Authored by Simon White, Bloomberg macro strategist,

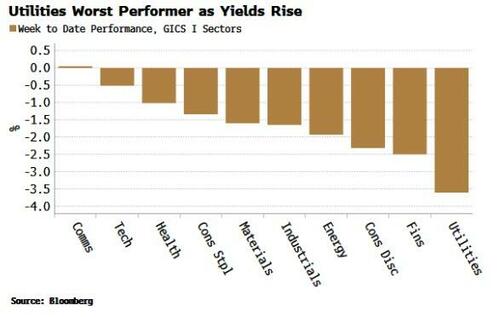

The US utilities sector has taken a hammering as bond prices fall, with the sector seeing its tenth largest weekly underperformance versus the S&P on Monday, going back over 30 years.

But utilities (and other low-duration sectors such as energy) may soon see their traditional “bond-proxy” role reversed, and begin to outperform when the market perceives that inflation risks have not gone way.

Sectors such as utilities that have strong and steady cash flows and high ROICs have bond-like qualities that have earned them the moniker of bond proxies. Unfortunately that cuts both ways as when bonds fall, utilities tend to underperform, as has happened recently.

That being said, the correlation between utilities and bonds has been secularly falling over the past three decades, and today sits at an unremarkable ~20% (based on correlation of daily changes). Recent moves may be more of a knee-jerk reaction than a balanced assessment of whether holding low-duration sectors such as utilities and energy is actually a good idea when inflation is elevated.

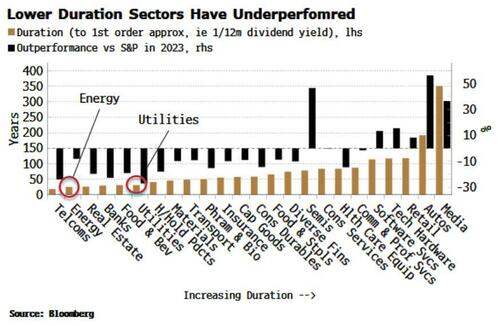

Utilities, along with energy and health, were the best performing sectors in 2021 to 2022.

Low-duration sectors prospered at a time when inflation was reaching multi-decade peaks and the Federal Reserve had not yet started raising rates.

But utilities et al began to lag as the Fed tightened, and higher-duration sectors such as tech and semis began to lead the rally, later fuelled by OpenAI’s release of ChatGPT 3.5.

The market was essentially giving the Fed a vote of confidence that it would durably bring inflation down, and owning stocks with a high duration was a safe long-term bet. We can see this clearly in the chart below, showing that the sectors with the highest duration saw the greatest outperformance this year, and vice versa.

Inflation is likely to re-accelerate, and at that point utilities and similar sectors may be sought after once more for their low-duration characteristics.

But for now, they are likely to struggle as long as bond prices are falling, and they continue to erroneously be perceived as simply bond proxies.

Loading…

https://www.zerohedge.com/markets/battered-utilities-may-morph-bond-proxy-inflation-hedge