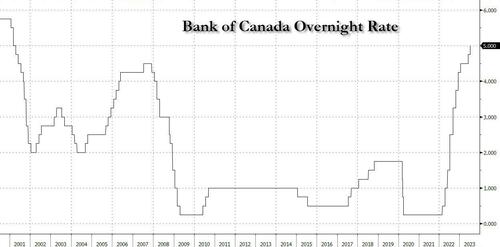

Two weeks before the Fed hikes another 25bps despite today’s softer than expected CPI print, moments ago the Bank of Canada did what virtually all expected, and hiked rates by 25bps to 5%, the 10th consecutive increase and the highest rate since April 2001.

In the surprisingly hawkish statement, the BOC said that it now sees CPI returning to the 2% target six months later, or by the middle of 2025 – even though headline inflation has been falling quickly. Previously that was the end of 2024. The central bank also removed language from the June statement that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target

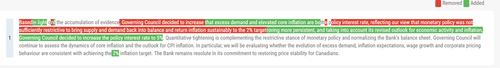

A redline comparison of the BOC statement is below:

Here are the other highlights from the hawkish statement:

Inflation

- In the July MPR projection. CPI inflation is forecast to hover around 3% for the next year before gradually declining to 2% in the middle of 2025. This is a slower return to target than was forecast in the January and April projections.

- Governing Council remains concerned that progress towards the 2% target could stall, jeopardizing the return to price stability.

- While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from easing underlying inflation.

- With the large price increases of last year out of the annual data, there will be less near-term downward momentum in CPI inflation.

- With three-month rates of core inflation running around 3!4-4% since last September, underlying price pressures appear to be more persistent than anticipated.

- This is reinforced by the Bank’s business surveys, which find businesses are still increasing their prices more frequently than normal.

Growth

- As higher interest rates continue to work their way through the economy, the Bank expects economic growth to slow, averaging around 1% through the second half of this year and the first half of next year.

- This implies real GDP growth of 1.8% in 2023 and 1.2% in 2024.

- The economy will move into modest excess supply early next year before growth picks up to 2.4% in 2025.

Policy

- In light of the accumulation of evidence that excess demand and elevated core inflation are both proving more persistent, and taking into account its revised outlook for economic activity and inflation, Governing Council decided to increase the policy interest rate to 5% from 4.75%.

- Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation.

- In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the 2% inflation target.

- The Bank remains resolute in its commitment to restoring price stability for Canadians.

- Quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet.

- Removes language from June that suggests monetary policy was not sufficiently restrictive enough.

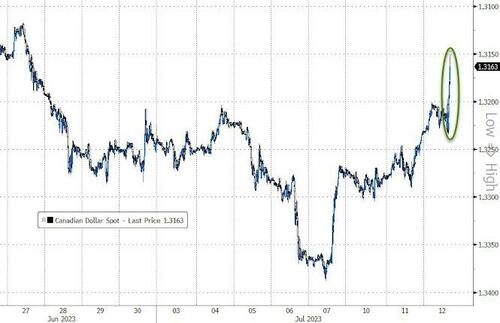

In reaction to the hike and the hawkish commentary, USDCAD fell from 1.3188 to 1.3155 before extending the move to a low of 1.3149 and then trimming the move.

Loading…

https://www.zerohedge.com/markets/bank-canada-hikes-5-no-longer-sees-inflation-dropping-target-mid-2025