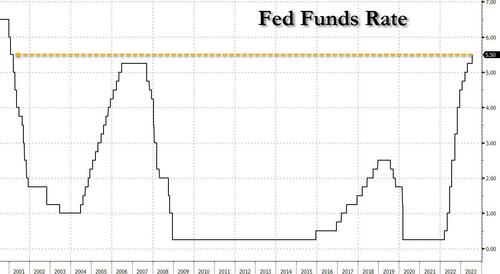

And so, one month after the Fed’s “skip”, what may well be the final rate hike of the Fed’s 2022-2023 tightening cycle, the so-called “July and Goodbye” is in the history books, when moments ago the Fed announced that the FOMC hiked rates by 25bps – as expected – to a 5.50% Fed Funds rate, the 11th consecutive rate hike and surpassing the highs of the 2006-2008 tightening cycle, when the Fed Funds rate peaked at 5.25%.

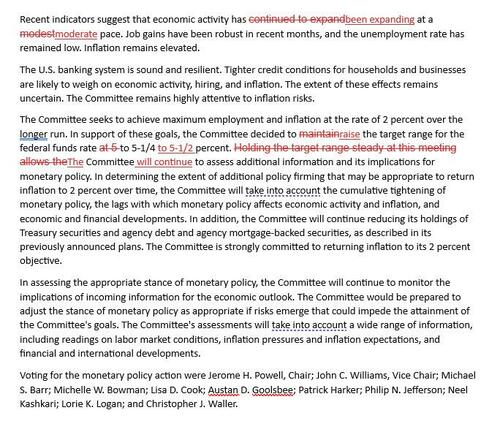

Looking at the statement, the FOMC kept the language (as JPM said it would) that the Fed would “continue to assess additional information and its implications for monetary policy”, and also keeping the language that in “determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.“

In fact, the only changes compared to the June “hold” statement is revising the “continued to expand” language in the first sentence to “been expanding”, slightly upgrading the economic assessment from expanding at a “modest” pace to expanding at a “moderate” pace, and also removing the language that “Holding the target rate steady at this meeting”, which obviously the FOMC did not do in today’s (final) hike.

Perhaps the key sentence remains a familiar one: “The Committee remains highly attentive to inflation risks.”

Full statement redline below.

Courtesy of Bloomberg, here are the key takeaways from today’s nothingburger of a statement:

- Federal Open Market Committee raises benchmark rate by 25 basis points, as widely anticipated, to target range of 5.25%-5.5%, highest since 2001; leaves door open to further increases

- Fed says it “will continue to assess additional information and its implications for monetary policy,” suggesting next meeting could be either another hike, or it could pause or skip again; also repeats language referring to consideration of “the extent of additional policy firming that may be appropriate”

- Slight upgrade of economic assessment, saying that economy “has been expanding at a moderate pace,” a change from “modest pace” in June statement

- Officials maintain pace of balance-sheet reduction, with monthly caps of $60 billion for Treasuries that are allowed to mature without being reinvested and $35 billion for mortgage- backed securities

- Decision is unanimous

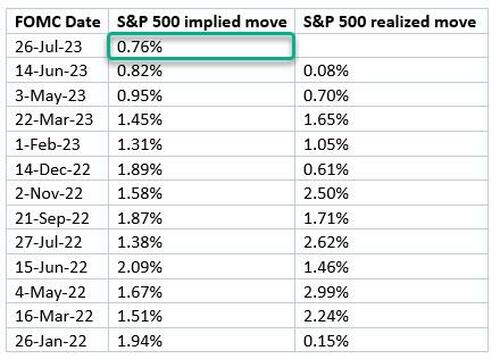

Not surprising, with the market pricing in the lowest implied volatility ahead of today’s FOMC since at least 2021…

…the market reaction has been extremely subdued with stocks, bonds and the dollar barely budging.

Commenting on the widely expected decision, Bloomberg economist Anna Wong writes:

“The 25-basis-point hike was expected, and the lack of changes in the policy statement speaks volumes – it suggests the FOMC hasn’t changed their outlook much since the June meeting.

“That said, Bloomberg Economics expects that more subdued inflation data and gathering signs of a weakening economy by the next meeting in September — absent new adverse supply shocks — will convince the Fed to keep rates on an extended pause for the rest of the year.”

And here is Bloomberg chief rates strategist Ira Jersey chiming in:

“Although he may leave the door open to a September or November hike, there’s the chance he gives more details on the Fed’s reaction function — not only on when it will pause, but almost more importantly, under what conditions the central bank might start to cut rates.”

Gurpreet Gill, Goldman fixed income strategist, says that today’s move was expected (clearly), and what investors remain divided on is whether this marks the last increase of the Fed’s tightening campaign.

“We think recent data is consistent with the US policy rate peaking in July, as core CPI inflation slowed sharply in June. But any renewed signs of inflation strength in key data like the Employment Cost Index released on Friday and upcoming PCE inflation releases still have potential to extend the hiking path.”

The bottom line is that with a statement that is treading water at best and not pushing for either a hawkish or dovish case, it puts even more of a focus on the wording that Powell will chose to deliver at the press conference at 2:30pm.

Loading…

https://www.zerohedge.com/markets/fed-hikes-rates-25bps-expected-stays-data-dependent