- European bourses trade with little in the way of firm direction following a similarly indecisive close on Wall Street yesterday.

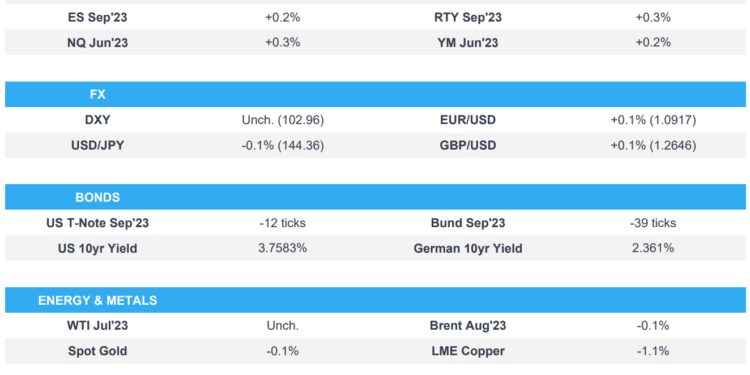

- US equity futures are around flat with the ES holding above the 4400 mark.

- Fed Chair Powell revealed his expectations for Friday’s PCE data (Core PCE likely rose 4.7% Y/Y in May, overall PCE estimated to have risen 3.9%) and remarked that a strong majority of Fed policymakers see two or more rate rises by the end of this year.

- Fed said 23 banks tested showed projected losses of USD 541bln in stress tests but maintain capital ratios well above the required levels.

- Sweden’s Riksbank hiked by 25bps as expected, while forecasts expect at least one more hike this year and increased the pace of bond sales.

- Looking ahead, highlights include German CPI, US PCE Prices (Final), IJC & GDP (Final), remarks from BoE’s Tenreyro

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses trade with little in the way of firm direction following a similarly indecisive close on Wall Street yesterday.

- US equity futures are around flat with the ES holding above the 4400 mark. In terms of newsflow, markets were treated to another set of remarks from Fed Chair Powell, where he revealed his expectations for Friday’s PCE data (Core PCE likely rose 4.7% Y/Y in May, overall PCE estimated to have risen 3.9%) and remarked that a strong majority of Fed policymakers see two or more rate rises by the end of this year.

- Equity sectors in Europe are mixed with Autos top of the leaderboard, supported by Renault after the Co. raised its FY 23 outlook for group operating margins and automotive operational FCF. Retail is another leading sector amid gains in H&M after Q2 profits exceeded estimates and noted that Q3 has seen a “good start”. To the downside, Travel & Leisure, Chemicals and Industrials lag peers.

- Click here and here for a recap of the main European updates.

- Click here for more detail.

FX

- DXY lost a bit of momentum after its firm midweek bounce as several rivals recovered some poise on the back of supportive macro fundamentals, while the Yuan benefited from reports of more Chinese state bank buying and the Yen got a boost from another verbal riposte by Japanese Finance Minister Suzuki.

- Yen saw some sudden strength at one point with no notable headlines to drive price action at the time but with participants cognizant of Japanese MoF presence.

- Aussie outperforms following an overnight boost from the much firmer-than-expected Aussie Retail Sales.

- EUR/SEK was extremely volatile within 11.8175-11.7140 extremes in wake of the Riksbank opting to stick with guidance for a 25 bp hike, as the repo rate path was ratcheted higher and the two dovish dissenters refrained from objecting this time.

- Click here for more detail.

- Click here for more detail.

FIXED INCOME

- Sellers into upticks have dominated price bond action across bonds and the general direction.

- Eurozone inflation data has surprised to the upside, latest remarks from Fed Chair Powell had a hawkish twist and the Riksbank continued its tightening cycle with a loftier rate path for the rest of 2023.

- Bunds, Gilts and the T-note hover just above intraday lows.

- Click here for more detail.

COMMODITIES

- WTI and Brent futures have tilted modestly firmer on the session after a horizontal APAC session, with the sector buoyed by this week’s inventory data.

- Spot gold is subdued given the strengthening of the Dollar seen this week, with the yellow metal hovering just north of the USD 1,900/oz mark as it returned to levels seen mid-March.

- Base metals are softer across the board amid the recent hawkish central bank commentary, whilst concerns surrounding China’s economic recovery remains a grey cloud.

- Click here for more detail.

NOTABLE US HEADLINES

- Fed Chair Powell reiterated that a strong majority of Fed policymakers see two or more rate rises by the end of this year. Powell said Core PCE likely rose 4.7% Y/Y in May, overall PCE estimated to have risen 3.9% (note: in-line with street expectations; data released on Friday), via Reuters. Click here for more comments.

- Fed said 23 banks tested showed projected losses of USD 541bln in stress tests but maintain capital ratios well above required levels, while the stress tests showed large banks are well positioned to continue lending in a severe recession and their trading books were resilient to a rising rate environment.

- US Treasury Secretary Yellen said the Treasury is monitoring the commercial real estate sector very closely and expects some losses to banks from changes in commercial real estate. Yellen said the US will address supply chain risks in areas such as EV, minerals and solar panels, while she also commented that inflation is now about 5% but remains too high.

NOTABLE EUROPEAN HEADLINES

- ECB’s Centeno said “we are reaching the time when monetary policy may pause and that we are very close”, according to Reuters.

- ECB’s de Cos said ECB September meeting is absolutely open regarding interest rates, according to Reuters.

- Swedish Riksbank Rate 3.75% vs. Exp. 3.75% (Prev. 3.5%); forecast expects at least one more hike this year and increased the pace of bond sales – Click here for the full release.

EUROPEAN DATA RECAP

- German State CPIs all saw upticks vs priors, although this is in-fitting with the expectations for the national print at 13:00BST/08:00EDT.

- Spanish CPI MM Flash NSA (Jun) 0.6% vs. Exp. 0.3% (Prev. 0.0%)

- Spanish CPI YY Flash NSA (Jun) 1.9% vs. Exp. 1.7% (Prev. 3.2%)

- Spanish Core CPI YY 5.9% (Prev. 6.1%)

- UK Mortgage Approvals (May) 50.524k vs. Exp. 49.7k (Prev. 48.69k)

- UK BOE Consumer Credit (May) 1.144B GB vs. Exp. 1.5B GB (Prev. 1.586B GB)

- UK M4 Money Supply (May) 0.2%

- UK Mortgage Lending (May) -0.092B GB vs. Exp. -0.5B GB (Prev. -1.384B GB)

- EU Business Climate (Jun) 0.06 (Prev. 0.19)

- EU Consumer Confid. Final (Jun) -16.1 vs. Exp. -16.1 (Prev. -16.1)

- EU Services Sentiment (Jun) 5.7 vs. Exp. 5.5 (Prev. 7.0)

- EU Economic Sentiment (Jun) 95.3 vs. Exp. 96.0 (Prev. 96.5)

- EU Industrial Sentiment (Jun) -7.2 vs. Exp. -5.5 (Prev. -5.2)

- EU Selling Price Expec (Jun) 4.4 (Prev. 6.6)

- EU Cons Infl Expec (Jun) 6.1 (Prev. 12.2)

CRYPTO

- Bitcoin is modestly firmer on the day but remains under USD 30,500 while Ethereum trades on either side of USD 1,850.

GEOPOLITICS

- EU is preparing to offer ‘security commitments’ to Ukraine although some member states are reportedly wary of the French-led plan to offer Kyiv assurances, while it was also reported that Denmark said the EU should not lower the bar to take in Ukraine, according to FT.

- Israeli PM Netanyahu said he wants to find a middle ground on court-system changes in Israel and regarding Ukraine, while he added Israel couldn’t allow the US to give Ukraine the Iron Dome air-defence system developed jointly with the US and he has conveyed his concerns to Russia about growing military ties with Iran, according to WSJ.

APAC TRADE

- APAC stocks traded mixed amid some indecision heading closer towards month/quarter/ half-year end and after the choppy performance stateside as global markets digested the slew of central bank rhetoric from the Sintra Forum.

- ASX 200 was kept afloat as strength in the tech and telecom sectors offset the losses in utilities, real estate and miners, with some encouragement also from better-than-expected Australian Retail Sales.

- Nikkei 225 extended on gains and briefly climbed back above 33,500 as it coat-tailed on the recent advances in USD/JPY and after Japanese Retail Sales topped forecasts.

- Hang Seng and Shanghai Comp were subdued amid ongoing frictions and the potential for additional US tech export restrictions on China but with losses in the mainland cushioned by the PBoC’s liquidity efforts.

NOTABLE ASIA-PAC HEADLINES

- PBoC set USD/CNY mid-point at 7.2208 vs exp. 7.2540 (prev. 7.2101)

- Chinese state banks spotted selling USD in onshore currency markets at around the 7.25 mark, according to sources cited by Reuters.

- Chinese Regulators are stepping up Yuan surveys “as currency slump worsens”, according to Bloomberg; stepping up scrutiny of currency trading and cross-border capital flows.

- US Treasury Secretary Yellen said the US will continue to take actions to protect national security interests with regards to China even if that imposes some economic cost, while she hopes to travel to China and wants to re-establish contact, as well as discuss disagreements, according to an interview with MSNBC.

- Top US diplomat for East Asia Kritenbrink said they have seen a clear and upward trend of Chinese coercion in the South China Sea and China’s provocative behaviour poses risks for businesses, while Kritenbrink also said the US and China discussed ways to increase commercial flights in a phased manner.

- Chinese Embassy Spokesman Liu Pengyu said US and China working groups will discuss the journalist issue and said China has not seen positive US initiatives on semiconductors, while Liu added that the US must remove sanctions before military talks with China.

- Chinese balloon that flew over the US earlier this year reportedly used American-made equipment to spy on Americans, while preliminary US findings showed the craft collected photos and videos but didn’t appear to transmit them, according to WSJ.

- US officials reportedly consider tightening the export of AI chips to China based on computing power in which an update to the rules may come by late July, according to Reuters sources, although one source cautioned that such US actions involving China often get delayed.

- Nvidia (NVDA) CFO said they are aware of reports on new China export restrictions but expect no material change to earnings from rules, while the CFO added that China accounts for 20%-25% of Data Centre sales and the China export ban will result in a loss of opportunities.

- Japan Finance Minister does not comment on FX levels; one-sided and unstable moves are undesirable; will not rule out any options if FX moves are excessive. Japan and South Korea agreed to resume a bilateral currency swap deal worth USD 10bln, according to Reuters.

- China issued measures to promote opening in some free trade zones and ports on a pilot basis to meet high international standards, according to Reuters.

DATA RECAP

- Japanese Retail Sales MM (May) 1.3% vs Exp. 0.8% (Prev. -1.1%)

- Japanese Retail Sales YY (May) 5.7% vs. Exp. 5.4% (Prev. 5.0%)

- Australian Retail Sales MM (May) 0.7% vs. Exp. 0.1% (Prev. 0.0%)

- New Zealand ANZ Business Confidence (Jun) -18.0% (Prev. -31.1%)

- New Zealand ANZ Activity Outlook (Jun) 2.7% (Prev. -4.5%)

Loading…

https://www.zerohedge.com/markets/es-holds-above-4400-feds-chair-powell-spoke-madrid-riksbank-hiked-25bps-newsquawk-us-market