By Charlie Zhu, Bloomberg Markets Live reporter and analyst

Three things we learned last week:

1. A town builder’s last-minute bond repayment reignited fears over a potential default by such issuers. Investors are watching out for the first missed payment by a local government financing vehicle, something regional authorities are trying hard to avoid. The possibility has recently increased, as a weakening fiscal situation means authorities are less able to provide support.

Research from GF Securities Co. shows there were 73 cases of shadow-banking defaults in the first four months, already a full-year record since data became available in 2018.

“Missing payments in shadow banking are a signal that debt risks in a certain region have become more prominent,” GF analysts led by Liu Yu wrote in a report.

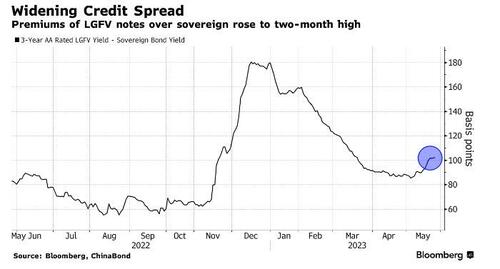

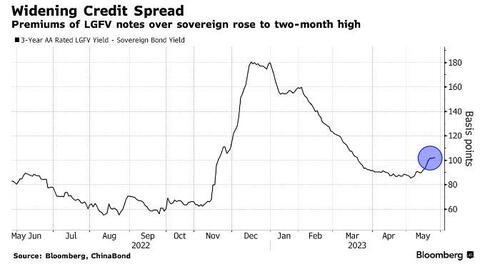

Yields on Kunming Dianchi Investment Co.’s note due in December surged to over 20% last week, as two holders said they didn’t receive payments until after business hours for a note due this month. Premiums of three-year AA rated LGFV bonds widened to the most since March, and investors cited local-debt worries as one of the reasons behind a decline in Chinese stocks.

China’s LGFVs had 13.5 trillion yuan ($1.9 trillion) of bonds in total outstanding as of end-2022, or almost half of the nation’s non-financial corporate notes, data from Moody’s Investors Service show.

Steps by authorities “to lower LGFV debt risks will not fully resolve long-term issues,” and their refinancing ability depends on investors’ confidence in government support, especially in weaker provinces, Moody’s analysts led by Ivan Chung wrote in a report.

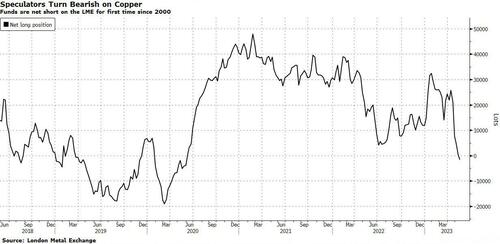

2. With the financial strength of both town builders and their sponsors deteriorating, investors became more pessimistic about China’s demand for raw materials. Copper dived below $8,000 a ton while iron ore breached $100, unwinding gains since Beijing ended its Covid Zero policies late last year.

At the London Metal Exchange’s annual Asian event in Hong Kong, participants reported lackluster activity and said that any market optimism from the National People’s Congress in March had evaporated.

The selloff in Chinese stocks also extended, with the benchmark CSI 300 Index erasing all of its gains for the year. Now, even bulls are rethinking their calls, with Citigroup Inc.’s global allocation team cutting its overweight rating on China to neutral.

3. Luckily, positive developments on China-US bilateral relations helped to alleviate some of the pessimism. Soon after President Joe Biden said he expected ties with China to improve “very shortly” after a spat over an alleged spy balloon earlier this year, top commerce officials from the two countries agreed to strengthen communications. The meeting served as a sign that Beijing and Washington are trying to prevent their relations from worsening further.

It remains to be seen though if China’s decision to bar Micron Technology Inc. from supplying critical infrastructure leads to another round of tension. Some analysts see this as an opening shot by Beijing to retaliate, while US lawmakers want to react with putting more Chinese firms on a blacklist.

Loading…

https://www.zerohedge.com/markets/china-shadow-banking-defaults-surge