Authored by Simon White, Bloomberg macro strategist,

European equities should stay supported despite growth faltering somewhat as a global cyclical upturn driven by China builds momentum.

The initial look at 1Q euro-area GDP came in slightly below expectations, at 0.1% quarter-on-quarter, versus a 0.2% estimate, and 1.3% year-on-year versus 1.4%.

That is a far cry from weak expectations last year in the heat of Russian’s invasion of Ukraine and a sharp rise in energy prices. However, a lot of the positivity around Europe came from rock-bottom expectations that swung to comparatively euphoric once markets realized the worst wasn’t going to happen.

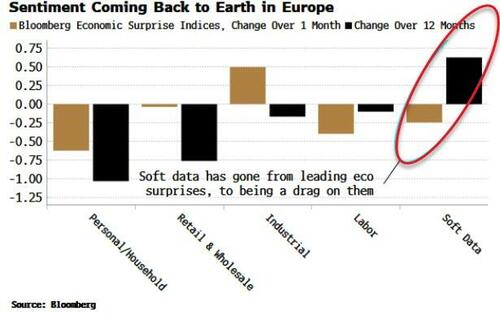

The chart below shows that economic surprises were greatest in soft, i.e. survey, data over the last year. Now, though, soft data is disappointing.

And hard data too are disappointing, with household, retail and labor releases all recently coming in lower than expectations.

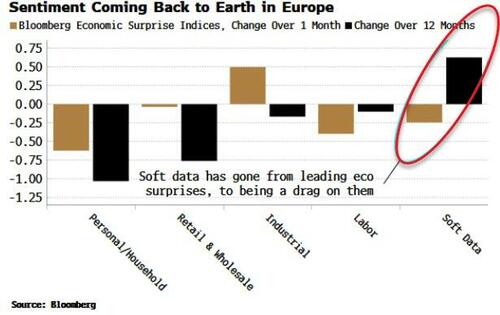

We can see the soft-data weakness in the PMIs, which picked up from their lows, but are now mostly falling again.

However, sentiment can only take you so far and there will be a re-evaluation of Europe’s growth prospects as it is realized that just because the situation is not as bad as feared, that does not mean there is nothing at all to fear.

European equities have surfed the wave of this upswing in optimism, coming in ahead of the US, UK, Canada, Australia and Japan this year. While they are beginning to reflect this less upbeat outlook, that does not mean they are doomed to lose all of their mojo.

Europe is highly sensitive to China and global growth, and the cyclical upswing that is gradually, but surely, building momentum as easing in China gains traction will keep European equities supported, and continuing to outperform the US.

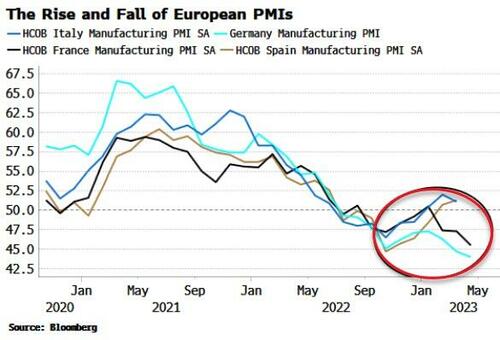

Semiconductors are one of the best bellwethers of global cyclical growth, and after struggling through most of 2021 and 2022, chip stocks have bounced strongly, pointing to a rise in European earnings.

Revenues are the main positive support of European equity returns, compensating for the drag from margins and multiples. However, a pick-up in earnings should make up for the expected decline in revenues as the economy slows through the year, keeping prices supported.

Loading…

https://www.zerohedge.com/markets/global-upturn-trumps-domestic-slowdown-european-stocks