The ECB has hiked its three key interest rates by 25 basis points (the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will be increased to 4.25%, 4.50% and 3.75% respectively) all of which was expected; the ECB reiterated that future decisions will ensure that the key ECB interest rates “will be set at sufficiently restrictive levels” for as long as necessary to achieve a timely return of inflation to the 2% medium-term target.

More importantly, in its statement the ECB said this about its future actions:

- The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to the 2% medium-term target.

- The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction.

- In particular, its interest rate decisions will continue to be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

Here, traders noted a small language tweak: the statement now says “decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to the 2% medium-term target” (previously it said it would be brought to sufficiently restrictive)

Some other highlights from the statement, first on PEPP: the ECB reiterates PEPP reinvestments of the principal payments from maturing securities purchased under the programme until at least the end of 2024.

As for Inflation, the ECB said it continues to decline but is still expected to remain too high for too long:

- The rate increase today reflects the Governing Council’s assessment of the inflation outlook, the dynamics of underlying inflation, and the strength of monetary policy transmission.

- The developments since the last meeting support the expectation that inflation will drop further over the remainder of the year but will stay above target for an extended period.

- While some measures show signs of easing, underlying inflation remains high overall. The past rate increases continue to be transmitted forcefully: financing conditions have tightened again and are increasingly dampening demand, which is an important factor in bringing inflation back to target.

- The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It therefore today decided to raise the three key ECB interest rates by 25 basis points.

- The Governing Council’s future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to the 2% medium-term target.

Full statement here, and here is a redline comparison to the previous statement.

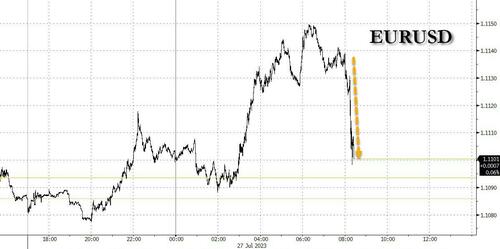

In kneejerk reaction, the EURUSD dropped back near session lows after the ECB said that inflation will drop lower, but the move was contained and merely reversed an earlier gain.

Loading…

https://www.zerohedge.com/markets/ecb-hikes-25bps-expected-will-ensure-future-rates-are-sufficiently-restrictive