No macro data but plenty of FedSpeak, which was once again hawkish this morning:

Minneapolis Fed President Kashkari: “If we were to skip in June that does not mean we’re done with our tightening cycle, it means to me we’re getting more information. Do we then start raising again in July, potentially?“

“… What’s important to me is not signaling that we’re done… It may be that we need to go north of 6%, let’s see what happens in the underlying services economy.”

Then St.Louis Fed’s Jim Bullard cranked it up to ’11’: “I think we’re going to have to grind higher with the policy rate in order to put enough downward pressure on inflation and to return inflation to target in a timely manner… I’m thinking two more moves this year – exactly where those would be this year I don’t know – but I’ve often advocated sooner rather than later.”

“As long as the labor market is so good it’s a great time to fight inflation, get it back to target,” he said.

“Get this problem behind us and not replay the 1970s.”

As a reminder, after the bell of Friday, The Fed released data showing deposits outflows, especially from Small Banks, continue to accelerate…

Source: Bloomberg

Regional bank shares soared helped by PACW which spiked on a deal to sell a big chunk of its real estate construction loans. However, as the chart below shows, the KRE ETF ramped up to last week’s highs and stalled (and we offer the large chart for context…

JPM CEO Jamie Dimon had some less than exciting words for regional banks, warning about “what’s runnable” as opposed to uninsured vs insured deposits and said “everybody should be prepared for higher rates from here.”

Dimon expressed concern about the impact of QT and thinks markets and regulators haven’t focused enough on the unknowns that are coming as the Fed continues its fight against inflation. The turmoil could push interest rates as high as 7% he said.

Small Caps were the day’s best performers (financials and short-squeeze) while The Dow was the biggest loser. The S&P was unch and Nasdaq managed some gains

0-DTE call-buyers did God’s work and engineered the S&P back above 4200 again (but it couldn’t hold for the close)…

Source: SpotGamma

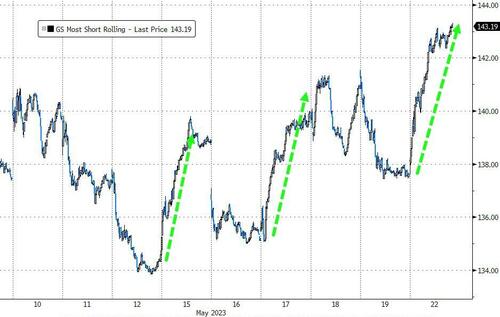

The 0-DTE impulses stoked the squeeze as ‘Most Shorted’ stocks surged higher…

Source: Bloomberg

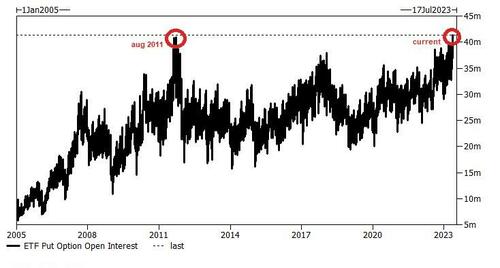

Goldman’s Brian Garrett notes that the combined put open interest across major equity ETFs stands at ~41mm contracts (as of last data count // Thursday close). This is the highest ETF put open interest in history…

…the last time put open interest approached these levels was Aug of 2011 (debt limit version 1.0) … note this index tracks 14 most commonly traded (ie, XL sector ETFs + SPY, QQQ, etc). Garrett notes that Goldman’s data suggests risk in equities is increasing, implied volatility is bottom of the range, the cost to hedge is low (cheap?), and clearly investors are finally using the option market to protect left tail.

Interestingly, the vol curve remains lower (bullish) into the X-Date…

Source: Bloomberg

Treasury yields were higher across the curve in a relatively uniform manner (up 3-4bps)… once again the main selling pressure was during the US session…

Source: Bloomberg

This is the 7th straight day of higher yields (longest streak since Sept 2022) with the 2Y back at its highest since March 10th (right as SVB collapsed)…

Source: Bloomberg

Rate-hike odds rose today, erasing FDriday’s decline…

Source: Bloomberg

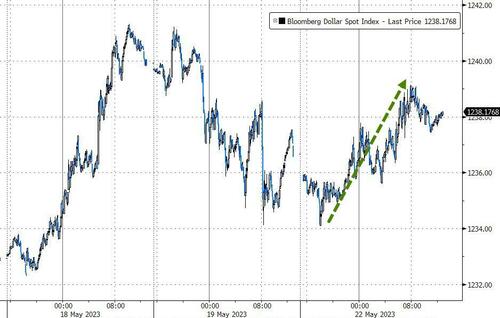

The dollar rallied today from overnight weakness…

Source: Bloomberg

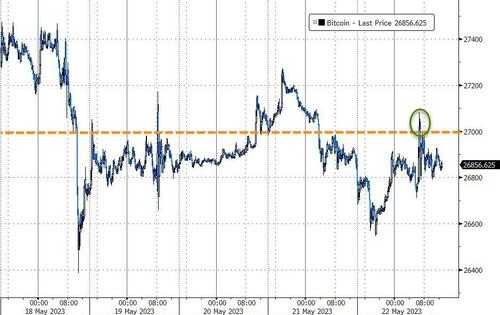

Bitcoin rallied back above $27,000 but could not hold it – ending around unch…

Source: Bloomberg

Gold dipped lower with futs unable to get back to $2,000…

Oil rallied very modestly on the day, with WTO back above $72…

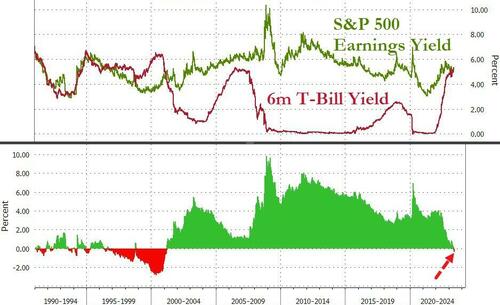

Finally, we note that 6mo T-Bill yields are now trading at a 33bps premium to the earnings yield of the S&P 500…

Source: Bloomberg

That’s the largest premium since Feb 2001.

Loading…

https://www.zerohedge.com/markets/despite-hawkish-fedspeak-deposit-outflows-banks-lead-squeezy-stocks-higher-hedges-hit