The last few days have seen the exuberance fade in regional bank shares as the brief short-squeeze ends and higher rates hint at increasing pressure on bank deposits (that we detailed last Friday).

Tonight’s money-market flows data is certainly not going to help things at all as inflows soared by the most since the first week, up $47 billion to a new record high at $5.39 trillion…

Institutional funds saw $39.4 billion in inflows and retail saw $7.26 billion more inflows…

Source: Bloomberg

This huge resurgence in money market fund inflows strongly suggests tomorrow’s H8 deposit report will show the bank walk/run is continuing…

Source: Bloomberg

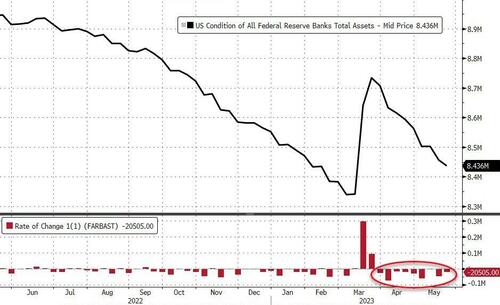

The Fed’s balance sheet shrank once again, down $20 billion to $8.436 trillion…

Source: Bloomberg

As far as QT is concerned, the Total Securities Held Outright dropped only $3.65 billion last week (notably less than the $29.89 billion the prior week) as QT started up again…

Source: Bloomberg

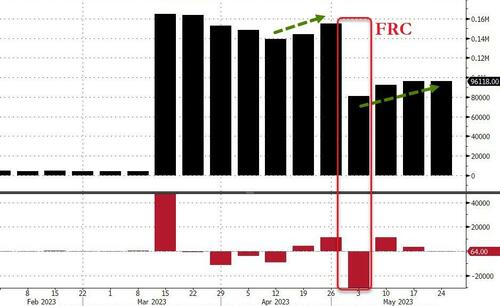

The US central bank had $96.1 billion of loans outstanding to financial institutions through two backstop lending facilities in the week through May 24, up slightly from the previous week.

Source: Bloomberg

…with the Fed’s Bank Term Funding Program rising yet again to a new record high (up from $87 to $91.9 billion)

Source: Bloomberg

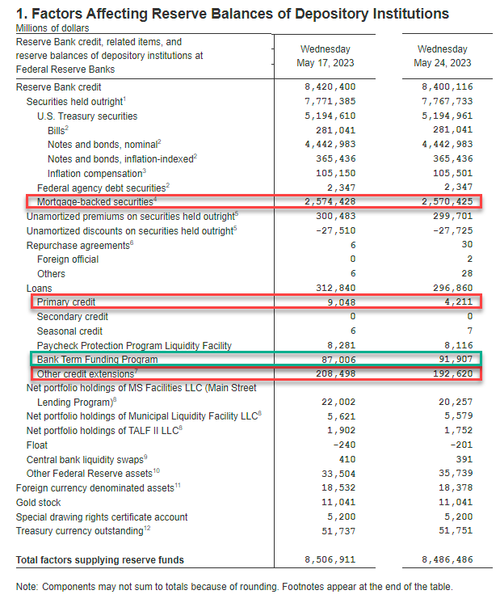

The Fed’s H4 table breakdown in details:

US Bank reserves at The Fed dipped last week, stocks remain blind to it (for now)…

Former Dallas Fed head Robert Kaplan dropped some uncomfortable truth bombs on the US banking system:

We are now heading into the third phase.

Bank leadership at small and midsize banks are considering how to shrink their loan books in order to address the mark-to-market loss of capital, as well as to guard against potential deposit instability in the future.

Bank leadership is very aware that the economy is slowing, and that we are likely about to enter a challenging credit environment.

While asset/liability mismatches are relatively easy to spot, assessing the quality of loan portfolios is much more complicated.

CEOs of many small and midsize banks are in a tough position.

They can’t easily raise equity because their stock prices are down.

As a result, they are turning to shrinking their loan books, finding places to pull back on existing loans and future loan commitments.

This is making it much harder for small and midsize businesses to get and keep their bank loans.

It is a quiet phase that won’t make headlines but is nevertheless relentlessly going on beneath the surface.

Read the full interview here…

We will find out if that is continuing to quietly occur as The Fed’s H8 report exposes the reality of bank deposits continuing to flow out and loan volumes declining.

Loading…

https://www.zerohedge.com/markets/bank-bailout-facility-usage-hits-new-record-high-money-market-fund-inflows-soared-again