Yields surged higher today, despite dismal economic data, as supply (corporate and govt) dominated along with positive employment signals from the PMIs (although the JOLTs data was shitshow and should have trumped any positives from PMIs). The dollar also ripped higher… on a bad data day (to start the month) as PMIs were abysmal around the world (and non-USD fiat weakness means USD fiat strength).

Global Manufacturing PMIs and Global Stocks seem to be in disagreement…

Source: Bloomberg

“probably nothing…”

Equity markets were broadly under pressure today early on but the ubiquitous short-squeeze lifted them off the lows. The Dow ended higher

Another day, another short-squeeze…

Source: Bloomberg

It’s now been 40 days since the S&P had a down 1% day…

Source: Bloomberg

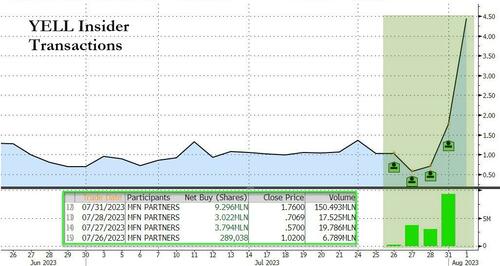

And of course, bankrupt trucker Yellow was up over 150% today – hitting $5.00, its highest since Oct 2022 – massively higher from the 43c lows late-last week…

And WTF is this!!!!

Banks were dumped today…

Treasuries were clubbed like a baby seal during the European session and the selling pressure abated after Europe closed. The long-end notably underperformed…

Source: Bloomberg

Bloomberg’s Alyce Andres offers 10 reasons why bond investors are so bearish today.

-

The US refunding projections for Wednesday are skewed higher after the Treasury increased borrowing estimates Monday

-

The technical break of 4% in 10s was meaningful and provided some momentum as yields retest recent highs ahead of the refunding announcement and Friday’s jobs report

-

Foreign real money sold 10-year futures contracts right out of the gates today in New York, while cash desks noted similar accounts exited longs in 5s

-

Relative-value accounts sold in both 5s and 20s against 2s

-

Financial-linked corporate bond issuance slowed today, lessening the need to receive in swaps

-

Month-end is out of the way — lessening the need for indexing demand

-

With the adjustment in duration, investors are preparing for for convexity sales. Dealer desks say it has yet to materialize but easily could

-

Pressure also seen in mortgage-backed securities, with hedge fund sales due to the shift in duration. Weakness in MBS can often lend to hedging flows in Treasuries. Dealers report the recent money manager bid looks a bit tired in MBS

-

Commodity Trading Advisors and speculative accounts remain short and are willing to let those winning trades ride — feeling no pressure to unwind

-

Liquidity is low, exaggerating price action

10Y yields topped 4.00% and 30Y yields ripped up to their highest since Nov 2022…

Source: Bloomberg

The yield curve (2s30s) steepened notably today (less inverted)…

Source: Bloomberg

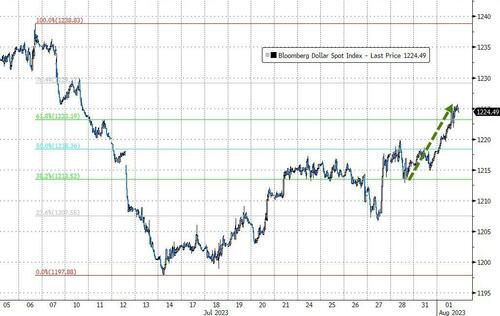

The dollar extended its rebound from mid-July’s plunge (retracing almost 70% of the drop)…

Source: Bloomberg

We also note that The Dollar Index is closing in fast on key technical levels…

Source: Bloomberg

Bitcoin dumped and pumped back above $29k…

Source: Bloomberg

Gold tumbled back below $2000 today…

WTI hit $82 today, back at OPEC-Cut highs from April…

Finally, Mr.Biden may have a problem (well let’s be honest, this is but one of many)…

Source: Bloomberg

Retail gas prices are set to explode (and that won’t help the “inflation is defeated” narrative).

Loading…

https://www.zerohedge.com/markets/banks-bonds-bullion-battered-dollar-rips-start-august