By Ven Ram, Bloomberg markets live reporter and strategist

Interest-rate traders reckon the Federal Reserve won’t have to raise rates again this year, but the markets are doing a far more effective job of tightening financial conditions. Which is why long-dated yields have surged to the exclusion of those at the front end (notwithstanding the rally today).

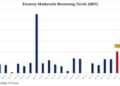

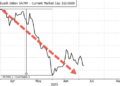

That has spurred a frantic dis-inversion in the Treasury curve since the start of the second half of the year: 10-year yields, which were some 100 basis points lower than the two-year rate at the end of June, are now only some 30 basis points lower.

Much of that rapid dis-inversion in the nominal yield curve has been underpinned by soaring real rates. For instance, 10-year inflation-adjusted rates are now near the highest level since the global financial crisis, boosted in part by a paradigm shift in investors’ time preference. And with geopolitical tensions flaring again in the Middle East, that trend may well accelerate, with investors deciding to consume now and seek a higher discount rate on assets that will pay out at a future point. The implication of all that is that long-dated yields may have little incentive to come off the boil yet.

What happens to the front end, though? My two cents is that the markets are underpricing the risk of the Fed staying higher for longer. Just last week we got another eye-popping expansion in the labor market, and with oil prices climbing afresh this week, there is little to suggest a Fed pivot is imminent.

Even so, the dis-inversion in the curve may have further to run yet, with long-dated yields rising more to possibly equal those on the two-year maturity. That would, of course, mean a yield curve that is back at zero — which would send headline writers into a tizzy.

Loading…

https://www.zerohedge.com/markets/frantic-dis-inversion-treasury-curve-may-have-further-run