Authored by Simon White, Bloomberg macro strategist,

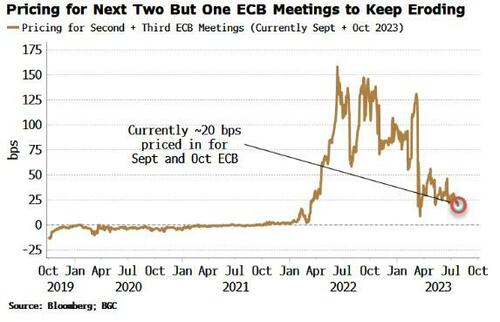

While today’s ECB meeting should be a foregone conclusion with a 25 bps hike, the outlook after that is likely to become considerably less certain, as the growth, inflation and monetary picture clouds. The 20 bps priced in for the September and October ECB meetings is beginning to look on the high side.

The Fed joined the ECB at its rate-setting meeting on Wednesday in making explicit the bank will now be data dependent in deciding policy.

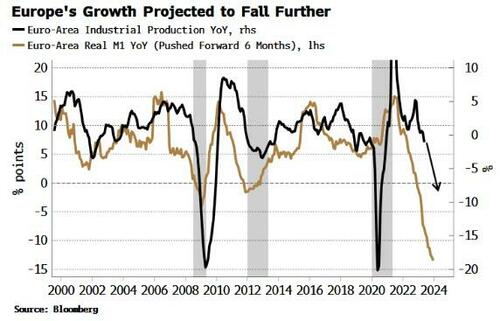

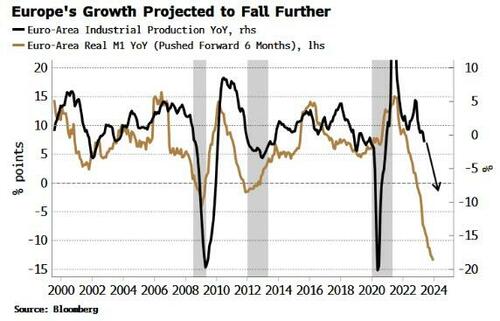

For the ECB, the die has been cast, with leading data pointing to a much weaker outlook over the next 3-6 months.

First, the slowing in growth is set to intensify. There was much fanfare earlier in the year as PMIs in Europe had perked up. But soft data is by its nature much more sensitive to sentiment. It rose mainly because things were not as bad as had been feared after the invasion of Ukraine.

But sentiment alone cannot right a listing ship, and the underlying hard data in Europe continued to weaken. Real money growth is one of the most reliable leading indicators for Europe’s economy, and its collapse points to the trend in weaker growth intensifying.

Lending demand and growth are deteriorating in Europe, and the two biggest economies, Germany and France, are showing increasing signs of weakness.

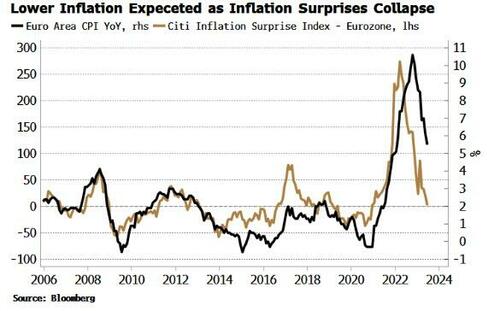

On top of that, inflation should continue to decelerate at a rising pace. Fixing swaps see European HICP at 4% in September, and 2.8% in October. This corroborates the message from the steep fall in inflation surprises seen in the euro-zone.

The fall in inflation will tighten real rates even if the ECB takes its foot off the brake. This comes at the same time as a considerable drop in the size of the ECB’s balance sheet.

It is 19% off its highs, versus only about 8% for the Fed. The ECB’s QT has been turbocharged by the early repayment by banks of hundreds of billions of euros of TLTROs.

As conditions in the Europe tighten considerably more in the coming months, while growth keeps weakening and spot inflation is set to be much lower, the ECB is likely to have several off-ramps to skip hiking at the September meeting, and the meetings after that.

There’s currently about 20 bps of hikes priced in for the September and October meetings; that could erode away in the coming weeks and months.

Loading…

https://www.zerohedge.com/markets/traders-should-favor-ecb-pause-after-julys-expected-hike