Authored by Simon White, Bloomberg macro strategist,

Recession risk to equities is becoming less severe as odds rise the next downturn will be mild.

After narrowly beating Napoleon in the Battle of Waterloo, the Duke of Wellington called it “the nearest run thing you ever saw.” It’s beginning to look that way with a US recession. Although the base case is we will still get one, there is an increased likelihood its severity will be clipped.

Recessions happen when the cycles that operate in markets and economies begin to reinforce each other negatively. The worst recessions, such as in 2008, occur when all the major cycles hit their nadir at the same time.

But when some cycles are in an upswing, that alleviates the depth and severity of the recession shock. There are increasing signs this is what we are seeing in the current environment.

Consider five of the most influential cycles:

-

Business cycle

-

Inventory cycle

-

Housing cycle

-

Credit cycle

-

Liquidity cycle

None of the above is in sterling shape.

But several of them show solid signs of having bottomed, while leading indicators anticipate they will soon turn up. It’s highly unlikely it’ll happen soon enough to avert a recession altogether, but it means the likelihood of a severe slump is receding. This eases (but does not eliminate) the predominant risk for stocks.

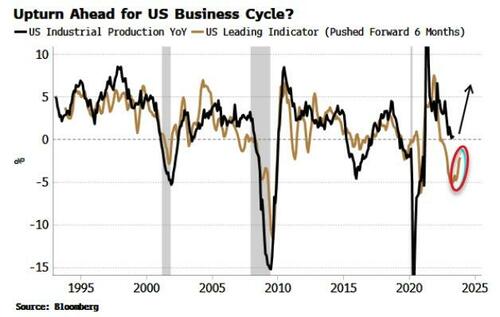

The business cycle is the most widely understood, and is the simplest way recessions are measured, i.e. GDP growth. The NBER uses a broader approach to call recessions, encompassing other cycles. Nonetheless, even though growth has been weakening, leading data is turning up strongly now, indicating the business cycle should start improving within the next six months.

The indicator is built from leading hard and soft data, and is being driven higher by inputs such as building permits and a steeper yield curve. Truck sales, which also lead the business cycle, are turning higher. Those are not the hallmarks of an economy about to crash badly.

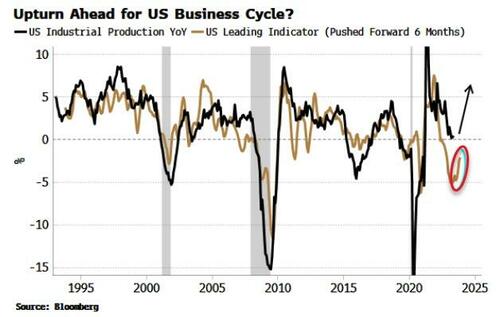

The inventory cycle is also an important determinant of a recession’s intensity. Yet today the inventory cycle is already in a full downswing. Moreover, leading data shows that it should stop falling in the next 6-9 months (shown for durable goods inventories in the chart below; non-durables are also falling). The gluts seen after the pandemic have been largely worked through. Inventories having to be built back up rather than worked through will alleviate the downturn.

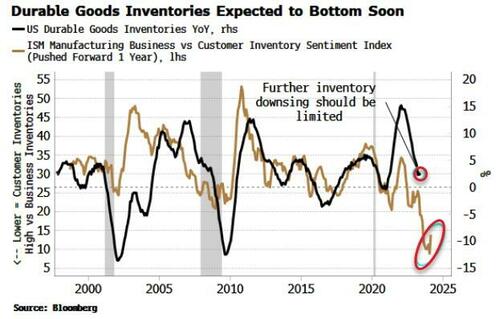

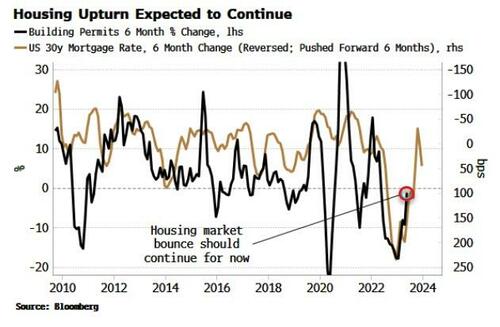

The housing cycle’s bounce took many by surprise, especially as the Federal Reserve was continuing to hike rates. But it’s the second derivative that’s more important. Mortgage rates have been falling sharply on an annual basis this year, and are currently ~100 bps lower than they were a year ago. As the chart below shows, that should lead to a continued rise in building permits, a positive for the housing market.

Furthermore, housing survey data is turning up sharply, expected future sales is rising rapidly, and inventory of existing homes is low.

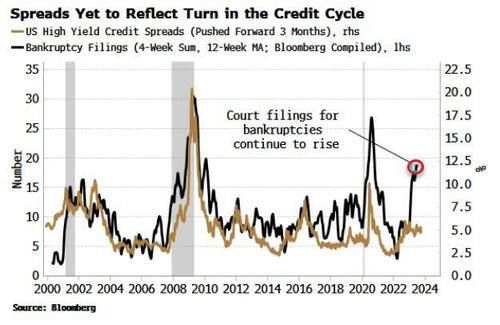

One less rosy area is the credit cycle. Banks have been tightening credit, demand for loans is falling, and banks are beginning to make fewer loans. Loan delinquencies are rising, especially for auto loans and credit cards. Weekly bankruptcy filings have risen fast, and are near the highs seen in previous recessions. Credit spreads, though, are yet to reflect this.

That is one area of concern. Credit markets do have the potential to turn a mild recession into something more serious, especially considering the now capacious size of the less-visible private-credit markets, and so must be watched closely.

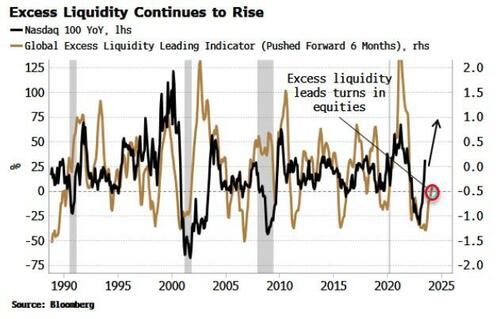

Much more positive is the liquidity cycle, which is turning up strongly. I have noted on several occasions the nascent but burgeoning rise in excess liquidity, the difference between real money growth and economic growth.

The other cycles mentioned above (ex-credit) do not have a consistent or strong relationship with asset markets. The economy and stocks, for instance, display little correlation. But excess liquidity does have a consistent leading relationship with risk assets.

Not only are stocks likely to face a diminished risk from a less deep recession, excess liquidity is giving them a tailwind. This is reflexively more positive as better-supported stocks are less able to exacerbate a downturn through a hit to sentiment and a weakening in the wealth effect.

None of this is to say it will be plain sailing for equities – nothing moves in a straight line after all. Stocks are short-term overbought, and investor sentiment has become quite bullish, with heavy option-driven speculation. Breadth is widening, but still quite narrow.

It’s a near run thing, but the greatest risk to stocks this year – a recession – is looking like it may not be as bad as initially feared. And after that, stocks are set to fare relatively well, in nominal terms, with inflation that is likely to remain historically elevated.

Loading…

https://www.zerohedge.com/markets/will-it-or-wont-it-nearest-run-recession-you-ever-saw-your-life