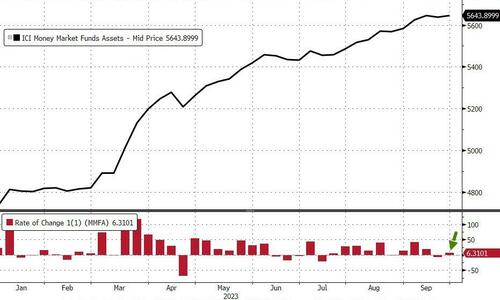

After an unusual outflow last week, US money market funds saw a $6.3BN inflow this week, back up close to record highs…

Source: Bloomberg

Once again, retail funds saw inflows (no outflows since April) of $7.8BN while institutional funds declined $1.5BN…

Source: Bloomberg

That is the second week of institutional outflows as retail inflows send total retail funds to a new record high…

Source: Bloomberg

And the gap between money fund assets and bank deposits continue to grow…

Source: Bloomberg

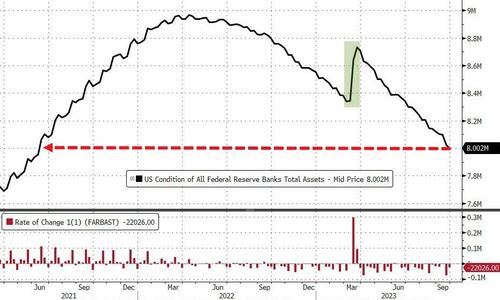

After last week’s huge drop, The Fed’s balance sheet continued its shrinkage (down $22BN to its smallest since June 2021)…

Source: Bloomberg

With regard to the QT program, The Fed continues to sell securities, down 17.3BN last week to its smallest since June 2021…

Source: Bloomberg

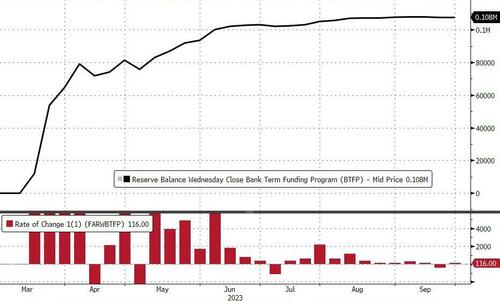

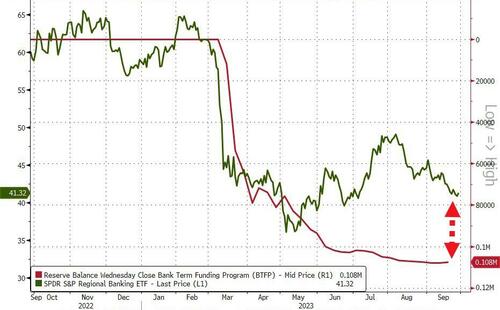

Usage of The Fed’s emergency funding facility for banks remains at record highs around $108BN (+$116MN last week)…

Source: Bloomberg

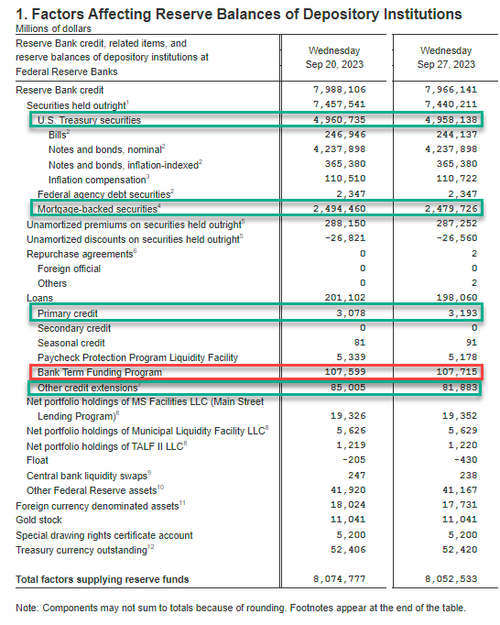

The detailed breakdown is as follows:”

-

Fed QT: $2.5BN drop in TSY securities; $15BN drop in MBS

-

Discount Window: up $100MM to $3.2BN

-

BTFP up $116MM to $107.7BN

-

Other credit Extensions (FDIC Loans) down $3.1BN to $81.9BN

The spread between US equity market cap and bank reserves at The Fed is starting to converge…

Source: Bloomberg

And finally, as we like to remind readers, there’s an $108BN hole in my bucket… and bank stocks are starting to catch on to the reality that in 6 months, they’ll have to fill it…

Source: Bloomberg

…or The Fed will simply keep the “emergency” facility open ad infinitum under pressure from the administration during an election year.

Loading…

https://www.zerohedge.com/markets/banks-demands-feds-emergency-funds-remains-near-record-highs-retail-money-market-fund