By Ye Xie, Bloomberg Markets Live reporter and strategist

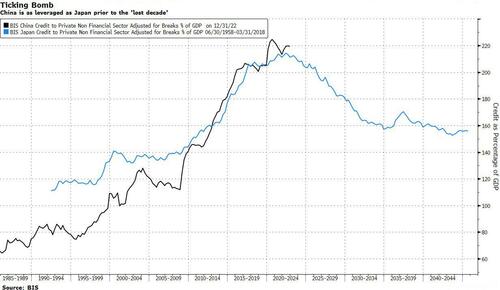

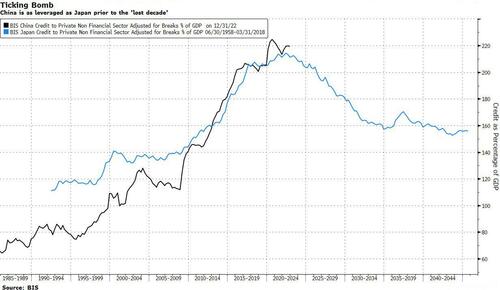

Richard Koo has become an unexpected celebrity in China these days. All of a sudden, the work of the economist who coined the phrase “balance-sheet recession” to describe the root cause of Japan’s lost decade is highly relevant to what’s happening in China.

What the Nomura Research Institute economist sees isn’t encouraging: It may take Chinese companies and households many years to cut down debt and restore financial health in a “very painful process.”

The concept of a balance-sheet recession, which Koo came up with in the 1990s, is simple. After asset markets turn from boom to bust, households and companies need to save to pay down debt. When they do it at the same time, no one spends, which sucks the oxygen out of the economy. In response, the government should step in as the borrower and spender of last resort.

This week, Koo offered his diagnosis on China. In a speech that went viral on social media, he made a few comparisons between China and Japan’s situation three decades ago. He concluded that the fate of Japanification is highly likely. (The transcript of his speech hasn’t been independently verified, but the view is consistent with his recent interview on CNBC.)

Richard Koo has been one of my favorite macro thinkers. I have always believed that his thoery on balance sheet recession will prove to be extremely relevant for China one day. Yesterday he gave an extraordinary speech on China’s Japanification risk, below are the main takeaways:

— Shanghai Macro Strategist (@ShanghaiMacro) June 28, 2023

He noted that both countries experienced a similar housing boom. Once the bubble bursts, the balance-sheet recession starts. The good news, in his view, is that policymakers in Beijing were aware of the issue early on, which makes it likely they will respond to it more quickly than Japan did.

The bad news is that China faces a bigger challenge than Japan did three decades ago. For starters, China’s economy is more reliant on the construction industry. At 26% of GDP, the size of the sectors are comparable in both countries. But the strength of other Japanese industries, such as auto and tech, softened the blow. Unfortunately, China doesn’t have similar industries that could fill in the void left by the housing slump.

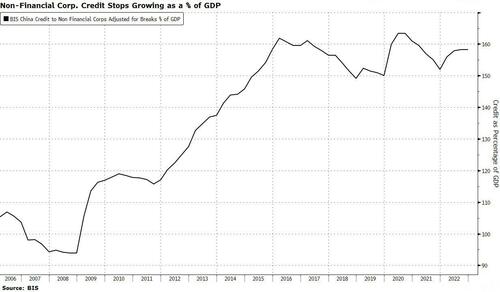

What’s particularly puzzling to Koo is that China’s deleveraging seemed to have started well before the housing bust in 2020. Corporations have stopped borrowing at times since 2015, suggesting something else has sapped the animal spirits of the private sector. (The timing coincided with the government’s supply-side reform that targeted eradicating overproduction capacities in various industries.)

Also, China is facing greater geopolitical risks. While Japan also had economic frictions with the US in the 1990s, the conflict was limited to the trade sector. In China’s case, a full-blown decoupling with the West would mean the nation could only export to poorer economies that make up just 27% of global GDP, which would hold down its growth.

What makes it even trickier is that China’s population started to shrink at the same time that the housing industry went from boom to bust. In Japan, the population started to decline nearly two decades after the bubble burst. Throw in regulatory uncertainties and lack of subsidies during the pandemic, and Beijing has a bigger problem on its hands.

What should Beijing do? Don’t waste time on monetary policies, or structural reforms. Instead, focus all energy on fiscal stimulus to keep the economy going, Koo advised. Meanwhile, complete all the unfinished housing projects “at any cost” to avoid a collapse.

To end the speech, he said: “I hope Chinese policymakers understand and respond to these challenges, because this might be the last chance for China to reach the living standards of the First World.”

Coming from the man who arguably understands the subject more than anyone else, this is quite a warning to policymakers in Beijing.

Loading…

https://www.zerohedge.com/markets/balance-sheet-recession-guru-warns-japanification-coming-china