Authored by Simon White, Bloomberg macro strategist,

The effects of Fed rate rises will be increasingly amplified as households’ duration risk rises, strengthening the hand of those in the FOMC who would prefer a “wait-and-see” approach to further tightening.

Five hundred basis points of rate rises in a little over a year would normally be expected to cause some damage. While there have been a few casualties along the way, and growth has taken a hit, it’s remarkable how resilient the economy has been.

Yet this rate-hiking cycle has been different from others in that the Fed has had a large amount, over $5 trillion, of the market’s duration risk sitting on its balance sheet, shielding the economy from the worst of the effects of rate rises.

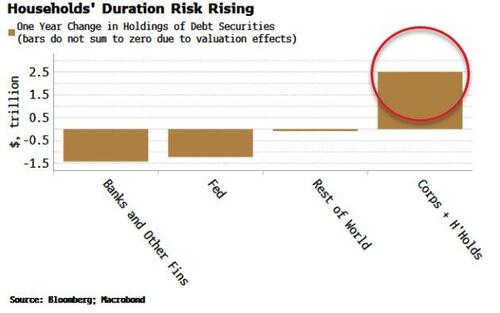

That is changing though. The Fed is allowing securities to run-off its balance sheet. Banks are selling Treasuries as they typically do when rates rise. And foreigners are on net not buying as FX hedging costs and a deeply inverted yield curve make USTs less attractive.

The duration has to go somewhere, and it is households and corporates whose debt holdings are rising, by $2.5 trillion in the last year.

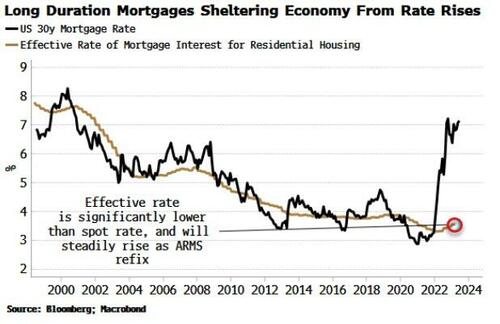

Households have also been shielded from higher rates by fixed mortgage rates. The effective rate on existing mortgages is only around 3.5%, considerably less than the market rate of 7%.

Adjustable-rate mortgages are 15% of the dollar value of all mortgages (according to the Mortgage Bankers Association), this is much lower than the 45% peak seen before the housing crisis, but more than a doubling from the ~7% seen before the pandemic.

As ARMs refix to higher rates, more households will experience the “real feel” of 5% points of rate hikes, along with the impact from the $2.5 trillion increase in debt exposure (taking the total amount to $8.3 trillion).

This comes as the Fed uses more “jaw-jaw” to reduce the size of the market’s implied Fed pivot. The spread between Dec 23 and Dec 24 SOFR futures continues to steepen, rising 34 bps since early June.

The net impact is the cumulative effect of the Fed’s hikes thus far will be felt more keenly across the economy.

Loading…

https://www.zerohedge.com/markets/fed-policy-transmission-set-intensify-duration-risk-rises