Authored by Simon White, Bloomberg macro strategist,

Speculation continues to drive stocks higher and volatility lower, thus keeping credit spreads contained. But over-extended breadth in equities will be one indication for when spreads will widen.

Credit spreads continue to tighten, defying signs of deteriorating fundamentals. Bank credit is tightening, bond and leveraged-loan defaults are rising, charge-off and delinquency rates for loans are climbing, while corporate bankruptcy filings have risen sharply. Even the US is not free from the worsening global credit outlook, if you agree with Fitch’s analysis behind its downgrade of the country’s sovereign debt.

The stock market continues to grind higher, in such a way that index volatility across maturities is falling, including in the one-day VIX, which has just hit a series low. One driver is the narrowness of stocks driving the advance, pushing implied correlation lower.

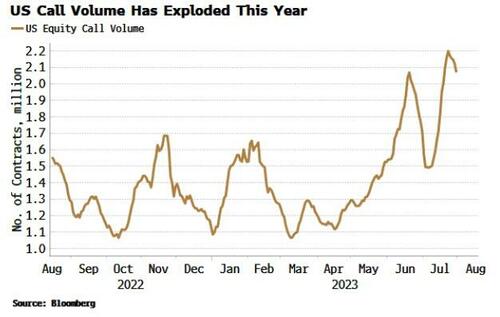

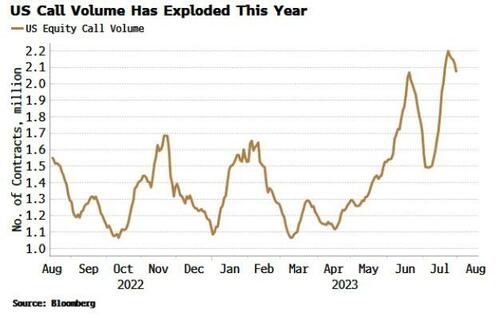

The other is option speculation, driven in good part by investors selling calls. This increases gamma, and causes dealers to repress volatility as they hedge their positions.

High-yield credit spreads and equity volatility tend to move closely together for good fundamental reasons, with the result that the VIX and HY credit spreads have both declined this year.

A pop in equity volatility would therefore likely coincide with a widening in credit spreads – and that could be abrupt given the worsening backdrop in credit markets.

Seasonally, August and September are the two months of the year that see the highest average rise in the VIX, so it will pay to stay alert through the so-called silly season.

And it will also pay to keep an eye on breadth in the equity markers for signs of market over-extension or capitulation. Very few breadth indicators are flashing danger at the moment, but they are moving in that direction. The percentage of S&P stocks above their 200-day moving average is over 70%, lower than previous market peaks, but it has risen quickly.

The advance-decline for the S&P line is also stretched, but not yet quite at alarm-bell levels (see chart below). Similarly the number of stocks on the NYSE making new 52-week highs remains at moderate levels, but rising.

Breadth will be one signal to watch (among others) highlighting when stocks, vol and credit are liable to take a turn for the worse.

Loading…

https://www.zerohedge.com/markets/equity-breadth-will-give-clues-when-credit-will-widen