Beijing, you have a problem…

Amid a ‘reopening‘ that is barely noticeable, an ongoing slump in real estate, a brewing (or boiling may be a better analogy) crisis in the shadow-banking system, record high youth unemployment (which is so bad, it’s hidden from the public’s view now), Chinese authorities cut interest rates and injected liquidity this week in hopes of raising sentiment (because the actual liquidity appears to merely be filling a leaking bucket given the lack of demand for credit last month).

The hopes of a sentiment shift did not work as Chinese stocks and the yuan continued lower.

So, Beijing reached down into its old bag of tricks and tapped stock market investors on the shoulder overnight.

Bloomberg reports that Chinese authorities asked some investment funds this week to avoid being net sellers of equities, as a rout in the nation’s financial markets deepened.

Despite denials from official sources, stock exchanges issued the so-called window guidance to several large mutual fund houses, telling them to refrain for a day from selling more onshore shares than they purchased, according to the people who asked not to be identified discussing private information.

The instructions were relayed to fund managers through investment executives at the firms, they added.

The authorities issued similar instructions to investment firms several times last year, according to the people.

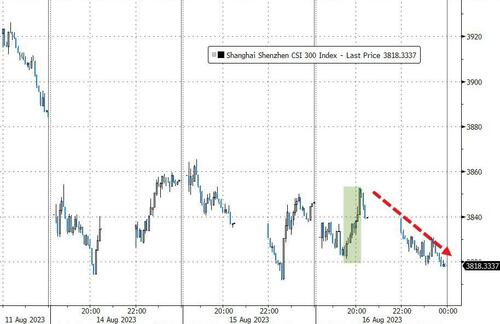

Chinese stocks did bounce briefly as the headlines crossed overnight (green shade), but after lunch, the selling resumed…

Source: Bloomberg

Pushing the major Chinese index back to critical support at 2023 lows…

Source: Bloomberg

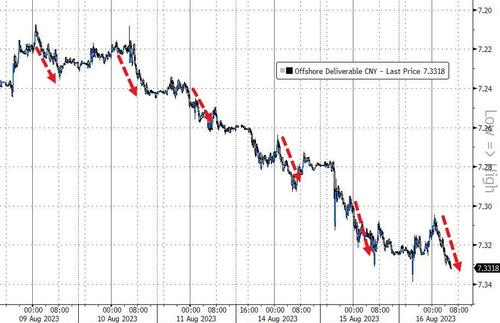

Additionally, after an initial rally, China’s offshore yuan fell back to fresh YTD lows, down for the 10th of the last 12 days (back at its weakest vs the greenback since early Nov 2022)…

Source: Bloomberg

Notably, the chart shows that CNH selling tends to hit as Europe opens.

Finally, we note that history shows that such guidance tends to do little to support the market.

After the authorities were said to have made a similar request in September, the CSI 300 gauge plunged about 10% in the following few weeks to reach the lowest in over three years.

Loading…

https://www.zerohedge.com/markets/beijing-begs-funds-not-sell-stocks-china-challenges-mount