Authored by Simon White, Bloomberg macro strategist,

Idling credit spreads are increasingly unreflective of underlying credit conditions, leaving them exposed to a significant widening.

Credit spreads – investment grade and high yield – have in net terms gone nowhere over the last nine months. But this is concealing a worsening backdrop in the economy, less credit availability, and burgeoning credit stress.

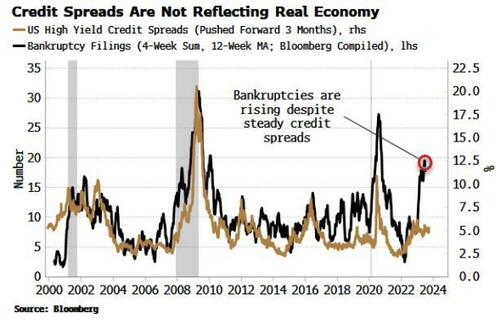

Take bankruptcy filings. They are – and it’s not melodramatic to phrase it like this – soaring. The chart below shows the number of bankruptcy filings of US companies with more than $50 million of liabilities. At the current rate, they will soon exceed the 2009 and 2020 peaks.

The chart above also shows that normally wider credit spreads would presage a rise in filings, but that has signally not happened thus far.

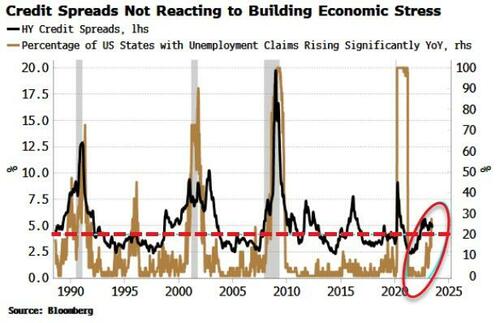

Also, credit spreads are not reflecting stress building in the jobs market. Typically, when we see an increasing percentage of US states whose unemployment claims are rising steeply, credit spreads rise too.

The pervasive worsening in the labor market is an early-warning signal of oncoming economic distress that credit spreads tend to pick up too. But again, that has failed to happen this time.

What’s behind this?

One likely culprit is speculation in equity markets is repressing volatility and this is flattering companies’ implied probability of default.

Speculation can keep markets aloft for longer, but they will become increasingly unstable.

When the party’s over though, credit markets face a rude awakening as they reprice to what is actually happening on the ground.

Loading…

https://www.zerohedge.com/markets/credit-spreads-and-real-economy-are-increasingly-odds