While we previously did a lengthy preview of what to expect from today’s “Final rate hike and pause” Fed meeting, due to the significance of today’s meeting we wanted to summarize the key points.

Echoing what we said last night, this morning Goldman trader Rich Privorotsky writes “a 25 bp hike today seems like a forgone conclusion. The big debate will be the language in the statement. The market is hoping for a 25bp and done message. Most expect a dovish outcome, that the statement will remove/alter language stating “some additional policy firming may be appropriate.” As an aside, the weak JOLTS data will support a Fed pause with step down in open jobs and notable increase in construction separations.

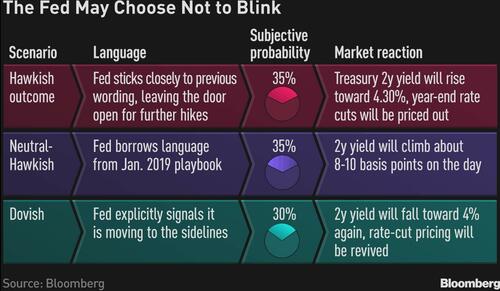

For context, the Goldman trader notes that “hawkish” would be the Fed keeping the language as close to unchanged as possible, while “dovish” is an explicit call out to being on hold from here and the neutral comprise is somewhere in-between (maybe the 2019 language).

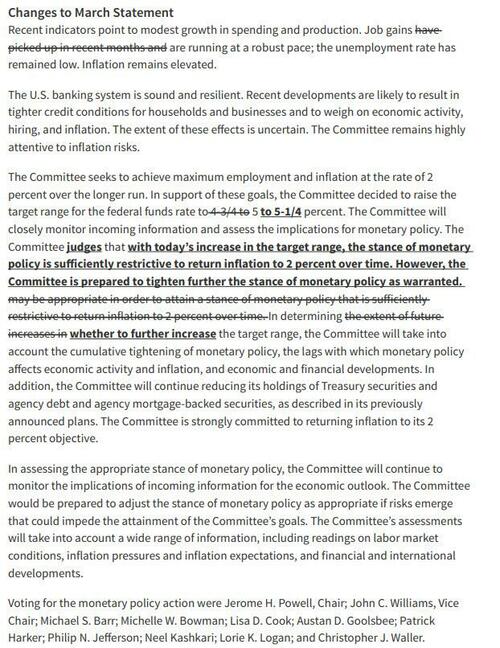

Next, let’s take a look at what the Fed’s statement will look like in red-lined format compared to the March FOMC. As a reminder, the Fed already discussed policy approaching a “sufficiently restrictive” level last month, language which this month will escalate to the point of pausing, which also means eliminating the language that “additional policy firming may be appropriate.” Here is how Barclays sees this transition…

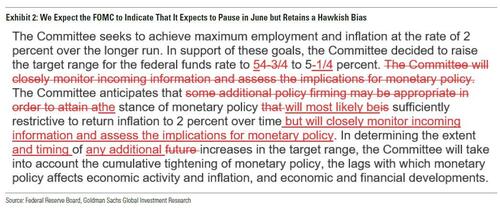

… and here is Goldman.

- The variables that will drive two-year Treasuries will be a) whether the Fed signals a pause after raising rates by 25 basis points on Wednesday and b) how it telegraphs its intent given that this month’s review won’t be accompanied by either a summary of economic projections or a dot plot

- Broadly stated, the key part of the Fed’s statement could go one of three different ways, each with different implications for front-end yields

- The markets will be keenly focused on any change to this part of the Fed statement from March:

“The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Hawkish outcome:

- While the markets have been positioned for a “one more and done” stance since the March policy review, the Fed may well scupper those expectations by leaving the statement above intact

- Why would the Fed do that, though? These are the broad arguments:

- With First Republic now having been acquired, policymakers may reckon that inflation is still the dominant headwind to the US economy

- PCE inflation has averaged 4.9% this year, compared with the 3.3% estimate the Fed had penciled in for 2023

- Core PCE inflation has averaged 4.7% this year, compared with the Fed’s 3.6% expectation

- Seven of the 18 members had indicated in the March dot plot that the policy rate needs to be higher than 5.25% at the upper end to quell inflation. Given how stubbornly high inflation has been, it may not take much for the hawkish ranks to grow

- If the Fed were to leave that statement intact, two-year Treasury yields would surge at least 10-15 basis points on the day, and may continue to rise toward 4.30% beyond then

Neutral-to-Hawkish outcome:

- In this scenario, the Fed would essentially leave the door open for further rate hikes, but without expressly saying so. In constructing the language around this outcome, it may dust off the wording it used in January 2019. That was the first month that it held rates after the end of the tightening cycle in December 2018. The statement may read something like this:

“In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.”

- That would, again, not go down well with the markets, with the lack of explicit signaling about the end of the tightening cycle likely to spur traders to price out the policy loosening they are factoring by year-end

Dovish outcome:

- In this scenario, the Fed would be explicit in its signaling that it is moving to the sidelines, and may borrow from the play book of the Bank of Canada, which said this after raising rates in January:

“If economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest-rate increases.”

- Should the Fed employ similar language, the markets would be emboldened to add to the rate cuts they are factoring in by the year-end. That would spark a rally in front-end Treasuries and put a bid on stocks, especially the Nasdaq 100 basket

- On balance, given its persistent concern about the threat posed by inflation and the recent thawing of stress markers in credit spreads and elsewhere, the Fed would be wary of calling an explicit halt to its tightening cycle

Next, turning to the Powell presser, Goldman notes that while the press conference is always worth listening to, it will be virtually impossible for Powell to credibly walk back a dovish message in the statement, if the Fed has signaled being on hold don’t think there will be much he can say to convince the market otherwise…on the other hand if the statement leans hawkish he probably can sound dovish in the presser (he has had a tendency to do so lately).

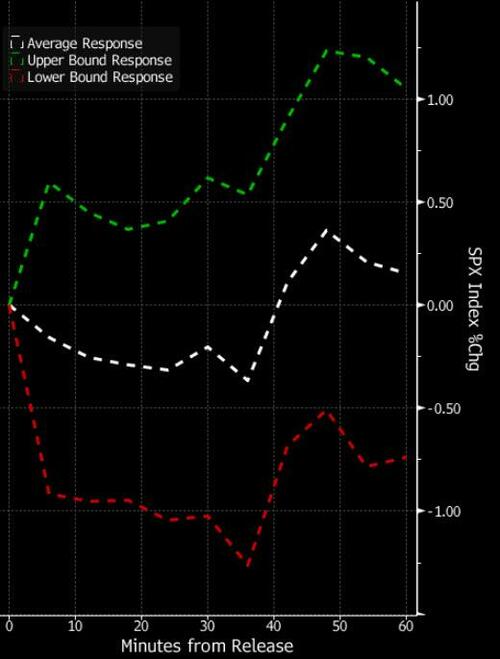

Speaking of the Powell presser, Bloomberg’s Mark Cudmore notes that “in the past 12 months, equities have typically reacted positively to the FOMC statement, or rather, not the statement itself, but Jerome Powell’s uncanny ability to soothe the market at the post-meeting press conference. You can see the effect very clearly in this graphic of the S&P 500 in the hour following the release of the communique.”

“There’s a notable uptick about 36 minutes after the statement has been released. That’s the Powell effect” according to Cudmore.

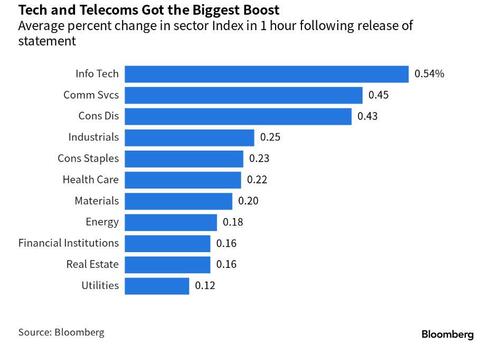

Drilling down, here’s what the average response looks like broken down by sector. While all gained, the more rate-sensitive tech sector gained the most.

That’s remarkable given that the Fed has been in an extraordinarily aggressive hiking cycle throughout the period covered by this data.

Finally, going back to Goldman, at end of the day, the bank does not sees the Fed as actually delivering a meaningful dovish surprise (outside the 1 day move)- they either want to keep policy restrictive or keep hiking. Instead, the focus will be on how the real economy progresses and again how stable the regional banking equity is…feeding itself back into deposits, which however will continue to see flight as there is no way regional banks can offer anything near the 5.25% that money market funds will offer after the close today, draining further billions in deposits away from the regional bank system.

Loading…

https://www.zerohedge.com/markets/single-sentence-will-define-everything-heres-what-fed-will-say-today