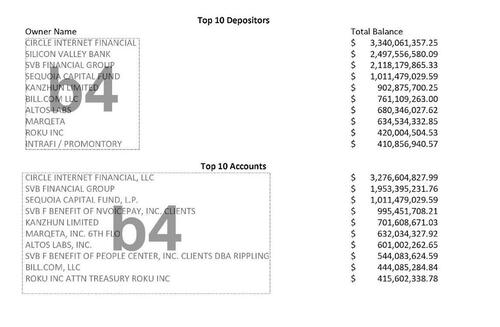

A document released by the Federal Deposit Insurance Corp (or FDIC) which the agency said it mistakenly released unredacted in response to a Bloomberg News Freedom of Information Act request, has provided the most detailed glimpses yet into biggest Silicon Valley Bank customers who were bailed out when the Biden administration decided to backstop all the bank’s deposits.

As a reminder, when regulators stepped in to backstop all of Silicon Valley Bank’s deposits back in March, they saved thousands of small tech startups to prevent what many (especially those whose money was tiled up with SVB) said would have been a catastrophic blow to a tech sector that relied heavily on the lender.

But the stunning decision to guarantee all accounts above the $250,000 federal deposit insurance limit helped bigger companies that were in no real danger. Among them was Sequoia Capital, the world’s most prominent venture-capital firm, which ended up recovering the $1 billion it had with the lender courtesy of taxpayers. Another was Kanzhun Ltd., a Beijing-based tech company that runs mobile recruiting app Boss Zhipin, which received a backstop for more than $900 million.

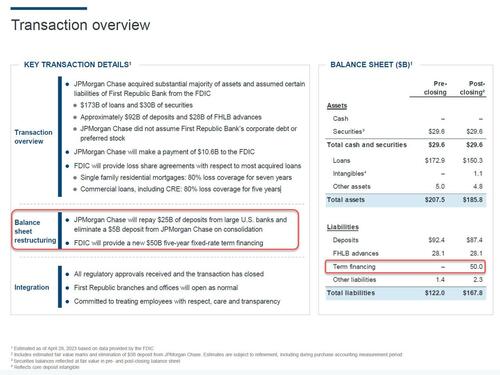

While the incompetent buffoons at the FDIC – which has been selling off pieces of the bank since its failure and which absurdly ended up giving JPMorgan a $50 billion loan in Jamie Dimon’s taxpayer-funded rescue of First Republic Bank…

… asked that Bloomberg destroy and not share the depositor list, saying the agency intended to “partially” withhold some details from the document “because it included confidential commercial or financial information,” according to a letter from an attorney for the regulator. The agency subsequently declined to comment on the substance of the information in the document.

Bloomberg, however, refused to comply. The list – whose contents were largely known already except for a handful of names – mistakenly sent by the FDIC is below:

Back in March, when regional banks were falling like dominoes amid a cascading bank run targeting smaller US banks, regulators decided to declare a “systemic risk exception” and make all depositors at Silicon Valley Bank whole after a white-knuckled weekend in which tech founders digested SVB’s collapse on Friday, March 10 and were begging to be rescued.

Joe Biden described the solution as one that “protects American workers and small businesses, and keeps our financial system safe.”

Treasury Secretary Janet Yellen cast the government’s response – including backstopping all depositors – as necessary.

“American households depend on banks to finance their homes, invest in an education, and otherwise improve their standards of living. Businesses borrow from these institutions to start new companies and expand existing ones,” she said at an industry conference the following week before discussing the intervention.

In the end, US taxpayers ended up bailing out such VC titans as Sequoia; it’s why the decisions that government agencies, including the FDIC, made in a frantic few days after SVB failed were immediately controversial.

Critics said that making all depositors whole at the lender and Signature Bank, which failed March 12, created a moral hazard. A fierce debate is also raging over whether the insurance limit needs to be raised for all businesses.

Former Vice President Mike Pence argued that backstopping all depositors amounted to a bailout – which of course it was – even though the Biden administration has forcefully pushed back against such a description. Pence blasted the government’s decision to insure all deposits, in part, because the move would cover Chinese companies that did business with the bank.

In May, the FDIC proposed tagging the largest banks with billions of dollars in extra fees to replenish the US government’s bedrock deposit insurance fund after it was tapped to backstop deposits above the $250,000 threshold. At the time, the regulator estimated the decision to cover all depositors at SVB and Signature cost the fund (i.e. US taxpayers) $15.8 billion.

FDIC Chairman Martin Gruenberg has previously said that at SVB the guarantee to uninsured depositors covered small and midsize business, as well as those with very large balances, and that the bank’s top 10 depositor accounts held $13.3 billion total. At least he wasn’t lying.

As detailed by the FDIC document, we now know for a fact that in addition to serving a legion of startups and fledgling businesses, SVB was a go-to bank for tech industry giants, including some that have kept their relationships with the bank confidential.

- The $1 billion that Sequoia, the firm famous for backing iconic companies including Apple, Google and WhatsApp, had at SVB made up a fraction of its $85 billion assets under management. In addition to maintaining its own accounts at the lender, the firm also recommended every startup it backed do the same, Michael Moritz, a partner at the firm, wrote in the Financial Times. A representative for Sequoia declined to comment on the depositor list.

- Kanzhun, which had $902.9 million in deposits with SVB according to the document, didn’t respond to multiple emailed requests for comment. The company, which was heavily backed by Chinese giant Tencent before it went public on the Nasdaq in 2021, was among the largest Chinese companies to IPO in the US that year.

- Altos Labs Inc., a life sciences startup that works on cell regeneration, had $680.3 million in deposits with the bank. The privately held company has raised $3.27 billion from billionaires including Jeff Bezos and Yuri Milner, as well as Mubadala Investment Company and other investors. An Altos representative declined to comment.

- Payments startup Marqeta Inc. had $634.5 million at the bank, according to the document. In a statement, the firm acknowledged that it had “significant deposits” at SVB, but was already in the process of moving money to other banks. “While Marqeta supported the decision to guarantee all deposits at the bank, our ability to execute as a business and meet our financial obligations would not have been impacted, even if it was a longer resolution process” the firm said.

- IntraFi Network, which provides deposit services to financial institutions, had $410.9 million worth of deposits at the bank, according to the document. However, in a statement, the firm said that it didn’t actually have any of its own money with the lender, nor was it a client. The amount, rather, represents the funds of almost 2,000 different depositors whose balances were fully insured when SVB collapsed, according to IntraFi.

- Crypto stablecoin company Circle Internet Financial Ltd. previously disclosed its SVB deposits, which at the time represented 8.2% of the reserves backing its USD Coin. A spokesman said the company had no additional comment. The USD Coin, which is intended to maintain a 1-to-1 peg to the dollar, briefly drifted from that $1 level on the news of Circle’s exposure. The document listed it as SVB’s biggest depositor with a balance of $3.3 billion.

- Streaming set-top box maker Roku Inc. also previously disclosed having roughly 26% of its cash and cash equivalents parked at the bank. The document listed its balance at $420 million. A Roku spokesman declined further comment.

- Fintech company Bill.com previously disclosed it had roughly $670 million at the bank. The firm said the amount included about $300 million of its money and $370 million that belonged to customers. A company spokesman declined further comment. The FDIC document listed Bill.com’s total balance at $761.1 million.

Finally, Silicon Valley Bank and parent SVB Financial Group were both listed as having a combined $4.6 billion in deposits. SVB Financial has argued in its bankruptcy case that at least $2 billion in deposits the parent had with the bank should be returned. Federal regulators have said SVB Financial must apply to the bank’s receiver for that money.

* * *

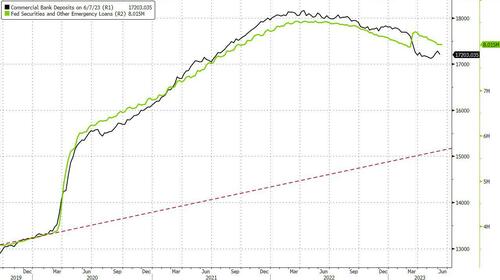

While the regional banking crisis is currently on the backburner, it is nowhere near over: as long as the Fed continues its QT, the total amount of deposits in the financial system continues to shrink (it’s why the Fed’s BTFP program is so instrumental to avoiding an acceleration in the bank run).

In fact, once the small bank reserve constraint is hit again, expect round 2 of the 2023 banking crisis to hit with a vengeance.

It’s why Peter Crane, president of money-fund tracking firm Crane Data LLC, said Friday at the Crane’s Money Fund Symposium in Atlanta that cash will “relentlessly” keep pouring out of banks and into money funds.

“Until they guarantee all deposits, which they will have to do at some point, institutional investors are looking at a big block of uninsured deposits” Crane said. “With cash, it’s the possibility of losing money you’re trying to avoid.”

On the retail side, Crane said that investors are shifting out of deposits because of the 4.5%-5% yield available in money funds relative to the sub-1% yield on bank deposits: “That’s the greed of a 4% spread,” he said. “You can drive a truck through that spread.”

Loading…

https://www.zerohedge.com/markets/fdic-mistakenly-releases-list-top-firms-bailed-out-biden-admins-backstop-svb-deposits