Global stocks slid, US equity futures slumped and bond yields tumbled as a raft of news on collapsing Chinese trade, Italian banks hit with an unexpected windfall tax, and a downgrade of US banks by Moodys (on increasing funding costs/CRE exposure) sparked a fresh round of fears about the financial system and global economy. At 7:45am, S&P futures were down 0.7% trading as low as 4,502 while Nasdaq futures dropped 0.8% amid a broad flight to safety across markets which sent yields on the 10-year Treasury 10 basis points lower and the equivalent rates in Germany fell 15 basis points. The Bloomberg dollar index climbed 0.5% while oil resumed its slide following ugly oil import data by China. Today’s macro data includes Small Biz Optimism, Trade Balance, and Wholesales Sales/Inventories … nothing market-moving as we await Thursday’s CPI print.

In the premarket, tech and small-caps underperformed while defensives were the green. Investors are also closely watching US financials after Moody’s lowered credit ratings for 10 small and midsized lenders and warned about the risks tied to commercial real estate: the XLF was indicated -67bps and KRE -1.3% lower in premarket trading. Eli Lilly extended gains to 8.6%, after the drugmaker boosted its revenue guidance for the full year; the guidance beat the average analyst estimate. Earlier, Lilly shares jumped following Novo Nordisk’s Wegovy update. Here are some other notable premarket movers:

- Hims & Hers Health shares surge 17% after the telehealth company boosted its full- year adjusted Ebitda outlook. Overall, analysts said the print was better than expected, with Citi highlighting the better average order value being a key driver for the beat.

- Home Depot and Lowe’s are downgraded to market perform from outperform at Telsey Advisory Group. Home Depot falls 1.3%, while Lowe’s slides 1.4%.

- Lucid gains as much as 4.5% on Tuesday after the EV startup said it still believes it will produce at least 10,000 vehicles this year.

- Maravai LifeSciences shares slide 15% after the biotech firm cut its full-year outlook for adjusted earnings per share, adjusted Ebitda and total revenue.

- Olaplex tumbles as much as 27%, after cutting its full-year projections for net sales, adjusted Ebitda and adjusted net income.

- Palantir Technologies shares edge higher 2.6% after the data-analysis software company reported second-quarter results and raised its full-year adjusted operating profit forecast.

- Paramount Global rises as much as 4.4% after the media company reported revenue for the second quarter that beat the average analyst estimate, driven by a jump in its streaming-TV business.

- Proterra Inc. which makes heavy-duty electric vehicle components like chargers and batteries, filed for bankruptcy on Monday. Shares fall 66%.

In Europe, the Stoxx 600 dropped 0.7% with banks posting the steepest losses after Italy announced an unexpected tax on windfall profits, sending shares of UniCredit SpA and Intesa Sanpaolo SpA down more than 7%. The euro-area banks index slumped as much as 3.4%. BPER Banca, Banco BPM, Intesa Sanpaolo and UniCredit all fell at least 7%. In the UK, banks also fall as BNP Paribas Exane says that while lenders in Britain are cheap, it is staying relatively cautious, downgrading Barclays to neutral and Virgin Money UK to underperform. Here are the most notable European movers:

- Novo Nordisk jumps as much as 16%, the most since 2002, after results from the SELECT cardiovascular outcomes trial for Wegovy, where the obesity drug achieved its primary objective.

- Glencore shares drop as much as 4.4% after the miner reported a 50% drop in first-half adjusted Ebitda. Analysts said profits were weaker than expected amid a drop in commodity prices

- Abrdn falls as much as 9.6% after the investment company posted 1H operating profit and net outflows that missed expectations. RBC says the results signal a further delay of return to growth

- InterContinental Hotels shares rise as much as 2.2% after the hotel operator reported estimate- beating results and said there’s no sign of cooling in leisure demand

- Fraport rises as much as 8.6% after the German airport operator produced second-quarter earnings that beat analysts’ estimates and showed a continued recovery toward pre-pandemic levels

- Norma shares advance as much as 9.4%, the most in more than six months, after the tech hardware firm provided guidance that Baader Helvea says looks “reasonable”

- TI Fluid shares rose as much as 22%, the most intra-day on record, after the UK car- fluid-storage manufacturer delivered what the analysts saw as a strong trading update with a significant EBIT beat

Earlier in the session, Asian stocks slumped as the early optimism following the positive lead from Wall St was soured as Chinese markets entered the fray, while the region also digested disappointing Chinese trade data.

- Hang Seng and Shanghai Comp spooked markets with the Hong Kong benchmark heavily pressured as tech and property stocks lead the broad declines across sectors, while sentiment was also not helped by the wider-than-expected contraction in Chinese exports and imports data.

- ASX 200 traded rangebound after mixed consumer sentiment and business confidence surveys.

- Nikkei 225 was initially lifted by a weaker currency and earnings release but then wiped out nearly all of its gains as markets were spooked by selling in Chinese stocks.

Investor sentiment took a big hit after China released more data that showed its economic engine is sputtering. Exports plunged by the most since early 2020, the beginning of the Covid pandemic, and imports contracted last month. The Hang Seng China Enterprises Index and a gauge of European mining shares fell about 2%. Commodities prices retreated, with oil and copper losing almost 2%. Sentiment was further dented after two missed coupon payments by Country Garden.

As Bloomberg notes, China’s disappointing economic recovery is being felt acutely among exporting nations in the developing world. The MSCI Emerging Market Index of stocks headed for the lowest close in almost four weeks and looked to breach the support level at its 50-day moving average. Its currency-index counterpart also traded at the weakest level since July 10, with the South Korean won and Malaysian ringgit among the worst performers.

“Reduced demand for raw materials and commodities due to its economic slowdown is likely to lead to a decrease in global commodity prices,” according to Nigel Green, CEO of DeVere Group. “Those countries heavily reliant on commodity exports would then experience economic hardships as their revenues decline.”

In FX, the Bloomberg Dollar Spot Index rises 0.4% with the world’s reserve currency advancing against all of its of Group-of-10 peers. The yen slid the most against the US currency after falling as much as 0.7%. The People’s Bank of China set Tuesday’s yuan reference rate at 7.1565 per dollar, revising an earlier fixing in the morning when it had indicated a stronger fixing of 7.1365. The latest fixing was set at the weakest level in nearly a month. “A clearly visible CNY depreciation trend might further strengthen the tendency of private domestic capital to leave China,” said Ulrich Leuchtmann, head of currency strategy at Commerzbank AG in Frankfurt. “The Chinese authorities have to be very certain that their capital controls work well if they want to risk that.”

In rates, treasuries hoeld gains into early US session with yields lower by up to 10bp across long-end of the curve. Treasury yields are down 3bp to 10bp across the curve with 2s10s, 5s30s spreads flatter by 5.5bp and 2.5bp on the day; 10- year yields just under 4% are richer by 10bp on the day with bunds and gilts outperforming by 4.5bp and 1bp in the sector. Treasuries drew support during Asia session following disappointing China trade data. Today’s bull-flattening move is led by bunds, drawing flight-to-quality flows with Italian banks slumping after the government introduced a surprise tax on “extra profits” this year. US regional banks are also in focus after Moody’s Investors Service lowered credit ratings for 10 small and midsize lenders based on mounting funding costs. Treasury auction cycle begins with 3-year note sale at 1pm New York time. The treasury auction cycle includes $42b 3-year note followed by $38b 10-year Wednesday and $23b 30-year bond Thursday in upsized auction amounts. WI 3-year yield around 4.38% is ~15bp richer than last month’s, which stopped 0.2bp through the WI yield.

In commodities, crude futures declined with WTI falling 2% to trade near $80. Spot gold drops 1%

Looking to the day ahead, on the data side in the US we will get the July NFIB small business optimism, June wholesale trade sales and June trade balance releases. Over in Europe, we have the final Germany inflation print for July as well as the releases of the ECB’s latest consumer expectations survey. Our economists’ dbDIG survey suggests that the ECB survey should show a further slight easing of inflation expectations – see their earlier note here. Among central bank speakers, we will hear from the Fed’s Harker and Barkin. Finally, earning releases include Eli Lilly, UPS, Glencore, Bayer, Coupang, Barrick Gold, Take-Two Interactive, Rivian and Lyft.

Market Snapshot

- S&P 500 futures down 0.3% to 4,522.00

- MXAP down 0.8% to 165.03

- MXAPJ down 1.1% to 520.05

- Nikkei up 0.4% to 32,377.29

- Topix up 0.3% to 2,291.73

- Hang Seng Index down 1.8% to 19,184.17

- Shanghai Composite down 0.3% to 3,260.62

- Sensex down 0.1% to 65,876.04

- Australia S&P/ASX 200 little changed at 7,311.14

- Kospi down 0.3% to 2,573.98

- STOXX Europe 600 down 0.4% to 457.83

- German 10Y yield little changed at 2.49%

- Euro down 0.2% to $1.0979

- Brent Futures down 1.2% to $84.28/bbl

- Gold spot down 0.2% to $1,932.35

- U.S. Dollar Index up 0.31% to 102.37

Top Overnight News

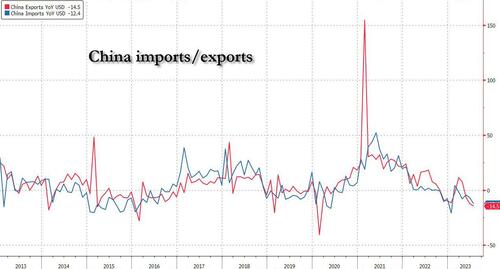

- China’s trade plunged in July as slowing global demand clouded the outlook for exports, while domestic pressures weighed on imports in a hit to the economic recovery. Overseas shipments dropped 14.5% in dollar terms last month from a year earlier — the worst decline since February 2020 — while imports contracted 12.4%, the customs administration said Tuesday. That left a trade surplus of $80.6 billion for the month. BBG

- Country Garden (2007.HK) said it has not paid two dollar bond coupons due on Aug. 6 totaling $22.5 million, confirming market fears that the biggest privately owned developer in China is slipping into repayment troubles. The bonds in question are notes due in Feb 2026 and Aug 2030 , the firm told Reuters. Both payments have 30-day grace periods, according to investors citing prospectuses. RTRS

- Chinese firms forced to cut prices amid tepid demand, raising the risk of a Japan-like slide into sustained deflation. BBG

- Eurozone inflation expectations sink further according to the latest ECB survey (“median expectations for inflation over the next 12 months decreased further to 3.4%, from 3.9% in May, and those for inflation three years ahead also declined, easing to 2.3% from 2.5% in May”) (ECB)

- Italy’s right-wing government shocked markets with an unexpected tax on banks’ windfall profits, wiping out around $10 billion from the market value of the country’s lenders. Deputy Prime Minister Matteo Salvini announced a 40% levy on the extra profits of lenders for 2023 late Monday night, as part of a wide-ranging decree approved at a cabinet meeting. BBG

- Apartment buildings, long considered a real-estate haven, are emerging as the next major trouble spot in the beleaguered commercial-property world. Investors bid up the prices of multifamily buildings for years, attracted by steadily rising rents and the prospect of outsize returns. Many took on too much debt, expecting they could raise rents fast enough to pay it down. WSJ

- Moody’s cut its rating on 10 small and midsize banks including MTB, WBS, BOKF, ONB, PNFP, FULT, ASB, and PB. and adopted a negative outlook for 11 lenders including PNC, COF, CFG, FITB, RF, ALLY, OZK, and HBAN. In addition, the agency said that it may downgrade major lenders including USB, BK, STT, TFC, and NTRS. The action came as part of a review driven by the challenges facing the industry including higher funding costs, potential regulatory capital weaknesses, and rising risks tied to commercial real estate loans amid weakening demand for office space “which have collectively lowered the credit profile of a number of US banks, though not all equally”. BBG

- Some of the biggest names in commercial real-estate lending have all but turned off the spigot. Blackstone Mortgage Trust and KKR Real Estate Finance Trust, two of the biggest mortgage real-estate investment trusts, have halted loans to any new borrowers. WSJ

- UPS (-7% pre mkt) reported small EPS upside at 2.54 (vs. the Street’s 2.50 forecast) as very healthy operating margins (13.2% vs. the Street’s 12.4% forecast) helped to offset a revenue shortfall (-10.9% to $22.055B vs. the Street’s $22.99B forecast). However, the company is cutting its guidance, with revenue getting hit by the macro environment (they now see $93B vs. the prior $97B) and op. margins pressured by the new Teamsters deal. RTRS

- Booming oil prices last year powered U.S. inflation to 40-year highs. That trend was reversing in 2023—until now. Benchmark crude prices are up 21% over the past six weeks, driving up the cost of American workers’ commutes and freight haulers’ trips.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded mixed after the early optimism following the positive lead from Wall St was soured as Chinese markets entered the fray, while the region also digested disappointing Chinese trade data. ASX 200 traded rangebound after mixed consumer sentiment and business confidence surveys. Nikkei 225 was initially lifted by a weaker currency and earnings release but then wiped out nearly all of its gains as markets were spooked by selling in Chinese stocks. Hang Seng and Shanghai Comp spooked markets as they entered the fray with the Hong Kong benchmark heavily pressured as tech and property stocks lead the broad declines across sectors, while sentiment was also not helped by the wider-than-expected contraction in Chinese exports and imports data.

Top Asian News

- China’s Ambassador to the Philippines said the Philippines took unilateral actions to undermine the existing management status quo on Second Thomas Shoal and China had no choice but to make necessary responses. Furthermore, China hopes the Philippines meets China halfway and said third-party forces will not help the situation, while China is waiting for feedback from the Philippine side and hopes to start talks ASAP, according to Reuters.

- Major Chinese property developer Country Garden Holdings (2007 HK) said it has not paid two USD bond coupons due Aug 6th worth some USD 22.5mln, according to Reuters.

European bourses are lower across the board, Euro Stoxx 50 -1.20%, risk tone hit by Chinese trade and reports around a property developer. Within Europe, the FTSE MIB -2.2% lags following Italy approving a 40% windfall tax on banks, pressuring the broader banking index, -2.7%. Elsewhere, sectors are more mixed; Banking lags as mentioned while Basic Resources are dented by the trade data and a poorly-received update from Glencore. Stateside, futures are in the red, ES -0.5% and feature continued modest underperformance in the RTY -0.8%. Elsewhere, the risk tone around banks was soured further by Moody’s downgrading several US banks.

Top European News

- BoE’s Pill said inflation remains much too high and they have seen a lot of news on inflation persistence. Pill added that there are risks on both sides on UK inflation and risks that the UK hasn’t raised rates enough but also noted that a lot of rate hikes have yet to hit the economy.

- Barclaycard UK July consumer spending rose 4.0% Y/Y vs. prev. 5.4% growth in June, while it noted that supermarket spending growth slowed sharply, according to Reuters.

- Italy’s Deputy PM said the Cabinet approved a 40% windfall tax on banks, limited to 2023. Subsequently, it was reported that Italy expects to collect last than EUR 3bln from windfall tax on banks, according to Reuters citing sources. Note, Italian banks have been under marked pressure in European trade, SX7E -2.7%

- ECB Consumer Inflation Expectations survey (Jun) – 12-months ahead 3.4% (prev. 3.9%); 3-year ahead 2.3% (prev. 2.5%)

FX

- A firm session thus far for the DXY, to a 102.47 peak irrespective of downside in yields in what is seemingly a flight to safety against the backdrop of the soured risk sentiment.

- Antipodeans are the marked laggards in early European hours amid the aforementioned downbeat risk tone and concerning Chinese trade data, whilst Australia also saw a decline in consumer confidence and sentiment data overnight.

- Traditional havens are softer on the back of the firmer Dollar, but losses are cushioned by the haven statuses, whilst a decline in US yields could also be providing some padding against the Buck.

- EUR and GBP are subdued given the USD’s upside, single currency saw little reaction to the latest consumer expectation survey while drivers for GBP have been limited and action largely USD-driven.

- The NOK is among the G10 laggards given its sensitivity to risk.

- PBoC set USD/CNY mid-point at 7.1565 vs exp. 7.1869 (prev. 7.1380)

Fixed Income

- Core benchmarks are firmer across the board given the deterioration in broader risk sentiment that took hold during APAC trade.

- Bund lifted to a 133.17 peak following a particularly strong Bobl auction, surpassing the July 31st/August 1st virtual double-top at 133.05/06. A move which brings into play 133.34 and thereafter 133.92, from the 28th and 27th of July respectively.

- A slight widening of the BTP-Bund yield spread to just above the 170bp mark, incrementally higher than the last few weeks but shy of the mid-July wides at circa. 175bp.

- Gilts are similarly bid with their own specifics light and action seemingly a function of the broader risk tone and aforementioned factors.

- Stateside, the picture is much the same as EGBs and Gilts with Treasuries posting gains of circa. 15 ticks in relative proximity to the high point of 110.31 to 111.18+ parameters, ahead of Fed speak and 3yr supply.

Commodities

- WTI and Brent futures are on the backfoot as a function of a firmer Dollar, broader risk aversion, and headwinds from downbeat Chinese trade data.

- Spot gold is subdued by the Buck and trades under its 50 DMA (USD 1,944.27/oz) around the USD 1,932/oz mark in a relatively tight USD 1,938-30/oz intraday range; yellow metal hit by the USD, but somewhat cushioned by the overall tone given its haven allure.

- Base metals have continued to dip following the commencement of the European session, initial pressure from APAC factors was further fanned by the release from Glencore. Though, internal commentary noted of a more positive macro backdrop in H2 and above-average real-term prices ahead.

- UBS retains a positive outlook for oil prices and forecasts Brent at USD 90/bbl by end-2023; Oil demand is set to breach 103mln BPD in August for the first time, due to China, India and the Middle East. See a market deficit of circa. 2mln BPD in July and August, vs around 0.7mln BPD in June.

- Turkey imposed a 20% extra fee for some gold imports, according to the Official Gazette.

Geopolitics

- Japan ruling LDP’s Aso said in Taipei that ‘we’ are moving from peacetime to times of turbulence and believe that issues that were hidden beneath the surface are coming to the fore, while he added that Taiwan is an important partner and friend. Furthermore, Aso said Japan has continued to say that peace in the Taiwan Strait is important for regional stability and the most important thing is to make sure war doesn’t break out in the Taiwan Strait.

- Polish Defence Ministry to send additional troops to Belarus border following request from border guard, according to PAP.

- Economic Community of West African States (ECOWAS) plans to mobilise 25,000 troops for possible intervention in Niger, according to Al Arabiya citing French Press.

US Event Calendar

- 06:00: July SMALL BUSINESS OPTIMISM, est. 91.3, prior 91.0

- 08:30: June Trade Balance, est. -$65b, prior -$69b

- 10:00: June Wholesale Trade Sales MoM, est. -0.2%, prior -0.2%

- 10:00: June Wholesale Inventories MoM, est. -0.3%, prior -0.3%

DB’s Jim Reid concludes the overnight wrap

As we approach the dog days of summer, and my holiday in a few days, it sometimes gets harder to explain moves in markets in both direction but as I’ve been doing this daily for nearly 17 years I’ve learnt to try to come up with rationales or I’ll have a blank piece of paper. We’ve had some big moves in rates in the last week following the US Treasury announcement last Monday, the Fitch US downgrade, the Treasury refunding announcement and then the reverse move after payrolls. All others things being equal I thought the extent of the rates rally after payrolls was strange given how 2-way the release was, and yesterday a 10bps intra-day rally in 2yrs from an earlier sell-off was also difficult to explain. All in all, 2yr US yields were flat (-0.1bp) at the close, with 10yr and 30yr yields up +5.6bps and +6.9bps. The S&P 500 (+0.90%) did rise after four days of losses though. Overnight, US 10yrs and 30yr yields are back -4bps and -5bps lower as I type so we are seeing some decent sized moves in these thin markets at the moment.

We did hear contrasting comments from FOMC members yesterday on the potential for further hikes. Federal Reserve Governor Bowman, who typically leans hawkish, emphasised the potential for further hikes, saying she expects that “additional increases will likely be needed to lower inflation to the FOMC’s goal”. By contrast, in an interview published by the New York Times, New York Fed President Williams said that “monetary policy is in a good place” and “whether we need to adjust it in terms of that peak rate — but also how long we need to keep a restrictive stance — is going to depend on the data”. To be fair, Bowman also stressed data dependence but she focused more on still high inflation and tight labour market. Williams did dangle a rate cutting carrot for 2024 if inflation continued to behave.

An ongoing theme in US rates has been that the sizable US yield moves have continued with only minor changes in near-term Fed pricing though. Rate pricing for end-23 rose by 1.5bps on Monday to 5.38%, while end-24 pricing retreated -2.0bps to 4.00%. So that is five and a half 25bp cuts priced for 2024. On the topic of 2024 rate cuts, yesterday our US economists published a report in which they consider what policy rules would imply for the timing and pace of rate cuts in 2024 under different economic scenarios. See their note here.

Meanwhile, short-end yields in Europe rallied on Monday following news late on Friday that the Bundesbank will from October stop paying interest on domestic government deposits. Back in September 2022, the ECB had lifted the zero ceiling on such deposits to rise in line with policy rates amid fears of a negative impact on the repo market, before reducing this ceiling to ESTR minus 20bp in the spring. A decline in government deposits at the central bank and reduced collateral scarcity may have made the Bundesbank less concerned about the risks, though it is rather unusual for it to take this step unilaterally (without other euro area national central banks). Together with the recent ECB move to pay zero interest on banks’ minimum reserves, central banks might be looking for ways to reduce their high interest costs, at least if this can be done without hindering policy effectiveness.

The yield on 6m German bills thus fell by -4.7bps on Monday, while the 2yr yield declined by -2.7bps. The German curve notably twisted and steepened as 10yr Bund yields were +3.9bps higher. An additional notable feature in European rates has been the ongoing gradual rise in long-term inflation breakevens. The 5y5y rose for the seventh session in a row yesterday to 2.67%, its highest level since 2009. So the market is not giving a strong vote of confidence in the 2% inflation target. This is similar to the US where a similar measure is up over 10bps in the past week and at levels less than a handful of basis points from 10yr highs. Elsewhere, 10yr UK yields were the biggest underperformer yesterday and +8.1bps higher, largely reversing their Friday decline.

A risk-on mode returned to equity markets on Monday, with the S&P 500 rising +0.90%, ending a run of four declines in a row. A broad rally was led by communication services (+1.88%) and financials (+1.36%). Energy stocks underperformed (+0.15%) as oil prices retreated from their 3-month high reached on Friday (Brent -1.04% to $85.34/bl). Tech stocks were a slight underperformer, although the NASDAQ still posted a solid +0.61% gain. Within the megacaps, Apple (-1.73%) and Amazon (+1.90%) saw continued contrasting moves. Meanwhile, Berkshire Hathaway gained +3.60% after its results, further cementing its position as the largest US company by market cap outside the tech mega caps. Over in Europe, equities were near flat on the day. The STOXX 600 eked out a +0.09% rise, after being weighed down initially by the weak US session last Friday.

Asian equity markets are mixed this morning despite a strong handover from Wall Street overnight. Across the region, the Hang Seng (-1.15%) is leading losses with the KOSPI (-0.12%), the CSI (-0.02%) and the Shanghai Composite (-0.04%) inching lower. Otherwise, the Nikkei (+0.32%) is bucking the regional trend. S&P 500 (-0.22%) and NASDAQ 100 (-0.34%) futures are moving a bit lower.

Early morning data from China showed that exports dropped for the third consecutive month, sliding -14.5% y/y in July (v/s -13.2% expected; -12.4% in June) and recording its biggest drop since July 2020, highlighting that the world’s second biggest economy is being dragged lower by weakness in global demand and a domestic slowdown. At the same time, imports contracted -12.4% y/y in July (-5.6% expected) compared to a -6.8% drop in the previous month. Elsewhere, household spending in Japan fell -4.2% y/y in June (v/s -3.8% expected), a steeper fall than the prior month’s -4.0% drop while recording a fourth straight month of decline. Meanwhile, real wages declined for a 15th straight month, easing -1.6% y/y in June (v/s -0.9% expected) and against May’s downwardly revised drop of -0.9%. Nominal pay growth in June (+2.3% y/y) came in lower than a revised +2.9% rise in May (v/s +3.0% expected).

It was fairly quite day on the data front yesterday. A highlight was Germany’s industrial production print, which saw a larger-than-expected -1.5% mom decline in June (-0.5% exp). Also in Europe, French private sector labour market data showed a slowing in Q2. Employment grew 0.1% qoq, the slowest pace since Q4 2020, while wage growth was +1.0% qoq, down from +1.9% in Q1. So some evidence to argue against the risks of a wage-price spiral emerging in the euro area.

Looking to the day ahead, on the data side in the US we will get the July NFIB small business optimism, June wholesale trade sales and June trade balance releases. Over in Europe, we have the final Germany inflation print for July as well as the releases of the ECB’s latest consumer expectations survey. Our economists’ dbDIG survey suggests that the ECB survey should show a further slight easing of inflation expectations – see their earlier note here. Among central bank speakers, we will hear from the Fed’s Harker and Barkin. Finally, earning releases include Eli Lilly, UPS, Glencore, Bayer, Coupang, Barrick Gold, Take-Two Interactive, Rivian and Lyft.

Loading…

https://www.zerohedge.com/markets/futures-and-yields-slide-global-markets-tumble-mood-sours-after-trifecta-dismal-news