‘Hard’ data collapsed further this week with ‘soft’ data staying near cycle highs as today’s jobs data offered something for everyone with stalling wage growth (yay, we beat inflation), a jump in job gains (yay, growth and a soft landing), but a scratch or two below the surface of the 6-signa headline beat and things are not so pretty after all…

Source: Bloomberg

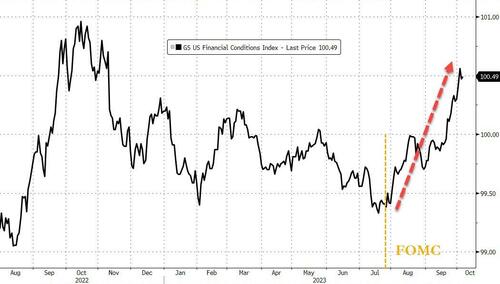

Financial Conditions continued to tighten aggressively this week, having turned after the July FOMC and now near the tightest it has been during this cycle…

Source: Bloomberg

Today saw a hawkish shift in rate-change expectations but on the week, 2023’s curve moved higher (slightly higher chances of more hikes) and 2024’s curve was flat to slightly lower (modest chance of more cuts)…

Source: Bloomberg

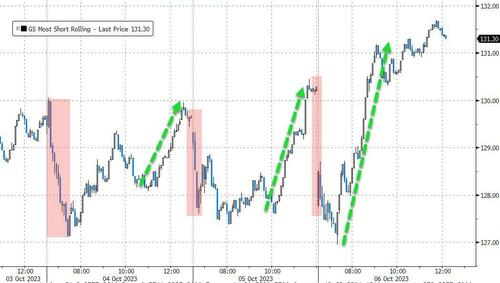

US stocks were bolstered in morning trading by the largest buy imbalance since mid-July and short cover. Momentum can beget more upside momentum in stocks.

Around 1140ET a massive buy program hit and smashed stocks higher…

Source: Bloomberg

At the same time, the ‘most shorted’ stocks basket also went vertical…

Source: Bloomberg

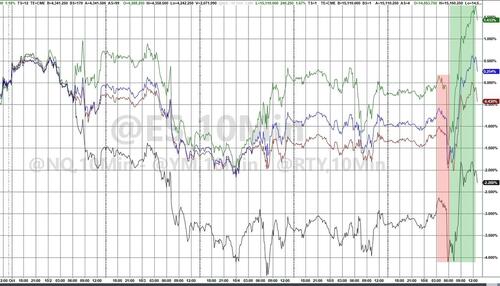

By the end of the week, thanks to today’s meltup, Nasdaq ended significantly higher on the week (along with the S&P). The Dow ended the week marginally lower while Small Caps lagged 2% in the red…

Tech and Healthcare were the only sectors green on the week with Energy the ugliest horse in the glue factory…

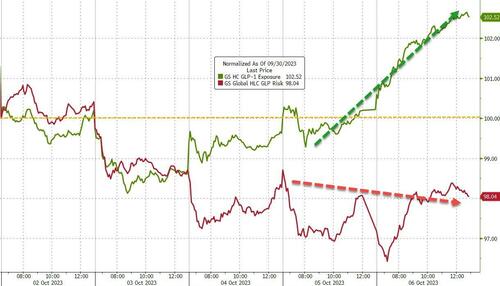

Healthcare was helped by the GLP-1 Analogs going bid…

Source: Bloomberg

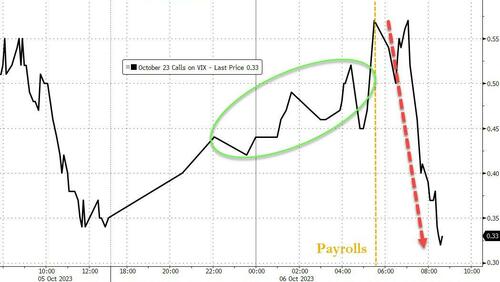

VIX didn’t even make it to 20 this morning as payrolls hit and stocks and bonds dumped. And then it just collapsed down to bear 17 the figure….

One big options trader potentially had a bad day. Chatter was a large VIX Call buyer stepped in early this morning ahead of the payrolls print, betting on a blowout number…

They got the blowout number, and for a split second things looked good, then everything reversed lower

And the aggressive positioning and reversal can be seen in SpotGamma’s HIRO indicator as the trader was forced to unwind his calls at a loss…

Still, at least he wasn’t long bonds this week!

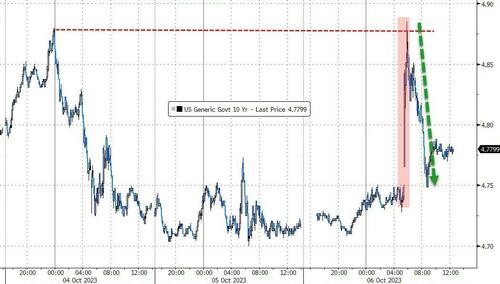

Bonds were clubbed like a baby seal this week, most notably the long-end, but today’s chaotic reversal put a little lipstick on the bond pig…

Source: Bloomberg

It all had a very technical feel with yields spiking on the payrolls print and running stops from earlier in the week before collapsing back lower…

Source: Bloomberg

The yield curve (2s30s) bear steepened most of the week, surging back up to a key level… next stop ‘un-inverted’

Source: Bloomberg

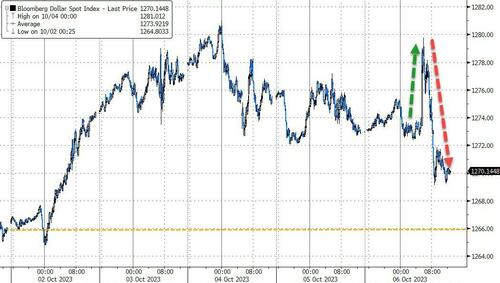

The dollar ended higher on the week, even with today’s pump-and-dump…

Source: Bloomberg

Bitcoin was its usual chaotic self this week, but ended higher (Friday to Friday), back above 28k…

Source: Bloomberg

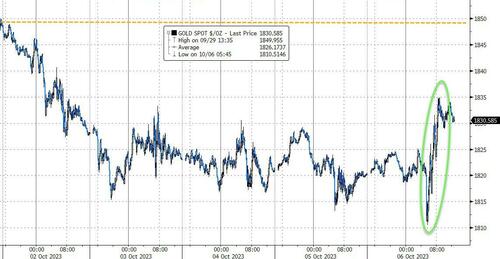

Gold (spot) ended lower on the week, despite today’s bounce…

Source: Bloomberg

Ugly week for the energy complex with WTI puking down to a $81 handle intraday – 6-week lows…

Source: Bloomberg

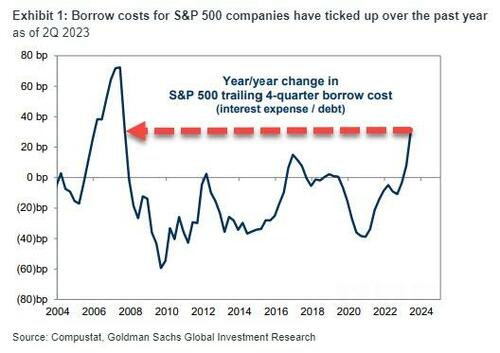

Finally, Goldman notes that The 60bp increase in 10-year Treasury yields this year is starting to have an impact on stock valuations as the S&P 500 is now down about 7% from the 2023 high it hit back in late July. But higher rates don’t just impact how much you pay for a company. Higher rates can also weigh on the amount of money a company earns…

…and as the chart above shows , this year, S&P 500 companies are staring down the biggest increase in borrowing costs since 2006.

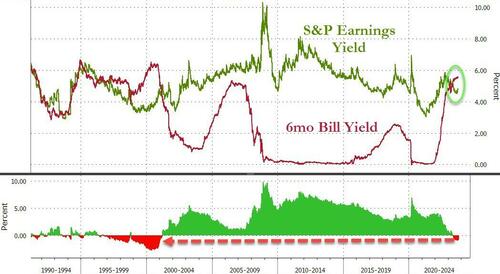

Making 5%-plus lending money to the US government certainly raises the bar for the level of corporate performance needed to attract investors…

Source: Bloomberg

…TINA’s not back yet.

Loading…

https://www.zerohedge.com/markets/big-squeeze-saves-stocks-bond-bloodbath