Something for every narrative in this morning’s CPI:

-

Headline CPI tumbled (yay, Fed is done forever!);

-

Goods inflation rebounding (Fed can pause as Services prices slow);

-

Core CPI warmer than expected and still sticky high (Fed can’t stop, but maybe a skip!);

-

SuperCore accelerating (Fed should keep hiking!).

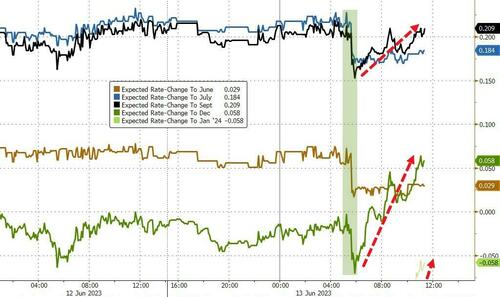

Choose your own adventure. The STIRs market chose to kneejerk dovish, but as reality set in rate-hike expectations for September rose (June and July were lower but the latter still high). Moreover, the market has now fully priced out any rate-cuts this year (Dec now pricing in rate 6bps higher than current)…

Source: Bloomberg

The initial reaction in stocks was ‘Buy Mortimer, Buy!”, but as the cash equity market opened we saw the rotation from mega-cap tech to small-caps reassert itself…

By the close, Small Caps were the winner, up over 1%, while The Dow lagged and S&P and Nasdaq were just a smidge better – all the majors were green on the day…

AI stocks soared, but we note that comments by AMD’s CEO that her new chips could mean ‘fewer GPUs’ are required for AI seemed to spook the entire sector…

Meme stocks soared…

Source: Bloomberg

TSLA rallied again today – the 13th straight day higher (a new record win streak) and up 41% in that time…

Notably, ORCL – which hit a fresh all-time record high at the open – spent the rest of the day being sold and ended red, despite strong earnings last night…

Treasuries were clubbed like a baby seal after an initial kneejerk lower on headline CPI.

Source: Bloomberg

2Y yields at highest since March and 5Y yields topped 4.00% for the first time since March 10th…

Source: Bloomberg

The yield curve (2s30s) kneejerked steeper on CPI then crumbled flatter all day to end at its most inverted of the day…

Source: Bloomberg

The dollar ended lower again – but well off its CPI-spike-lows – back at almost one-month lows

Source: Bloomberg

…as Treasury Secretary Yellen said she “expects a slow decline in the dollar as reserve currency.”

YELLEN: Sanctions motivate others to look for tools outside the dollar

– France is not happy about sanctions but there is no meaningful work around to using the dollar

– Increase in the use of other reserve assets outside the dollar is to be expected pic.twitter.com/zzos0pwFYk

— Bitcoin News (@BitcoinNewsCom) June 13, 2023

Bitcoin spiked up to the pre-weekend-purge levels before fading back and ending the day unchanged…

Source: Bloomberg

Gold spiked modestly on the headline CPI and was then monkeyhammered back to the lows of its recent range…

Oil prices ended higher, rebounding off yesterday’s lows/resistance…

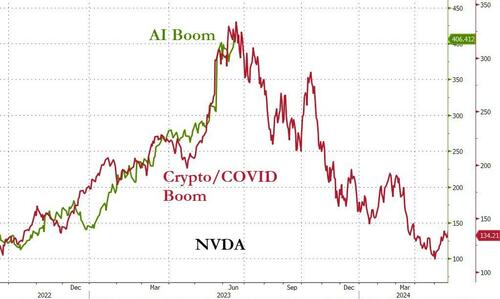

Finally, just as we saw in the middle of the supply-chain chaos during COVID, firms are pre-buying, bringing forward demand dramatically – and stocks just want to extrapolate the trend…

Because all Chinese companies are rushing to get ahead of the AI chip blockade https://t.co/HyViOxpS48

— zerohedge (@zerohedge) June 13, 2023

Which leaves us “here”…

Source: Bloomberg

Can’t be the same, right?

And what to expect tomorrow?

Check out this chart. The average intraday path the S&P has taken on the last six Powell Fed days has not been pretty.

Read more in our newest Fed Days report: https://t.co/OFWRCYKLzE pic.twitter.com/betBvy4YyQ

— Bespoke (@bespokeinvest) June 13, 2023

Loading…

https://www.zerohedge.com/markets/dollar-dives-yellen-questions-reserve-currency-bonds-bullion-battered-after-mixed-cpi