Authored by Simon White, Bloomberg macro strategist,

The Fed’s current hawkish stance is limiting the impact to risk assets from the worst effects of the Treasury issuance-induced liquidity absorption.

Whether it was intended or not, the Fed’s “hawkish pause” last week has ironically been a blessing for risk assets. After the debt-ceiling rapprochement, Treasury is issuing debt hand-over-fist, with over $600 billion already in June, and another over $200 billion slated for this week alone.

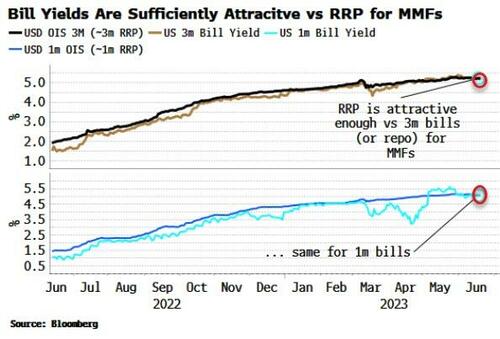

Treasury has tilted issuance towards bills. This means Money Market Funds (MMFs) are able to pitch in. However, this depends on the effective yield offered on bills being attractive enough versus the return offered by the RRP facility.

Both one-month and three-month bill yields, which were lower than the OIS rate (which is approximately equal to what the overnight RRP facility would offer with daily re-investment) earlier in the year are now almost exactly the same. Yet bills offer intra-day liquidity while the RRP cash is redeemed only in the afternoon, and there are no counterparty limits on bills, unlike the RRP.

So MMFs are drawing down on their RRPs, and this liquidity is negating the impact of some of the issuance which the Treasury is using to refill its account at the Fed (the TGA). Over the past week, the fall in the RRP has more than compensated for the rise in the TGA, leaving reserves unchanged.

If the Fed had not been so hawkish when it passed on hiking rates last week, there is a high chance bill yields, which are term instruments, would have dropped sufficiently below the overnight RRP rate as the market priced out near-term hikes and replaced them with cuts. The RRP would then not have acted as a cushion and risk assets may have faced some turbulence.

Nonetheless, risk assets are not in the clear. It is not the change in reserves that is most important for the performance of stocks and commodities, but the change in their change, i.e. their impulse.

Stocks face short-term risk as the impulse is set to turn negative. Equity investors, unusually, should hope the Fed keeps up the hawkish talk, but doesn’t walk the walk.

Loading…

https://www.zerohedge.com/markets/fed-hawkishness-cushioning-impact-treasury-liquidity-drain