Just days after we discussed how the market has gotten so exhausted of hearing the broken record announcement out of Beijing and its western media conduits that a “broad stimulus” is imminent, that it even failed to close green on the day China cuts its short term rates by a “whopping” 10bps for the first time in 10 months, this morning the WSJ reported that Beijing is planning “major” steps to revive the country’s flagging economy, including the possibility of billions of dollars in new infrastructure spending, and looser rules to encourage property investors to buy more homes.

So far so good; the problem, as always, emerges when reading the fine fine print which reveals that contrary to expectations for a big, shotgun stimulus – the kind that China used in the past to shock the world into growth – the latest stimmy may be – in the parlance of Zoolander – for ants?

Here are the details: as part of the broader stimulus, Beijing is considering issuing one trillion yuan, equivalent to about $140 billion, of special treasury bonds to help indebted local governments and boost business confidence. The special bonds would be used to finance infrastructure projects and other initiatives aimed at boosting economic growth. They would also be indirectly used to help local governments repay their debt.

As a reminder, one of the most likely sources of a systemic credit event cited by fund managers in the June survey was China real estate…

… and linked to that, short China equities was cited as the second most crowded trade after long big tech.

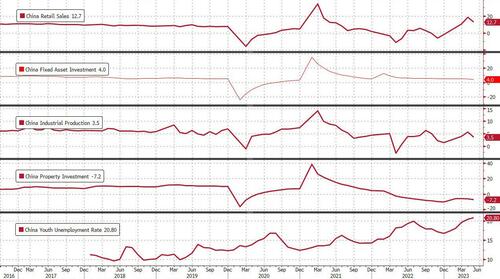

Add a record youth unemployment rate to an increasingly unstable economy and growing fears of a credit event and market crash, and it becomes clear why Beijing is starting to freak out. But even the latest proposed stimulus is unlikely to be seen as enough.

Beijing is also considering plans to scrap purchase restrictions on second homes in China’s smaller cities, as a way to boost the property market, the WSJ sources said echoing what Bloomberg reported earlier this week. Currently, buyers in many cities are prohibited from buying more than one property, a policy intended to prevent speculation.

According to the WSJ, the moves are a sign that Beijing officials are increasingly uneasy about the economy’s prospects now that a wave of excitement following the country’s abandonment of its draconian Covid-19 controls has receded.

The latest stimulus push follows a series of interest rate cuts by China’s central bank this week, including one on Thursday which cut a key policy rate for the first time since August, as fresh data showed the country’s economic recovery is flickering out. All of the recent cuts were mocked by market participants as too little, too late to reverse China’s accelerating decline.

Meanwhile, China’s latest data dump overnight showed that growth continues to slow…

… and adds to the growing list of challenges for Beijing which also includes icy relations with the U.S. and moves by Washington and its allies to throttle China’s access to advanced computer chips on the grounds of national security. Multinational manufacturers are rethinking China’s role in their supply chains in response to concerns over future trade disruptions from frictions with the West.

Still, as we discussed at length earlier this week, many traders and economists are growing skeptical that the latest measures will be enough to reverse weakening confidence and prevent a further slowdown. The moves also signal that officials are still wedded to old ways of juicing growth by using borrowing to fire up investment, rather than taking more difficult steps to boost household incomes and consumption (it wasn’t immediately clear what those “more difficult” steps may be).

Amid the relentless flood of leaks, news report and rumors about “imminent” stimulus, none of which have led to anything constructive, it is not surprising that everyone is reserving commentary to see what Beijing actually does before turning optimistic.

“The economy is facing rising risk of stagnation,” said Dan Wang, chief economist at Hang Seng Bank China.

“It’s hard to be positive about China’s economy at the moment,” said Katrina Ell, senior China economist at Moody’s Analytics.

Raising more funds for local governments could help restore confidence somewhat, by showing that the central government is willing to use its relatively robust balance sheet to bail out struggling cities, said Yao Wei, chief China economist at Société Générale.

China’s local governments borrowed heavily in recent years to finance infrastructure projects and other initiatives, with total local government debt reaching around 66 trillion yuan, according to the International Monetary Fund. The debt has become a major concern for policy makers, who worry it could pose risks to financial stability.

Meanwhile, economists are more mixed on the idea of using much of the money on infrastructure projects, such as building subways and bridges. Doing so would create jobs, but it would worsen China’s debt problems and could yield diminishing economic returns in the long run, since many of China’s infrastructure needs have already been met. Just a few days ago, the WSJ published “Fueled by Long Credit Binge, China’s Economy Faces Drag From Debt Purge” in which it noted that “after years of heavy borrowing, many in China are focused on paying down their debts this year— and the result could be weaker growth for a long time to come.” Unless of course Beijing shoves trillions in new debt down the throats of consumers and companies – which is what it will inevitably do as that’s the only thing it can do – and begins the countdown to the next global financial crisis.

Loading…

https://www.zerohedge.com/markets/china-planning-major-steps-revive-sinking-economy-market-skepticism-soars