- APAC stocks traded lower following the weak handover from global counterparts after the Nvidia-related euphoria wore off.

- European equity futures are indicative of a lower open with the Eurostoxx 50 future -0.3% after the cash market closed down 0.8% yesterday.

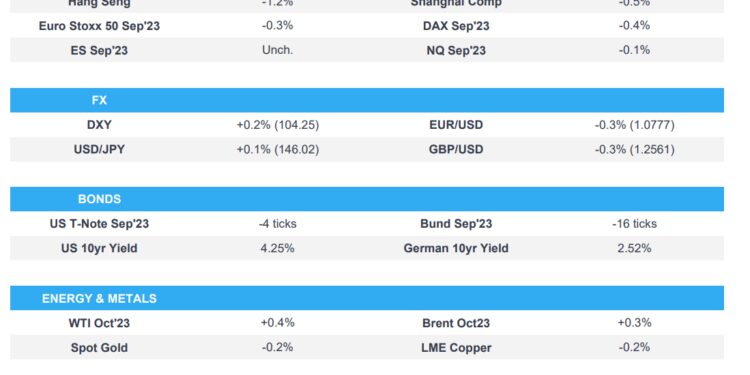

- DXY has extended upside above 104 and is firmer vs. peers, EUR/USD sits on a 1.07 handle whilst USD/JPY has reclaimed 146 status.

- ECB’s Nagel stated it is much too early to think about a rate-hike pause, Vujcic said it is to be seen whether rates are restrictive enough.

- Offshore Alliance members at Woodside Energy (WDS AT) endorsed the in-principle agreement.

- Looking ahead, highlights include German Ifo, US UoM Survey, Fed’s Powell, Mester, Harker, Goolsbee & ECB’s Lagarde.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were sold throughout the session and the initial Nvidia-induced euphoria was unwound with headwinds from firmer yields after lower-than-expected jobless claims data and as participants now look ahead to Jackson Hole.

- SPX -1.35% at 4,376, NDX -2.19% at 14,816, DJIA -1.08% at 34,099, RUT -1.27% at 1,846.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Former US President Trump was booked on election subversion charges at the Fulton County, Georgia jail and was released on a USD 200k bond.

APAC TRADE

EQUITIES

- APAC stocks traded lower following the weak handover from global counterparts after the Nvidia-related euphoria wore off and with markets bracing for Fed Chair Powell’s speech at Jackson Hole.

- ASX 200 was pressured by heavy losses in tech and the commodity sectors, while consumer stocks showed some resilience after stronger earnings from Wesfarmers.

- Nikkei 225 fell by as much as 2% after it gapped below 32,000 with tech stocks hit by the broad sector recoil.

- Hang Seng and Shanghai Comp declined with NetEase and Meituan among the worst performers in Hong Kong as the widespread tech selling clouded over their earnings results, while losses in the mainland were limited following a firm liquidity injection by the PBoC and after the securities regulator met with financial industry firms and urged longer-term funds to help steady the stock market.

- US equity futures languished near the prior day’s lows after the broad stumble seen across global equities.

- European equity futures are indicative of a lower open with the Eurostoxx 50 future -0.3% after the cash market closed down 0.8% yesterday.

FX

- DXY extended on the prior day’s gains above the 104 mark after surging on the back of the lower jobless claims data and after comments from Fed’s Harker and Collins, while the focus turns to Fed Chair Powell’s upcoming speech at Jackson Hole.

- EUR/USD continued its retreat and fell beneath the 1.0800 handle owing to the dollar strength.

- GBP/USD remained pressured at a sub-1.2600 level after the recent underperformance in activity currencies.

- USD/JPY made its way back to 146.00 territory with price action driven by a firmer buck and yield differentials.

- Antipodeans trickled beneath yesterday’s lows owing to the broad risk-off mood.

- PBoC set USD/CNY mid-point at 7.1883 vs exp. 7.2923 (prev. 7.1886)

- Brazilian President Lula said BRICS will move forward on trade currency without the dollar and that BRICS is not in a hurry to define the trade reference unit.

FIXED INCOME

- 10yr UST futures traded subdued after yields edged higher on the back of recent jobless claims data and with markets bracing for Fed Chair Powell’s opening remarks at the Jackson Hole Symposium.

- Bund futures were lacklustre with participants also side-lined ahead of comments from ECB’s Lagarde.

- 10yr JGB futures conformed to the dull mood following mixed data in which Tokyo CPI figures printed mostly softer than expected but national Services PPI topped forecasts.

COMMODITIES

- Crude futures traded rangebound amid the negative risk tone and lack of fresh energy catalysts.

- Offshore Alliance members at Woodside Energy (WDS AT) endorsed the in-principle agreement.

- Spot gold was contained as the dollar remained firm ahead of key central bank speeches.

- Copper futures mildly extended beneath yesterday’s lows owing to the broad risk-off mood.

- China’s Industry Ministry said it aims to increase the output of 10 non-ferrous metals by 5% in 2023-2024 and will promote companies cooperating in overseas iron ore exploration, especially in neighbouring countries.

CRYPTO

- Bitcoin remained subdued after recently testing the USD 26,000 level to the downside.

NOTABLE ASIA-PAC HEADLINES

- PBoC was said to ask some banks to limit southbound bond connect investments with the guidance said to be aimed at outflows and limiting yuan offshore supply, according to Reuters sources.

- US Treasury Deputy Secretary Adeyemo said he is closely monitoring the Chinese economy which is showing weakness that has global implications but added the US is probably the best prepared to deal with headwinds created by China’s economic weakness, according to Reuters.

- Reuters polls shows 55% of economists say the BoJ will not start unwinding ultra-easy policy until at least July 2024, while 73% of economists think BoJ will end YCC control in 2024 (prev. 50%) and 41% expect BoJ to end NIRP in 2024 (prev. 54%)

DATA RECAP

- Tokyo CPI YY (Aug) 2.9% vs. Exp. 3.0% (Prev. 3.2%)

- Tokyo CPI Ex. Fresh Food YY (Aug) 2.8% vs. Exp. 2.9% (Prev. 3.0%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Aug) 4.0% vs. Exp. 4.0% (Prev. 4.0%)

- Japanese Services PPI YY (Jul) 1.7% vs Exp. 1.3% (Prev. 1.2%)

GEOPOLITICS

- White House said US national security advisor Sullivan convened the Quint national security advisors of France, Germany, Italy and the UK on Thursday whereby they examined further ways to hold Russia accountable for its war.

- US Pentagon said it will start training Ukrainian pilots on F-16 aircraft in October.

- White House said US President Biden and Ukrainian President Zelensky discussed the start of training Ukrainian fighter pilots and the expedited approval of other nations to transfer their F-16s, according to Reuters.

- Russian military said it intercepted a Ukrainian S-200 missile over Russian territory, while the Russian Defence Ministry said a Ukrainian attack on Crimea involving 42 drones was thwarted, according to Reuters and AFP.

- Russian Foreign Minister Lavrov told UN Chief Guterres that Russia is ready to get back to the grain deal if its conditions are met.

- Taiwan Defence Ministry said 13 Chinese military aircraft entered Taiwan’s ‘response zone’ and 5 Chinese naval ships engaged in combat readiness patrols on Friday morning, according to Reuters.

EU/UK

NOTABLE HEADLINES

- ECB’s Nagel it is much too early to think about a rate-hike pause, while he stated they have to be stubborn on policy and more stubborn than inflation, according to an interview with Bloomberg TV.

- ECB’s Vujcic said the Eurozone economy is basically stagnating and inflation has most likely peaked, while he added that it is to be seen whether rates are restrictive enough, according to an interview on Bloomberg TV.

DATA RECAP

- UK GfK Consumer Confidence (Aug) -25 vs. Exp. -29 (Prev. -30)

Loading…

https://www.zerohedge.com/markets/dxy-lifts-broader-tone-softer-ahead-jackson-hole-symposium-newsquawk-europe-market-open