The world’s second-largest brewer slashed its 2023 profit growth forecast following a slowdown in Asia, the US, and Europe as consumers balk at ‘beerflation’.

Heineken said operating profit plunged 22% on an adjusted basis in the first half of the year. Overall volumes slid 5.6%, exceeding analysts’ average forecast of 3.4%.

The Amsterdam-based brewer blamed the “cumulative effect” of price hikes and a “challenging economic backdrop” that was responsible for a slowdown in beer demand.

Here’s a snapshot of 1H23 results:

-

Revenue growth 6.3%

-

Net revenue (beia) 6.6% organic growth; per hectolitre 12.7%

-

Beer volume organic growth -5.6%; Heineken® volume 1.7% growth (excluding Russia 3.7%)

-

Operating profit growth -22.2%; operating profit (beia) organic growth -8.8%

-

Net profit growth -8.6%; net profit (beia) organic growth -11.6%

-

Diluted EPS €2.04; diluted EPS (beia) €2.03

-

FY 2023 outlook updated. Operating profit (beia) stable to mid-single-digit organic growth.

“The start of the year was all about passing on the inflation on our input costs,” Chief Executive Officer Dolf van den Brink told Bloomberg in an interview.

Van den Brink said, “We front-loaded our pricing. We ran into a pretty strong economic slowdown in the key market of Vietnam, which is disproportionately important to us.”

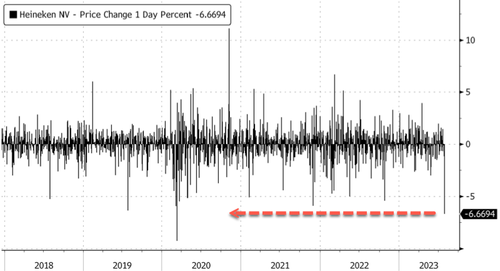

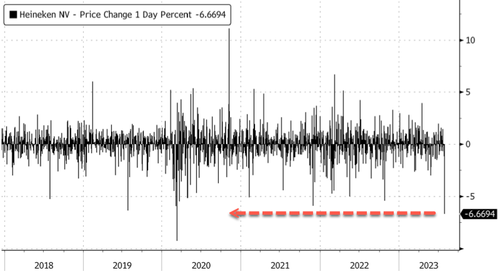

Heineken shares were down nearly 7% in European trading, their steepest drop since March 2020.

Citi analyst Simon Hales called the earnings results “extremely disappointing.”

Heineken expects cost pressures to ease next year, which will reduce beerflation. Previously the guidance was for mid- to high-single-digit earnings growth.

“The credibility of Heineken’s guidance is now in question,” Hales said.

RBC analysts James Edwardes Jones and Emma Letheren said, “This is the worst set of results we’ve had so far.” They were referring to other consumer companies their desk covers.

Here’s what other Wall Street analysts are saying about the results (list courtesy of Bloomberg):

AlphaValue (add, PT €121)

-

Points to a miss on every metric, with a strong decline in volume

-

All regions under pressure

-

“With consumption strongly affected, this does not send out a positive signal for the ABI and Carlsberg publications due in the next few days” analyst Davide Amorim writes

KBC (accumulate, PT €110)

-

Notes key weakness in Vietnam and Nigeria

-

“We continue to believe beer is a resilient category, with further underlying growth potential, whilst Heineken is demonstrating solid pricing discipline,” according to analyst Wim Hoste

-

Commodity and energy cost inflation will partially reverse next year

-

Future performance to be be supported by profit improvement initiatives

RBC (sector perform, PT €93)

-

“This is the worst set of results we’ve had so far,” analysts James Edwardes Jones and Emma Letheren write

-

Heineken missed expectations for organic sales growth in most regions, they note

-

Limited read-across on the sector as the brewer gave priority to price increases

Citi (buy, PT €130)

-

1H results are extremely disappointing, and the credibility of Heineken’s guidance is now in question,” according to analysts led by Simon Hales

-

The brewer missed expectations everywhere except Europe

-

Describe downgrade of Ebit guidance as “concerning”

-

Expect earnings-per-share consensus to fall and the stock to de-rate

Jefferies (buy, PT €115)

-

Analysts Edward Mundy and Andrei Andon-Ionita expect consensus for 2024 Ebit to drop toward Jefferies’ estimate of €4.98b, from the current €5.33b

-

Say shares look inexpensive on Jefferies’ lower-than- consensus numbers

-

Expect transitory factors such as commodities to ease

There are increasing signs that consumer strength worldwide might be waning as global central banks aggressively tighten monetary policy to curb the worst inflation in a generation.

Loading…

https://www.zerohedge.com/markets/heineken-shares-drop-most-pandemic-beerflation-curbs-demand