It may not be JPMorgan, but as one of the Big 4 commercial US banks, hopes were high that Bank of America would report results for Q2 that, like last quarter, would benefit from the recent turmoil in the small and regional bank space. And BofA did not disappoint, reporting earnings that generally came in stronger than expected across the board (and beat not only the top and bottom line but also all banking/markets expectations) while delivering a picture of what still seems to be a healthy consumer.

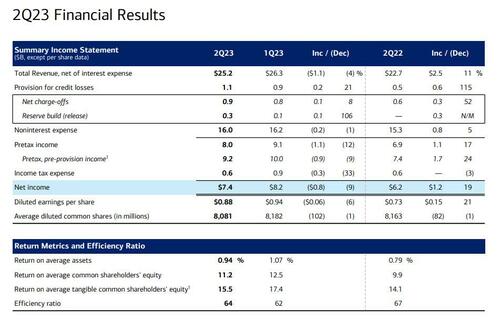

Here is a snapshot of what the bank reported for Q2:

- Revenue net of interest expense $25.20 billion, beating the estimate of $24.97 billion, up 11% or $2.5BN from $22.7 billion a year ago

- EPS $0.88, beating the estimate of $0.84, and up 21% from the $0.73 reported a year ago.

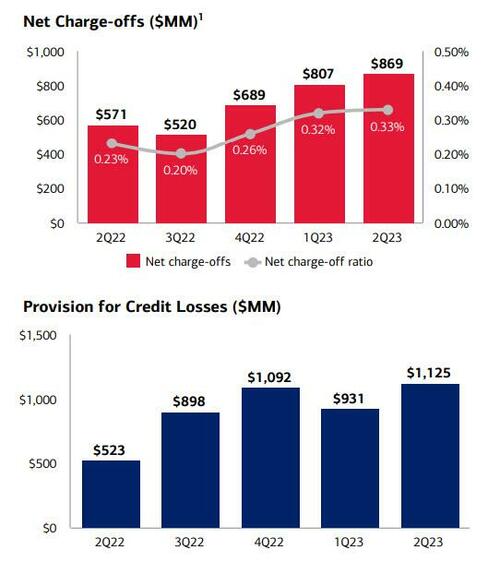

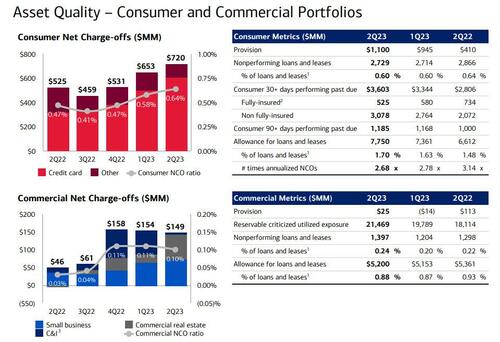

Similar to JPM, both the amount of charge offs and provision for credit losses jumped both sequentially and YoY. Total net charge-offs of $869MM increased $62MM from 1Q23.

- Consumer net charge-offs of $720MM increased $67MM, driven primarily by higher credit card losses. And while the credit card loss rate jumped to 2.60% in 2Q23 vs. 2.21% in 1Q23, the credit card loss rate remained below the Q2 19 pre-pandemic loss rate of 3.03%.

- Commercial net charge-offs of $149MM decreased $5MM, as lower Commercial and Industrial net charge-offs were mostly offset by higher Commercial Real Estate net charge-offs. The net charge-off ratio of 0.33% increased 1basis point from Q1 23 and remained below pre-pandemic levels.

At the same time, net reserve build of $256MM in 2Q23 was driven primarily by credit card loan growth

Combined, these two added up to BofA’s total Q2 provision for credit losses which more than doubled YoY to $1.125BN, up from $523MM in Q2 2022, but less than the $1.2BN expected. The allowance for loan and lease losses of $13.0B represented 1.24% of total loans and leases.

Going back to the bank’s organic results, we first take a quick look at Net Interest Income, which at $14.16BN and a Net Interest Yield of 2.06% both slightly missed estimates of $14.30BN and 2.14% and declined for a 2nd quarter in a row (NII decreased $0.3B, or 2%, from 1Q23, “driven by higher deposit costs and lower balances, partially offset by higher asset yields, higher NII related to GM activity, and one additional day of interest accrual”)…

… before we turn to BofA’s global banking and global markets where BofA surprised to the upside as CEO Brian Moynihan himself noted when he said that “All businesses performed well, and we saw improved market shares, particularly in our sales and trading and investment banking businesses.”

Indeed, BofA’s trading revenue excluding DVA was $4.39 billion, above the est of $3.98 billion, as fixed-income and equity traders delivered a surprise gain, covering a slight miss in expected net interest income. Revenue from FICC trading rose 18% to $2.76 billion in the second quarter, beating estimates of $2.44 billion as clients reacted to changing interest rates. At the same time Equities trading of $1.62 billion also beat estimates of $1.54 billion. Some more details:

- Markets revenue of $4.9B increased 8% from 2Q22, driven primarily by higher sales and trading revenue and the absence of mark-to-market losses related to leveraged finance positions in 2Q22

- Fixed income, currencies, and commodities (FICC) revenue increased 7%, to $2.7B, beating est. of $2.44BN driven by strong trading performance in currencies, emerging markets interest rates, and secured financing, as well as improved trading in credit and mortgage products, partially offset by weakness in commodities

- Equities revenue decreased 2%, to $1.62B, beating est of $1.54BN driven primarily by weaker trading performance in derivatives, partially offset by an increase in client financing activities

And visually:

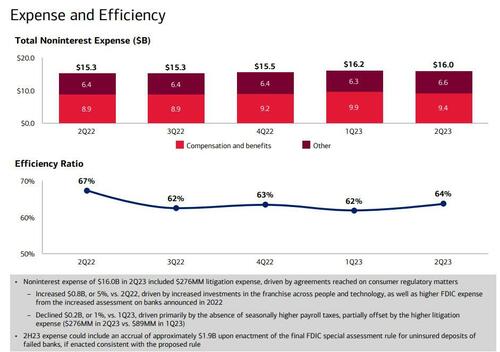

While revenues rose and beat estimates, so did expenses which were notably higher in the second quarter due to investments in technology and higher FDIC and legal costs, the bank said. Non-interest expenses rose 5% from a year earlier to $16 billion. Costs have been a focal point for investors, with persistent inflation putting pressure on spending and spurring wage growth. Analysts had expected a 3.3% increase to $15.78 billion.

Turning to the bank’s global banking group, it generated net income of $2.7BN, which was up 76% from 2Q22 on revenue of $6.5B “driven primarily by higher NII, higher leasing revenue, and the absence of mark-to-market losses related to leveraged finance positions in 2Q22”; This was partially offset by lower treasury service charges due to higher earnings credit rates.

Total investment banking fees of $1.2B increased $0.1B, or 7%, from 2Q22 and better than analysts expected amid signs of a revival in dealmaking. Revenue from equity issuance more than doubled to $287 million, while debt issuance dropped 9.4% to $600 million. Fees for advising on mergers and acquisitions declined 4.3%.

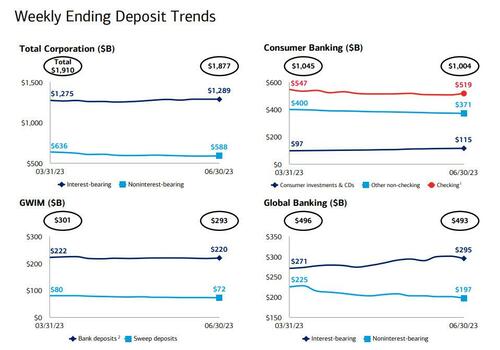

Also inside banking, deposits fell 1.7% from the previous quarter to $1.88 trillion, less than the 3% drop analysts had predicted…

… with BofA going so far as to break out its deposit trends on a weekly basis (arguably to assure investors that there was no shadow deposit flight taking place since March)…

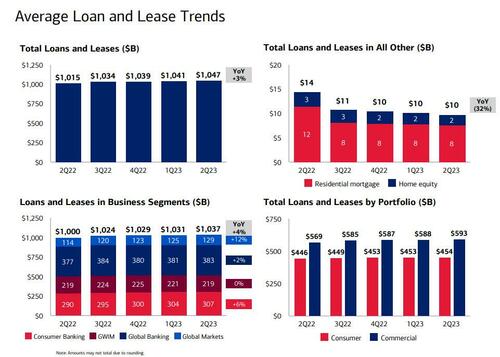

… while average loans and leases increased $6BN from Q2 2022 to $383BN.

Now, courtesy of trillions in QE, we know that banks have been stuck with massive excess deposits (over loans) ever since 2009. Well, in Q2, BofA was kind enough to finally share a breakdown of what these look like. Here is the answer.

After the strong earnings, BofA shares were volatile in premarket trading, first rising, the dipping before once again trading above the Monday close and gaining 0.8% to $29.62 at 8:80 a.m. in early New York trading. BofA shares have lost 11% this year through Monday.

Here is the Bank’s full investor presentation.

Loading…

https://www.zerohedge.com/markets/bofa-jumps-strong-trading-revenues-mask-weakness-interest-income-rising-expenses