Update (16:40 ET) : as leaked earlier by the WSJ, shortly after the close, PacWest Bancorp confirmed that it is merging with smaller rival Banc of California, in what is effectively a take under.

The banks said in a statement that Warburg Pincus and Centerbridge Partners would invest $400 million of new equity as part of the deal. The banks will sell assets with the aim of repaying $13 billion of wholesale borrowings, the companies said Tuesday.

PacWest stockholders will get 0.6569 of a share of Banc of California common stock for each of their shares. While PACW remains halted after hours, BANC shares are now trading at 14.75, suggesting that PACW stock will trade around just around $9 when it reopens at 5pm ET.

The combination “will create California’s premier relationship-focused business bank” with the following characteristics:

- Combined $36 billion asset bank with extensive Southern CA footprint to be headquartered in Los Angeles

- 20%+ accretion to BANC’s 2024 Estimated EPS and immediately 3% accretive to TBVPS

- $400 million equity raise is fully committed after extensive investor due diligence

- Robust capital at 10%+ pro forma CET1; hedges and forward sales lock in a strong and liquid balance sheet at close

- $13 billion of wholesale borrowings to be repaid, resulting in a <10% wholesale funding ratio

- Highly experienced management with proven expertise in acquisitions led by Banc of California’s CEO with deep understanding of PacWest’s franchise

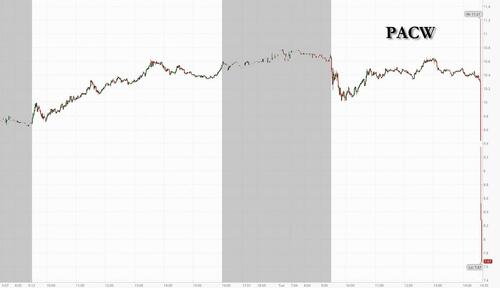

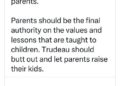

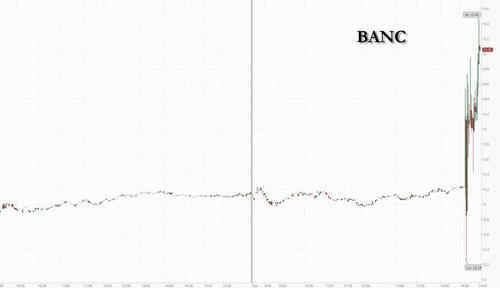

Shares of Banc of California surged as much as 22% after the Wall Street Journal reported the pair were in talks. PacWest shares tumbled 27%. as investors realized that the banking crisis has gone nowhere. The firms will carry the Banc of California name and that firm’s chief executive officer will lead management.

The Beverly Hills-based PacWest had been rapidly shedding assets to bolster liquidity. In May, the bank said it was weighing strategic options and had been approached by potential investors. Shortly after, it sold a pile of real estate loans to Kennedy Wilson Holdings Inc., an asset-backed loan portfolio to Ares Management Corp. and tapped an Apollo Global Management unit for a financing facility.

Santa Ana-based Banc of California had $10 billion of assets at the end of March, making it less than a quarter of the size of PacWest. But it saw relatively small deposit outflows in the first quarter and its 17% stock drop this year through Monday has been modest compared PacWest’s 54% plunge.

As Bloomberg notes, PacWest isn’t counted among the industry’s giants, ranking outside the top 25 biggest US banks. Established in 1999, PacWest focused on small, middle-market and venture-backed businesses. The bank grew in part through 31 acquisitions since 2000, with offices in California, Durham, North Carolina and Denver, plus loan-production offices around the country. It had 2,438 full-time, part-time, and temporary employees at the end of last year, according to regulatory filings.

* * *

Troubled regional bank PacWest Bancorp saw its stock move wildly moments ago, first spiking then tumbling, after the WSJ reported that the far smaller Banc of California (market cap of $770MM vs PACW’s $1.2BN) was in advanced talks to buy PacWest Bancorp PAC, in what appears to be the first aggressive post-crisis bank “take-under” as the lenders seek “to further shore themselves up following a regional-banking crisis earlier this year.”

Citing “people familiar”, the Journal notes that a deal could be announced as soon as today, when both banks are scheduled to report results, assuming there isn’t a last-minute snag.

PacWest has been at the center of recent fears about the regional-banking system since the failure of three California lenders this spring, with the Beverly Hills, Calif., bank beset by deposit outflows and a sinking stock price. Shares of Banc of California dropped significantly too, but they jumped following the WSJ report.

Both banks have come through the recent turmoil in relatively good health and both stocks have rebounded somewhat. PacWest has sold assets to shore up its balance sheet, while Banc of California remained profitable in the first quarter.

According to the report, Centerbridge and Warburg Pincus plan to contribute equity “to help fund the deal” and will serve as the only external source of funding for the acquisition.

Loading…

https://www.zerohedge.com/markets/pacwest-plunges-wsj-report-it-will-be-bought-far-smaller-peer-bank-california