumbled due to still-weak memory chip demand

- Hong Kong’s benchmark Hang Seng Index falls as much as 1.3%, nearing bear market territory, as Chinese authorities face pressure to back up their reassuring economic rhetoric with little hope of any breakthrough during US Treasury Secretary Yellen’s trip to China.

- Australia’s ASX 200 suffered its largest intraday drop since March with real estate and tech front running the declines across all sectors as Australian bond yields climbed.

- Nikkei 225 slumped at the open following disappointing Household Spending data which showed a surprise monthly contraction although the index bounced off its lows and recouped around half of the earlier losses.

- Korea’s KOSPI was dragged lower by weakness in index-heavyweight Samsung Electronics after its preliminary Q2 earnings in which operating profit topped forecasts but slumped by 96% Y/Y.

- Indian stocks ended the week as the best performing large market in the region despite registering their biggest drop in two months on Friday. The S&P BSE Sensex fell 0.8% to 65,280.45 in Mumbai, while the NSE Nifty 50 Index declined 0.8% to 19,331.80. For the week, though, Nifty 50 and BSE-Sensex climbed 0.7% and 0.9%, respectively, as continued buying from foreign portfolio investors and optimism for earnings growth helped Indian stocks outperform the MSCI Asia-Pacific Index’s 1.3% decline. ICICI Bank contributed the most to the Sensex’s decline on Friday, decreasing 1.3%. Out of 30 shares in the Sensex index, six rose and 24 fell.

In rates, Treasury yields ticked higher again in Friday trading, with the policy sensitive two-year yield near 5%, while the 10-year hovered close to the highest since March. The 10-year Treasury yield has broken above its recent downtrend, leaving chart watchers speculating over how high it could climb. A close above the 4.09% zone would open up the door to last year’s high of 4.34%, according to RBC Capital Markets strategist George Davis. Bund and gilt curves steepen as German and UK two-year yields fall by 4bps and 2bps respectively.

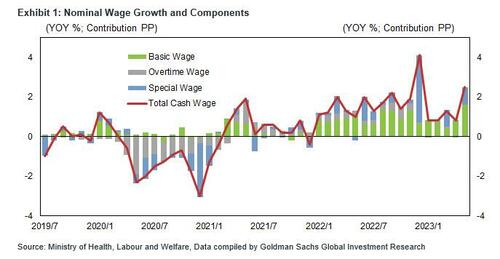

In FX, the dollar was treading water ahead of the US jobs report after Thursday’s ADP data jolted markets. The Bloomberg dollar index heads for a third weekly gain on the back of rising Treasury yields as investors position themselves before US monthly payroll data. The yen has rallied meanwhile, rising 0.7% versus the greenback after Japanese wages jumped by more than twice the estimate after cash earnings rose 2.5% in May, up from a revised 0.8% increase in April, the kind of data which will refresh speculation about an early end for yield curve control.

In commodities, crude futures advance, with WTI rising 0.4% to trade near $72.10. Spot gold rises 0.3% to around $1,916. Bitcoin falls 0.6%.

To the day ahead now, and the main highlight will be the US jobs report for June. Other data releases include German industrial production and Italian retail sales for May. From central banks, we’ll hear from ECB President Lagarde, Vice President de Guindos, along with the ECB’s Villeroy, Stournaras and Nagel, as well as the BoE’s Mann.

Market Snapshot

- S&P 500 futures down 0.2% to 4,438.50

- MXAP down 0.7% to 161.14

- MXAPJ down 1.0% to 505.61

- Nikkei down 1.2% to 32,388.42

- Topix down 1.0% to 2,254.90

- Hang Seng Index down 0.9% to 18,365.70

- Shanghai Composite down 0.3% to 3,196.61

- Sensex down 0.6% to 65,364.19

- Australia S&P/ASX 200 down 1.7% to 7,042.27

- Kospi down 1.2% to 2,526.71

- STOXX Europe 600 down 0.3% to 445.81

- German 10Y yield little changed at 2.63%

- Euro little changed at $1.0879

- Brent Futures up 0.1% to $76.62/bbl

- Gold spot up 0.2% to $1,914.65

- U.S. Dollar Index little changed at 103.09

Top overnight news from Bloomberg

- Federal Reserve Bank of Dallas President Lorie Logan said more interest-rate increases will likely be needed to spur meaningful disinflation and bring price-growth rates back to the central bank’s target.

- Japanese workers’ wages jumped by more than twice the pace expected by economists as annual pay hikes fed into monthly data, offering the central bank a sign that upward momentum in pay may be strengthening

- Doggedly strong US employment is causing pressure on bond markets far from American shores with a gauge of global yields climbing to the highest since 2008.

- US audit officials have started a fresh round of inspections of New York-listed Chinese companies in recent weeks as tensions mount between the world’s two largest economies

- US Treasury Secretary Janet Yellen will speak with Chinese Premier Li Qiang in Beijing on Friday afternoon, as she begins two days of talks designed to stabilize ties between the world’s largest economies.

- Samsung Electronics Co. reported its worst decline in quarterly revenue since at least 2009, stoking uncertainty over when a year-long electronics and memory chip demand slump will end.

- A state-owned Chinese newspaper issued a rare rebuttal of Goldman Sachs Group Inc. research after the securities firm’s analysts recommended selling shares of local banks, the latest sign of official attempts to counter negative sentiment in markets as the economy slows.

A more detailed look at global markets courtesy of Newsquawk

Asia Pac stocks were mostly lower amid spillover selling from global peers including in the US. ASX 200 suffered its largest intraday drop since March with real estate and tech front running the declines across all sectors as Australian bond yields climbed. Nikkei 225 slumped at the open following disappointing Household Spending data which showed a surprise monthly contraction although the index bounced off its lows and recouped around half of the earlier losses. KOSPI was dragged lower by weakness in index-heavyweight Samsung Electronics after its preliminary Q2 earnings in which operating profit topped forecasts but slumped by 96% Y/Y. Hang Seng and Shanghai Comp conformed to the downbeat mood as growth concerns and trade frictions lingered and with little hope of any breakthrough during US Treasury Secretary Yellen’s trip to China.

Top Asian News

- China’s Finance Ministry said it hopes the US will take concrete actions to create a favourable environment for the healthy development of economic and trade ties between China and the US, according to Reuters.

- China Customs banned the imports of food from 10 prefectures in Japan and noted the IAEA report on Japan releasing water from the Fukushima plant did not fully reflect the views of all experts involved in the assessment process, while it added that the Japanese side still has many problems in the legitimacy of sea discharge.

- BoJ announcement on the conduct of funds-supplying operations to purchase Japanese government securities with repurchase agreements

European bourses began the session in the red given the APAC/Wall St. handover; since, sentiment has improved incrementally though action is very contained overall pre-NFP. Sectors are mixed with cyclicals seeing upside after pressure earlier in the week while defensive sectors are currently lagging. Stateside, futures are moving in-tandem with European peers though magnitudes slightly more contained and the benchmarks currently reside just below the unchanged mark. Shell (SHEL LN) Q2 Update Note: Post-tax impairments of up to USD 3bln are expected for Q2’23, primarily driven by a 1% increase in the discount rate used for impairment testing. Integrated Gas: Trading & Optimisation: expected to be significantly lower compared to a strong Q1’23 due to seasonality and fewer optimisation opportunities. Continental (CON GY) plans to phase out business activates at Gifhorn plant by end of 2027; reason for the move is sharp rise in cost pressure in automotive industry.

Top European News

- CB’s de Guindos says transmission of our unprecedented policy hikes thus far to tighter financing conditions is well advanced, now beginning to see an impact on areas of the real economy. Services inflation and labour costs need to be monitored. While underlying price pressures remain strong, most indicators have begun to show some signs of softening. What happens to rates in September is an open question.. Need to focus more on broader macro conditions rather than relative contribution of wages and profits to inflation.

FX

- Yen continues impressive comeback as UST/JGB spreads tighten and JPY crosses retreat further amidst ongoing repositioning, USD/JPY probes 143.00 from just above 144.00.

- DXY tethered to 103.000 in advance of NFP.

- Kiwi and Aussie recover losses as risk sentiment settles after Thursday’s acute aversion, NZD/USD up near 0.6200 again and AUD/USD eyeing 0.6650.

- Euro flanked by option expiries at 1.0900 and 1.0850 in EUR/USD.

- Loonie labours ahead of Canadian LFS with USD/CAD elevated within 1.3359-87 range.

- PBoC set USD/CNY mid-point at 7.2054 vs exp. 7.2423 (prev. 7.2098)

Fixed Income

- Bonds huff and puff before resuming down the path of least resistance awaiting NA jobs data.

- Bunds probe Thursday’s Eurex low within 131.41-130.89 range, Gilts recoil from 92.95 to 92.39 and T-note towards the bottom end of 110-15+/24 overnight bounds.

Commodities

- Crude benchmarks are modestly firmer and benefitting from the JPY-induced USD downside with fresh specifics light but the complex seemingly still deriving support from the week’s developments; incl. OPEC summit and Saudi OSPs

- Spot gold has been meandering higher given the softer USD and softer risk tone, though this has dissipated somewhat, pre-NFP.

- Some key purchasers of Saudi Arabia’s crude in Asia and Europe are seeking lower volumes for next month after the kingdom hiked official prices and extended output cuts, according to Bloomberg.

Geopolitics

- Japanese Economic Minister Goto said they are aware that New Zealand received Ukraine’s request to join the CPTPP, while he added that they must carefully assess whether Ukraine fully meets the high level of CPTPP agreement in terms of market access and rules, according to Reuters.

- Philippines official says “There is an alarming increase in Chinese ships in the disputed waters in the South China Sea”, according to Al Arabiya.

- Austrian, Germany and Swiss Defence Ministers have signed an MOU re. their participation in the European Sky Shields initiative, via Swiss Federal Council.

- German Foreign Minister says we oppose sending cluster munitions to Ukraine, according to Al Arabiya.

US Event Calendar

- 08:30: June Change in Nonfarm Payrolls, est. 230,000, prior 339,000

- 08:30: June Underemployment Rate, prior 6.7%

- 08:30: June Unemployment Rate, est. 3.6%, prior 3.7%

- 08:30: June Average Weekly Hours All Emplo, est. 34.3, prior 34.3

- 08:30: June Average Hourly Earnings YoY, est. 4.2%, prior 4.3%

- 08:30: June Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

- 08:30: June Labor Force Participation Rate, est. 62.6%, prior 62.6%

- 08:30: June Change in Manufact. Payrolls, est. 5,000, prior -2,000

- 08:30: June Change in Private Payrolls, est. 200,000, prior 283,000

DB’s Jim Reid concludes the overnight wrap

For only the second time in probably a decade I am completely home alone this weekend with absolutely zero commitments as my wife is taking the kids to her best friend in Glasgow for the weekend after school breaks up for the summer today. As such my weekend looks something like this…… Tonight golf. Tomorrow golf. Sunday golf, with the possibility of a second round in the afternoon. Oh and watching cricket on the telly all weekend around that.

Before a weekend of freedom, today we arrive at another payrolls Friday at a fascinating juncture for markets after a massive global bond sell-off yesterday which bled into a risk off for equities. So another tough day this week for 60/40 portfolios.

Many thresholds were breached yesterday so it’s worth going through some highlights to start. In no particular order we saw 2yr Treasury yields surge to 5.11%, which is their highest level since 2008, before coming back in by the close to finish at just below 5.0%. 2yr real yields hit 3% intraday before closing at their highest level since late-2009, (2.90%). The 10yr UST yield rose back above 4%, as 10yr real rates rose to their highest level since 2008 at 1.78%. 10yr Gilts yields hit a 15-year high of their own, 10yr bunds rose above 2.6% for the first time since early March, and Europe’s STOXX 600 (-2.34%) slumped to a 3-month low.

Bonds have been steadily selling off of late, but this went into overdrive after a stunningly strong ADP which isn’t usually the most reliable monthly print, but it was a question of sell first ask questions later after the release.

The June’s ADP showed a bumper gain of +497k that was above every economist’s expectations on Bloomberg, and more than double the +225k consensus. 15 minutes later, we had the weekly jobless claims data, which showed continuing claims had fallen to a 4-month low of 1.72m (vs. 1.737m expected) over the week ending June 24. Finally, the ISM services index for June bounced back to a 4-month high of 53.9 (vs. 51.2 expected), with gains in the new orders (55.5) and employment (53.1) components as well. So a collection of positive releases that painted a stronger picture for the US economy than previously thought.

We’ll have to see if those numbers are backed up by today’s jobs report, but investors weren’t waiting for that as they priced in more hikes from central banks and fewer cuts next year. For instance, futures now see the chances of the Fed hiking this month at 89%, which is their highest level to date, whilst pricing for the terminal rate hit a post-SVB high of 5.44% through the November FOMC meeting. Market pricing for fed funds through the December 2023 FOMC meeting is north of 5.4% for the first time since the days just before SVB first signalled stress. Further out the curve, fed futures are now pointing to a fed funds rate of 4.26% by the end of 2024, up from 3.89% as of last Wednesday.

These moves were cemented by comments from Dallas Fed President Logan, a voter this year, who said that “the FOMC needs to make policy more restrictive so we can return inflation to target in a sustainable and timely way.” The moves weren’t confined to the US either, with investors growing in confidence that the ECB would keep hiking at the next couple of meetings.

All that triggered an astonishing selloff among sovereign bonds. Indeed, 10yr Treasury yields at one point were up nearly +15bps before closing +9.8bps higher on the day at 4.03%. This follows on from their +7.7bps increase the previous day, so the rise now stands at +17.5bps in just two sessions. The only other time that’s happened this year was in early February, when we had a seismic jobs report that initially showed a +517k gain in nonfarm payrolls. Real yields led the moves, with the 10yr real yield (+8.3bps) surpassing its previous peak for this cycle last November, before closing at 1.78%. The last time it was that high was in 2009, and it was the same story across the curve, the 2yr real yield surpassed 3% for the first time since the GFC as we described at the top before settling at 2.90%.

Much as the US was the focus yesterday, Europe actually saw a bigger rise in sovereign bond yields. By the close, yields on 10yr bunds (+14.8bps) and OATs (+17.0bps) had both surged to their highest level since early March. And in the UK for gilts there were some even bigger milestones, with the 10yr yield (+16.6bps) surpassing its peak from the mini-budget turmoil and closing at a post-2008 high of 4.66%. It’s worth noting that the UK is becoming an increasing outlier internationally as well, with the spread of 10yr gilts over bunds up to 204bps by the close, which is its highest level since last October, back when Liz Truss was still PM. The move in gilt yields comes as investors continue to dial up the amount of tightening they expect from the Bank of England, with some weight now even being placed on the chances of a 6.75% terminal rate.

Regarding the ECB, traders are pricing in a 92% chance of an ECB hike later this month, and have priced nearly a full additional hike through the October meeting. December 2023 swaps are pricing in an ECB policy rate of 3.945% which is up +7.5bps in a week and just shy of the 4.03% level seen just before SVB. Meanwhile the June 2024 swap increased +11.8bps yesterday to 3.83%.

The rates backdrop was tough for equities, with the S&P 500 (-0.79%) putting in its worst daily performance since May, even if it did rally back from nearly -1.4% down as rates rallied back. The decline was incredibly broad-based with 21 of 24 industry groups losing ground on the day. Tech hardware (+0.13%), software (+0.13%), and commercial services (+0.03%) were the only sectors to not lose grounds but none had particularly strong days. Moreover the VIX volatility index rose 1.2pts to 15.4, which is its highest level since June 1. Likewise in Europe, the STOXX 600 shed -2.34%, with even bigger losses for the DAX (-2.57%) and the CAC 40 (-3.13%).

Looking forward, the main highlight today will of course be the US jobs report for June, which is one of the first pieces of hard data that we’ll have for the month. For the last 14 months in a row now, the nonfarm payrolls number has come in above consensus on the day every time. So there’s been a persistent tendency to underestimate the strength of the labour market. For today however, our US economists are looking for a +200k gain in headline that’s slightly beneath the consensus +225k expectation. As a result, they think the unemployment rate will fall back a tenth to 3.6%, in line with consensus.

Speaking of the labour market, yesterday also brought the latest JOLTS report for May, although it got less attention than usual given everything else. The release showed that job openings fell to 9.824m (vs. 9.9m expected), which took the ratio of vacancies per unemployed individuals down to 1.61, and the lowest since October 2021. So that offered some evidence that the labour market tightness is continuing to ease. That said, there were other signs of things moving in the opposite direction, with the quits rate rebounding back up two-tenths to 2.6%, which is the highest it’s been since February. In addition, the private quits rate went back up to 2.9%, which is the highest since December.

Asian equity markets are playing “catch-down” overnight. As I check my screens, the KOSPI (-1.25%) is leading losses across the region after Samsung Electronics, the index heavyweight, guided to a -96% likely decline in its Q2 operating profit as a chip glut persists. The company is scheduled to release its detailed earnings on July 27. Elsewhere, the Hang Seng (-0.91%) is trading in the red, hitting a 5-week low with the CSI (-0.52%), the Shanghai Composite (-0.36%) and the Nikkei (-0.47%) also edging lower. US stock futures tied to the S&P 500 (-0.02%) and NASDAQ 100 (-0.04%) are flatish.

Early morning data showed that Japan’s regular pay (+1.8% y/y) grew at the fastest pace in over 28 years in May while boosting labour cash earnings/nominal wages by +2.5% y/y (v/s +1.2% expected) following a downwardly revised +0.8% increase in April. Meanwhile, real cash earnings contracted for the 14th consecutive month, shrinking -1.2% in May, as rising inflation is surpassing nominal pay growth. Separately, government household spending fell -4.0% y/y in May, a third month of decline and more than Bloomberg’s consensus forecast for a -2.5% decrease and after the prior month’s -4.4% drop.

To the day ahead now, and the main highlight will be the US jobs report for June. Other data releases include German industrial production and Italian retail sales for May. From central banks, we’ll hear from ECB President Lagarde, Vice President de Guindos, along with the ECB’s Villeroy, Stournaras and Nagel, as well as the BoE’s Mann.

Loading…

https://www.zerohedge.com/markets/futures-drift-yields-tick-higher-ahead-june-jobs-data