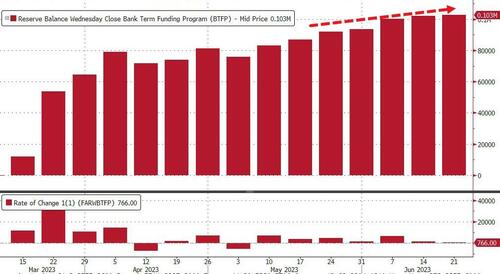

Yesterday we saw more, modest, outflows from institutional money-market funds (inflows from retail funds), but a rise to a new record high for usage of The Fed’s emergency bank bailout scheme, to over $106 billion.

Tonight, we get more of the picture – admittedly with The Fed’s own sprinkling of magic pixie dust that turns deposit outflows into inflows.

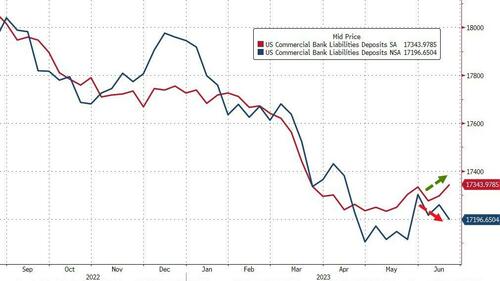

Seasonally-adjusted, total deposits rose a significant $46.95 billion last week to $17.3 trillion – the highest since 3/5/23…

Source: Bloomberg

Non-seasonally-adjusted, total deposits tumbled $63.1 billion…

Source: Bloomberg

The SA and NSA deposit totals are diverging once again…

Source: Bloomberg

The divergence between money-market funds and deposits continues (remember the deposit data is one-week lagged to the MM fund data)…

Source: Bloomberg

Seasonally-adjusted, both large and small banks saw deposit inflows (+$34.9bn and +13.4bn respectively) while foreign banks saw a small $1.4bn outflow…

Source: Bloomberg

The picture – non-seasonally-adjusted – is the exact opposite with large and small banks seeing outflows (-$52bn and -$13bn respectively) and foreign banks saw inflows of $1.9bn…

Source: Bloomberg

The Fed’s magic turned $65.1 billion of deposit OUTFLOWS for Domestic banks (ex-Foreign) into $48.3 billion of INFLOWS…

Source: Bloomberg

You have to laugh!

Loading…

https://www.zerohedge.com/markets/fed-fkery-turns-65-billion-bank-deposit-outflow-48-billion-inflow