- APAC stocks were indecisive as participants digested the latest from the debt limit negotiations.

- US House Speaker McCarthy said he had a productive agreement with President Biden but they don’t have an agreement yet.

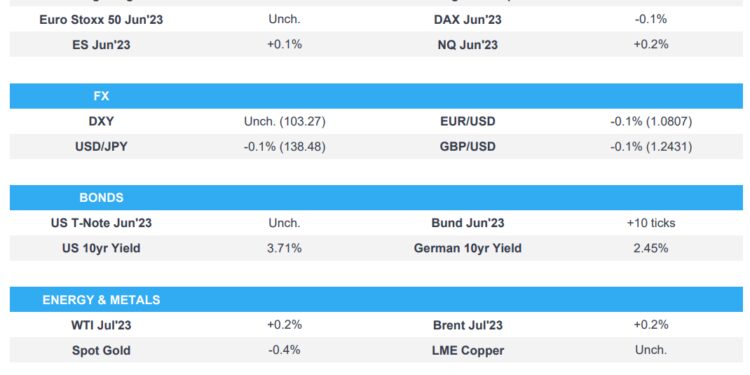

- European equity futures are indicative of a flat open with the Euro Stoxx 50 Unch. after the cash market closed down by 0.2% yesterday.

- DXY is steady on a 103 handle, FX ranges are narrow across G10 FX, EUR/USD lingers just above 1.08.

- Looking ahead, highlights include US, UK & EZ PMIs (Flash), US Home-Sales, Speeches from Fed’s Logan, ECB’s de Guindos, Nagel, Villeroy & Enria, BoE’s Bailey, Pill, Tenreyro & Mann, Supply from Netherlands, UK, Germany & US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mixed with price action choppy as participants awaited the latest developments in the debt ceiling standoff and digested a slew of Fed rhetoric, although Russell 2,000 saw strong advances and was supported by a bounce in regional banks as PacWest (PACW) surged after announcing the sale of real estate loans.

- SPX +0.02% at 4,192, NDX +0.34% at 13,849, DJIA -0.42% at 33,286, RUT +1.22% at 1,795.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed’s Kashkari (voter) said rates may have to rise from here and that he doesn’t want to say that they are done hiking rates, while he noted that they may not raise rates as aggressively or quickly. Kashkari added he is confident the US can get back to a pre-pandemic economy and said they have a solid job market and are on track to reduce inflation.

- Fed’s Barkin (non-voter) said recent use of the discount window is a sign of strength and a signal banks have access to liquidity, while he added that something will have to be done about uninsured deposits, whether it is insurance limits, gating, or structuring different products. Barkin added that he will not pre-judge the June meeting outcome and is still looking to be convinced inflation is in a steady decline.

- Fed’s Bostic (non-voter) said the SVB collapse shows that Fed processes and policies will have to change to become on-demand and may need Fed liquidity to be more available and nimble. Bostic said he is comfortable waiting a little bit to see how the economy plays out after the Fed has done a lot of tightening already, while he added that policy acts with a lag and will take decisions on a meeting-by-meeting basis.

- US President Biden said that he is optimistic they will make some progress on the debt ceiling and that they need a bipartisan agreement and sell it to constituencies, while he added that they need to cut spending and should look at tax loopholes and that the wealthy pay their fair share, according to Reuters. US President Biden later commented that he concluded a productive meeting with House Speaker McCarthy about the need to prevent a default and reiterated once again that default is off the table, while they will continue to discuss the path forward.

- US House Speaker McCarthy said after the meeting with President Biden that he felt they had a productive discussion but don’t have an agreement yet and that staff will continue discussions with negotiators instructed to come back together and find common ground. McCarthy also noted the tone of the conversation was better than any previous time and believes they can get a deal done. Furthermore, he is confident that President Biden wants a deal, while they both agreed that they want to reach an agreement and will talk daily until they get this done.

- US GOP. Rep. McHenry said they have a little more of the details they need to get to a package that can pass Congress and negotiators are on the same page, but added that he senses a lack of urgency from the White House and didn’t sense an alignment between President Biden and House Speaker McCarthy, according to Reuters.

- White House debt limit negotiators returned to Capitol Hill to resume talks but later declined to comment after the talks concluded for the night, according to Bloomberg.

- White House and GOP had reportedly agreed to cut excess COVID funding as talks progress, according to sources cited by Fox Business News prior to the Biden-McCarthy meeting.

- US Treasury Secretary Yellen reiterated that debt-limit measures could still run out as soon as June 1st and that it is highly likely cash will run out by early June, according to a statement from the Treasury Department.

APAC TRADE

EQUITIES

- APAC stocks were indecisive as participants digested the latest from the debt limit negotiations with the meeting between US President Biden and House Speaker McCarthy said to be productive but still lacked any major breakthrough.

- ASX 200 was kept afloat but with the upside capped by weakness in the consumer sectors and after Australia’s Flash Manufacturing PMI remained in a contraction.

- Nikkei 225 initially climbed to its highest level since August 1990 and was on course to match its longest win streak in around four years, before eventually deteriorating in afternoon trade.

- Hang Seng and Shanghai Comp. were subdued following Hong Kong’s failure to sustain the early tech-led momentum from China’s approval of 86 domestic online games in May, while the mainland was pressured after Chinese press reports noted expectations for the PBoC’s benchmark lending rates to remain unchanged for some time and after the US denied it was planning to lift sanctions on China’s defence minister.

- US equity futures were choppy but contained as the focus was on debt ceiling talks which were productive but lacked progress.

- European equity futures are indicative of a flat open with the Euro Stoxx 50 Unch. after the cash market closed down by 0.2% yesterday.

FX

- DXY traded steadily on a 103 handle following the productive Biden-McCarthy debt limit meeting in which the tone of the conversation was said to be better than any other previous time although a deal continued to elude negotiators. Nonetheless, the greenback held on to most recent gains after the slew of Fed commentary including from Kashkari who noted that the June meeting is a close call and suggested that they may need to go north of 6% on rates.

- EUR/USD was rangebound with the single currency eyeing a retest of support around the 1.0800 level.

- GBP/USD lacked direction after the prior day’s choppy performance and ahead of several BoE speakers later.

- USD/JPY briefly extended to a fresh 6-month high of 138.87 after the recent widening of yield differentials.

- Antipodeans were indecisive owing to the mixed risk tone and ahead of tomorrow’s RBNZ meeting.

- PBoC set USD/CNY mid-point at 7.0326 vs exp. 7.0327 (prev. 7.0157)

FIXED INCOME

- 10yr UST futures languished near the prior day’s lows after having bear flattened amid the latest bout of central bank rhetoric which suggested the potential for a ‘skip’ and not a ‘pause’ by the Fed.

- Bund futures traded sideways with prices stuck near a base at the 134.00 level.

- 10yr JGB futures were lower after recent selling in global peers and despite firmer demand at the 10yr inflation-indexed bond auction from Japan.

COMMODITIES

- Crude futures eked mild gains with early upside amid the initial positive risk tone although oil prices then came off highs as the mood soured following the lack of any major breakthrough in US debt ceiling talks.

- Goldman Sachs said rising fears of a US recession and a China slowdown are likely weighing on oil prices and it estimates that forward curves are pricing all the main bearish risks to their USD 95/bbl December 2023 Brent forecast. Goldman Sachs also stated that the oil market is too pessimistic and it expects sustained deficits from June as OPEC+ production cuts are fully realised and demand rises further.

- Spot gold marginally softened as the greenback held on to its recent advances.

- Copper futures were subdued by the recent hawkish Fed rhetoric and cautious risk tone.

CRYPTO

- Bitcoin prices strengthened overnight and extended above the USD 27,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese press reports stated that the PBoC’s Loan Prime Rates are expected to remain unchanged for some time and noted the LPR faces little downside due to the economic recovery and banks’ tight NIM.

- US State Department spokesperson Miller said the US has no plans to lift sanctions on China’s defence minister.

- Russian PM Mishustin said on his visit to China that Russia-China ties will positively impact both countries and 2023 trade turnover between the countries could reach USD 200bln, according to TASS and RIA.

DATA RECAP

- Japanese Manufacturing PMI Flash SA (May) 50.8 (Prev. 49.5)

- Japanese Services PMI Flash SA (May) 56.3 (Prev. 55.4)

- Australian Manufacturing PMI (May P) 48.0 (Prev. 48.0)

- Australian Services PMI (May P) 51.8 (Prev. 53.7)

GEOPOLITICS

- Twitter source noted a drone attack was said to have targeted the departments of the Ministry of Internal Affairs and FSB in Russia’s Belgorod, while air raid alerts sounded in central and western Ukraine due to Shahed drone activity.

- Russia’s Belgorod regional Governor said a counter-terrorism operation continues and a return to homes in the region’s Gaivoron district is not possible yet, according to Reuters.

UK/EU

- UK Chancellor Hunt will meet with food manufacturers today to ask for help from the industry to ease the pressure on households and steps up pressure on supermarkets to rein in soaring prices, according to FT.

- ECB’s de Cos said the bank still has some way to go to tighten monetary policy and rates will have to remain in restrictive territory for an extended period to achieve the inflation goal.

- Hungary is accelerating discussions with Brussels to release nearly a third of its EU funding after a long stand-off, but officials warned funds will likely remain frozen because of differences over reform efforts, according to FT.

Loading…

https://www.zerohedge.com/markets/apac-indecisive-following-debt-ceiling-inaction-flash-pmis-cb-speakers-ahead-newsquawk