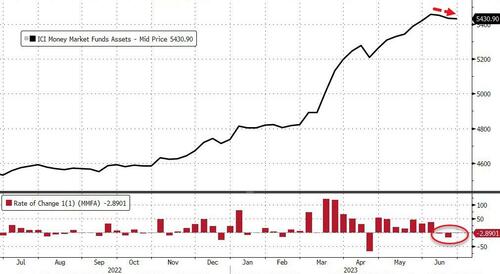

After last week’s surprise and sizable outflows from institutional money-markets (likely driven by corporate tax demands), expectations were for a return to inflows but for the 3rd straight week, money market funds saw outflows (albeit a small $2.9 billion)…

Source: Bloomberg

However, we note that once again retail saw a 10th straight week of inflows (+5.8 billion) while institutional funds saw $8.7 billion of outflows (3rd straight week)…

Source: Bloomberg

Is this corporate tax payments or chasing AI stocks?

There remains a significant decoupling between bank deposits and money market funds…

Source: Bloomberg

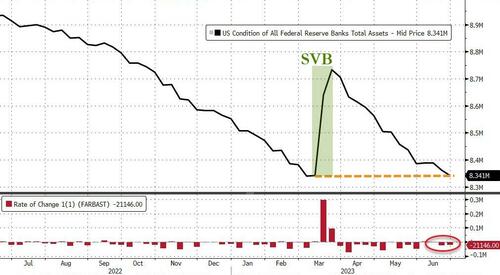

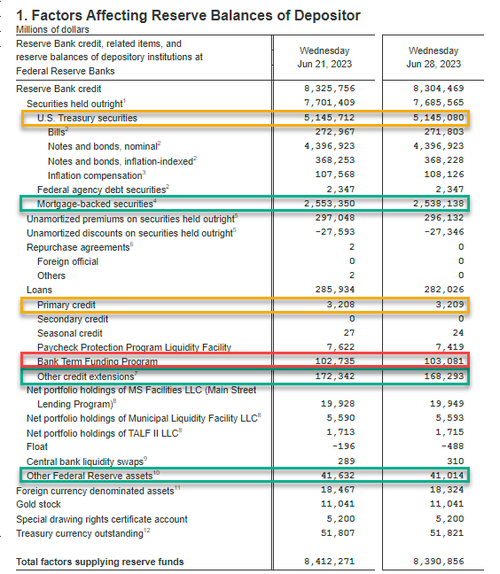

The Fed’s balance sheet finally retraced all of the increase from the SVB bailout, shrinking for the 3rd straight week (-$21.1 billion)…

Source: Bloomberg

As far as QT is concerned, The Fed sold a decent $7.9 billion of its securities last week to its smallest since Aug 2011…

Source: Bloomberg

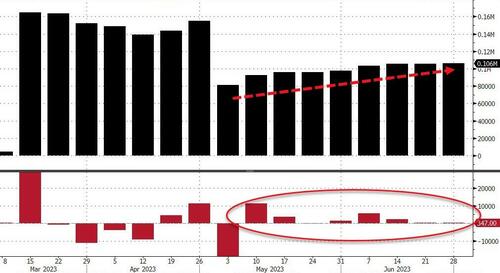

The US central bank has over $106 billion of loans outstanding to financial institutions through its two backstop lending facilities…

Source: Bloomberg

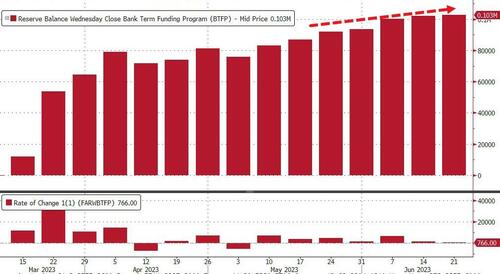

As banks’ usage of The Fed’s emergency Bank Term Funding Program rising once again to a new record at $103.1 billion (up $0.8 billion from last week), while discount window usage was unchanged at $3.2 billion…

The breakdown from The Fed’s H.4.1 table…

-

QT: MBS drop by $15BN to $2.538TN

-

Discount Window: unchanged at $3.2BN

-

BTFP: up $0.3BN to $1.03.1BN, new record

-

Other credit extensions (FDIC loans): down $4BN to $168.3BN

The US equity market is starting to catch down to the contraction of bank reserves at The Fed…

Finally, after all the big banks passed the stress test with flying colors, we remind readers that banks have 9 months left under the original 12-month BTFP Fed bailout program to find a way to stabilize their balance sheets.

Not only have they failed to do so, usage of the BTFP facility is at a new all time high, and yields are rising even more (great MTM losses).

Loading…

https://www.zerohedge.com/markets/fed-emergency-bank-bailout-facility-usage-hits-new-record-high-retail-money-market-fund

![“God Save [Free Speech]”: Britain Celebrates Coronation With Time-Honored Tradition Of Arresting Anti-Monarchists](https://beyondmainstream.news/wp-content/uploads/2023/05/God-Save-Free-Speech-Britain-Celebrates-Coronation-With-Time-Honored-Tradition-120x86.jpg)