Authored by Simon White, Bloomberg macro strategist,

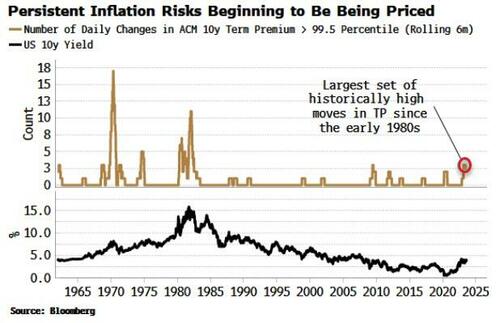

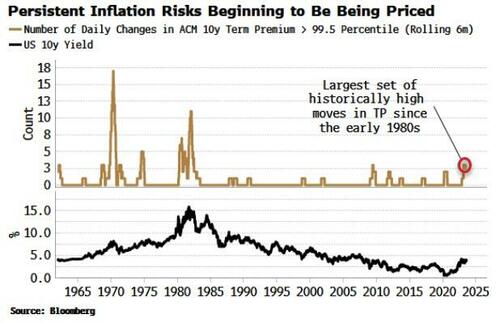

The rising bond term premium indicates investors are starting to demand greater compensation to bear heightening risks from inflation and an increase in issuance.

Yields and the curve are rising today in a bear steepening. This comes after a tumultuous seven days for bonds, after the Bank of Japan’s policy tweak, Fitch’s downgrade, and the Treasury’s increased borrowing and issuance needs.

The rise in yields is increasingly being driven by the term premium. An implied measure that’s not everyone’s cup of tea, it nevertheless gives valuable information on what is driving yields.

It has been contained and mostly negative in this cycle, which is eye-opening given the backdrop of the most elevated inflation seen for 40 years.

But it has been rising lately, by over 30 bps between July 28 and August 1 (the latest data point), with the 10-year yield up only about seven bps over the same period (using ACM term premium).

The term premium is still negative, but the daily moves are becoming historically large. We have seen the largest 6-month set of rises in the term premium in the top 0.5 percentile in over 40 years.

If you don’t like implied measures of term premium, such as the ACM model, it is also rising if we look at the 10-year yield versus 10-year OIS.

The bulk of term premium captures inflation risks. It is also captures liquidity risks and supply risks. Spot inflation may currently be down to 3%, but it is poised to re-accelerate, with the rise in commodity prices perhaps prompting bond holders to re-evaluate inflation risks (Bill Ackman for one).

Moreover, Fitch’s downgrade has prompted a re-focus on the US’s woeful fiscal situation, while the Treasury just announced it would have to borrow and issue more than it initially estimated, with expectations of $1 trillion of borrowing just for this quarter alone, with that to be tilted more towards longer-duration debt.

Inflation, fiscal profligacy and rising yields is a combustible mix and highlights the eventual path for the US is looking increasingly likely to be some form of yield curve control, either explicit or implicit.

Loading…

https://www.zerohedge.com/markets/rising-yields-show-market-senses-inflation-risks