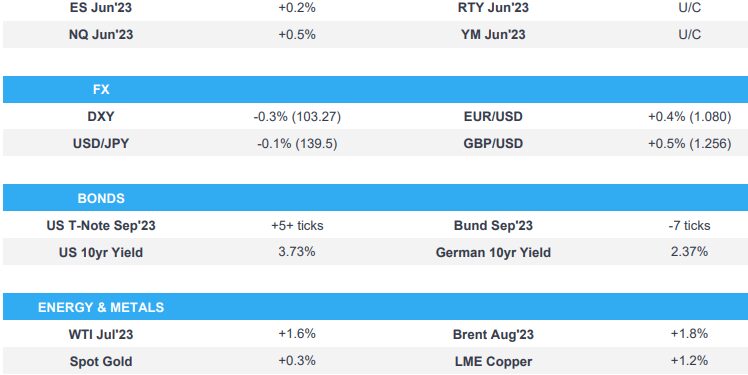

- European bourses & US futures are firmer but off best levels in a continuation of Monday’s action and ahead of US CPI

- NQ is the outperformer as the tech sector benefits from Oracle strength post-earnings

- USD dips pre-inflation while GBP lifts post-jobs/wages, Yuan attempts to recover after PBoC action

- Gilts continue to lag, impacted by data, supply and BoE rhetoric while USTs are once again more contained

- Crude bid after a softer settlement, base metals and spot gold glean support from China action/reports and USD respectively

- Looking ahead, highlights include US CPI. Speeches from BoE’s Bailey, Dhingra; US Treasury Secretary Yellen. Supply from the US. OPEC MOMR at 12:20BST/07:20ET

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are firmer though have eased off of post-open best levels, Euro Stoxx 50 +0.3%. The region is continuing the upside from yesterday’s session and was unreactive to German ZEW with markets fully focused on today’s US CPI.

- Sectors are mixed, Basic Resources outperforms as metals make gains following Chinese stimulus reports and action, a narrative which is also supporting Luxury. Elsewhere, Tech is bolstered by Oracle post-earnings.

- Stateside, futures are firmer across the board with the NQ +0.5% incrementally outperforming given the tech sectors strength; overall, action has modestly extended on Monday’s strength as we look to the inflation release.

- Oracle Corp (ORCL) – Q4 2023 (USD): Adj. EPS 1.67 (exp. 1.58), Revenue 13.84bln (exp. 13.73bln), raised quarterly dividend to USD 0.40/shr from 0.32/shr. Cloud services and license support revenue rose 23% Y/Y to USD 9.37 (exp. 9.1bln). Cloud license and on-premise license revenue fell 15% Y/Y to USD 2.15bln (exp. 2.33bln). Guides Q1 EPS USD 1.12-1.16 (exp. 1.17), guides Q1 rev. growth of 8%-10% (exp. 8.8% growth), adds FX will have a positive 0%-1% impact on rev. and + USD 0.01 on EPS. (PR Newswire) +4.3% in pre-market trade

- Home Depot (HD) reaffirms FY23 outlook; sees sales growth between 3-4% per year in its market stability base case. +0.8% in pre-market trade

- Click here and here for a recap of the main European updates.

- Click here for more detail.

FX

- Dollar soggy pre-US CPI as DXY drifts down between 103.620-210 bounds.

- Euro takes mixed German ZEW survey in stride as it probes option expiries, 1.0800 and 100 DMA vs Greenback.

- Sterling revival forged on strength of UK jobs and wage data, with Cable back above 1.2550 from almost round number below.

- Yuan regroups after PBoC reverse repo cut as reports swirl regarding more Chinese stimulus, USD/CNY and USD/CNH off circa 7.1675 and 7.1785 respective peaks.

- PBoC set USD/CNY mid-point at 7.1498 vs exp. 7.1490 (prev. 7.1212)

- South African Electricity Minister Ramokopa says over 5500 megawatts of renewable projects will be coming online by 2026; 55 gigawatts of wind and solar projects are under development across the country.

- Click here for notable OpEx for the NY Cut.

- Click here for more detail.

FIXED INCOME

- Bonds mixed again and UK debt still underperforming as strong labour data backs up hawkish BoE rhetoric.

- Gilts near the base of 94.80-95.18 parameters post-mediocre 2033 DMO auction, Bunds underpinned within 134.01-55 range after conflicting German ZEW survey findings and T-note afloat between 113-13+/22 bounds pre-US CPI and long bond sale.

- Click here for more detail.

COMMODITIES

- Crude benchmarks are firmer intraday though more broadly are consolidating after Monday’s subdued settlement, action which was driven in part by Goldman Sachs cutting its forecasts.

- Currently, WTI and Brent are firmer by around USD 1.00/bbl to USD 1.30/bbl and some USD 0.20/bbl from their initial session peaks at USD 67.15/bbl and USD 71.94/bbl respectively.

- Spot gold is once again gleaning some incremental upside from the softer USD, though is generally contained pre-CPI. Conversely, base metals are bid on the PBoC action and subsequent source reports and commentary around support measures.

- Boliden (BOL SS) reports a fire at the Rönnskär copper smelter facility, all production there is stopped until further notice. Initial assessment is this can be resumed in a few weeks. Boliden notes Rönnskär can produce 250k/T of copper per year, making it one of the world’s largest smelters

- Click here for more detail.

CRYPTO

- Bitcoin is rangebound and yet to deviate meaningfully from the USD 26k mark with specifics limited and markets broadly focused on upcoming US CPI as the final and potentially decisive input before Wednesday’s FOMC.

NOTABLE EUROPEAN HEADLINES

- BoE’s Greene (appointee, joins July 5th) says UK labour market surprisingly tight; indicators are not evolving as one might expect given significant monetary policy tightening. If you engage in stop-start monetary policy, can end up with worse outcomes. UK is seeing some second-round effects in inflation. Reasonable to expect inflation to come down fairly quickly. Expects it will be easier to get inflation down to 5% from 10%, than to 2% from 5%. If UK inflation drivers are persistent, BoE needs to lean against this.

- UK Energy Secretary Shapps says the UK does not need more green subsidies, and dismisses calls from green industries for a UK-version of the US’ Inflation Reduction Act, via Politico.

- EU’s Sefcovic warned that barriers between the UK and EU are likely to deepen further despite the resolution of a diplomatic stand-off over Northern Ireland creating a “new spirit” in relations, according to the FT.

- Germany aims to buy six Iris-T defence systems for around EUR 900mln for its air force; to decide on the purchase on Wednesday, via Reuters citing sources.

NOTABLE EUROPEAN DATA

- UK Average Earnings (Ex-Bonus) (Apr) 7.2% vs Exp. 6.9% (Prev. 6.7%, Rev. 6.8%); Average Week Earnings 3M YY (Apr) 6.5% vs Exp. 6.1% (Prev. 5.8%, Rev. 6.1%)

- UK ILO Unemployment Rate (Apr) 3.8% vs Exp. 4.0% (Prev. 3.9%); Employment Change (Apr) 250k vs. Exp. 162k (Prev. 182k)

- HMRC Payrolls Change (May) 23k (Prev. -135k, Rev. 7k); Claimant Count Unemployment Change (May) -13.6k (Prev. 46.7k, Rev. 23.4k)

- German ZEW Economic Sentiment (Jun) -8.5 (Prev. -10.7); Current Conditions (Jun) -56.5 (Prev. -34.8). Current recession is generally not considered particularly alarming and experts do not expect an improvement in H2.

- Norwegian GDP Month Mainland (Apr) -0.4% vs. Exp. 0.0% (Prev. 0.5%, Rev. 0.2%)

NOTABLE US HEADLINES

- US House Republican hardliners said they will allow chamber votes this week on partisan measures involving gas stoves, pistol braces and regulations, while they stand ready to block other measures while seeking a power-sharing deal with House Speaker McCarthy. It was also reported that House Speaker McCarthy stated Republicans have the votes to move forward on stalled legislation this week and he agreed to continue to talk to hardliner conservatives, according to Reuters.

GEOPOLITICS

- Belarusian President Lukashenko says Belarus will not hesitate to use nuclear weapons in the case of aggression against it, via Belta; says deployment of Russian tactical nuclear weapons in Belarus is a deterrent to discourage potential aggressors.

- Ukrainian air defence systems were engaged in repelling air attacks in the Kyiv region, according to the region’s military administration, while it was also reported that Russia conducted strikes on the city of Kryvyi Rih, according to the mayor.

- Russian Defence Ministry says their forces have seized German Leopard tanks, via Ria.

- US President Biden’s admin. is expected to approve depleted-uranium tank rounds for Ukraine, via WSJ citing sources.

- Latest US aid package to Ukraine will include more Bradley and Stryker fighting vehicles, according to NYT.

- US Central Command said a helicopter mishap in Northeastern Syria injured 22 US service members on June 11th and the cause is under investigation although there was no enemy fire reported, according to Reuters.

APAC TRADE

- APAC stocks eventually traded mostly higher following the gains on Wall St where the S&P 500 and Nasdaq 100 rose to their best levels in a year with big tech supported as yields softened ahead of the upcoming risk events, while the region also digested the PBoC’s cut to its 7-day reverse repo rate.

- ASX 200 just about kept afloat but with upside capped after mixed data in which Westpac Consumer Confidence improved but remained near recession lows and NAB Business Confidence deteriorated.

- Nikkei 225 resumed its outperformance and breached the 33,000 level for the first time in over three decades amid strength in automakers and with SoftBank spearheading the advances on news that Intel is to discuss being an anchor investor in the Arm IPO.

- Hang Seng and Shanghai Comp. were both initially subdued despite the PBoC’s cut to its short-term interbank funding rate which raises the prospects of a cut to the MLF rate and benchmark LPR, with sentiment dampened by ongoing growth concerns and lingering frictions after the US added 43 entities to its export control list.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 2bln via 7-day reverse repos and cut the rate by 10bps to 1.90% from 2.00%.

- China is said to be weighing broad stimulus with property support and rate cuts, according to Bloomberg sources; Plans include at least a dozen measures to support domestic demand and the property sector. Interest rate reductions are also being mulled. State Council may discuss policies as soon as Friday, although may not be announced or implemented.

- China’s state planner (NDRC) issues notice on lowering costs this year; to exempt and reduce VAT for small businesses until year-end. Will steadily lower loan interest rates. To introduce targeted tax and fee reduction policies in science and tech. Will guide financial institutions to raise medium and long-term loan issuances for the manufacturing industry.

DATA RECAP

- Australian Westpac Consumer Confidence Index (June) 79.2 (Prev. 79.0)

- Australian NAB Business Confidence (May) -4 (Prev. 0); Conditions (May) 8 (Prev. 14)

Loading…

https://www.zerohedge.com/markets/equities-cautious-dxy-weakens-and-usts-rangebound-ahead-us-cpi-newsquawk-us-market-open