Usage of The Fed’s emergency bailout facility rose to a new record high last week and money-market funds saw further inflows, all eyes are once again on bank deposits

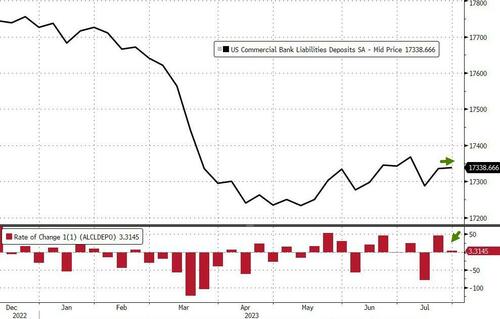

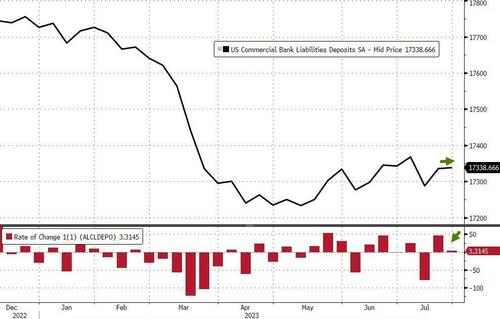

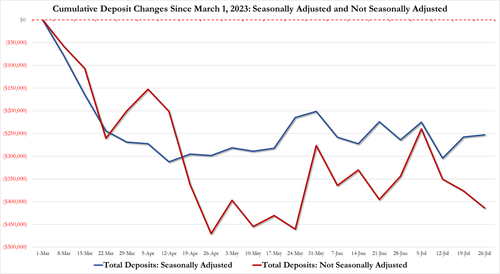

Seasonally-adjusted, total deposits rose by a de minimus $3.3 billion last week (the 2nd straight week on SA inflows)…

Source: Bloomberg

However, and not at all surprisingly, non-seasonally-adjusted total deposits tumbled $30 billion last week (the 3rd straight week of NSA deposit outflows)…

Source: Bloomberg

The divergence between money-market fund assets and bank deposits remains extreme…

Source: Bloomberg

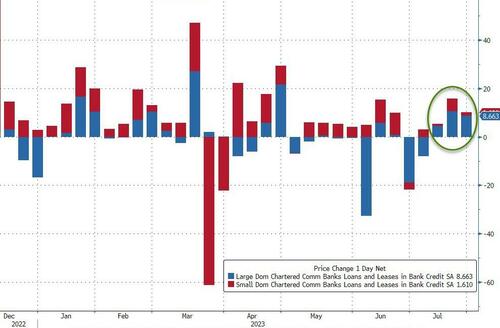

On the other side of the ledger, both large- and small-banks saw loan volumes increase (+$8.7BN and +$1.6BN respectively). This is the 3rd straight week of loan volume increases…

Source: Bloomberg

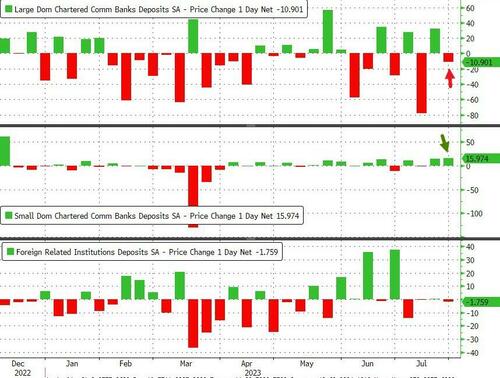

Seasonally-adjusted large-banks saw deposit outflows (-$11BN), while small-banks saw $16BN in deposit inflows. Foreign banks saw $1.8bn in deposit outflows…

Source: Bloomberg

But, Large-banks saw a massive $46BN deposit outflow on a NSA basis (the 3rd week in a row of big outflows) while small banks and foreign banks saw deposit inflows…

Source: Bloomberg

The aggregate NSA-SA ‘gap’ is now around $160BN!!

So, Domestically, banks saw a $5BN deposit inflow (SA) but a $37BN deposit outflow (NSA)

Source: Bloomberg

This is the second week in a row that The Fed’s sleight of hand has turned outflows into inflows.

Loading…

https://www.zerohedge.com/markets/fed-fkery-back-seasonal-adjustments-turns-38bn-bank-deposit-outflow-5bn-inflow