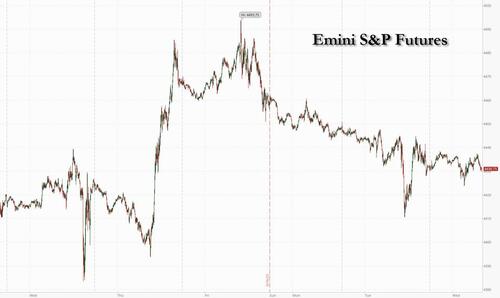

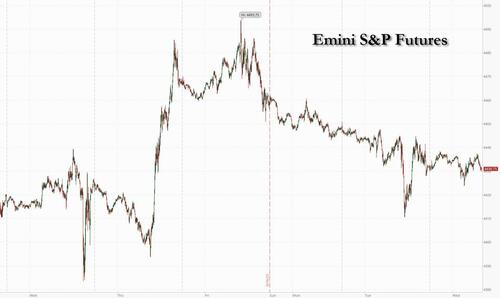

US equity futures are flat and global markets grind lower, as bond yields and breakevens rise in reaction to the latest “shockingly” hot UK inflation data (May U.K. CPI unchanged at 8.7% vs. exp. of a drop to 8.4% y/y ) which saw the odds of a 50 bps BOE hike tomorrow jump to 50%. At 7:30am, S&P futures were down -0.1%, flipping between modest gains and losses after trading in a narrow range after the S&P index notched its first back-to-back losses in nearly four weeks. Economic bellwether FedEx Corp. tumbled 3% in premarket trading after its outlook fell short of analyst consensus estimates on weakened demand. The Bloomberg gauge of the dollar moved higher and Group-of-10 currencies were mixed, with the pound the worst performer. Treasury yields drifted higher across the curve, following their UK counterparts. Gold and oil were little changed, while Bitcoin climbed for a third-straight day. BBG reports that Equity ETFs have seen $102BN in inflows vs. $93bn for FICC ETFs; if ECM and M&A turn back on, could flow outperformance increase.

There are no notable economic reports in the U.S. today (the MBA mortgage applications index rose 0.5% after last week’s 7.2% jump). Powell testifies today and tomorrow at 10am ET, with at least 8 more Fed speakers on deck for the rest of the week including Jefferson (10:00 a.m. ET), Goolsbee (12:25 p.m. ET), Mester (E: 4:00 p.m. ET). More hawkish rhetoric is expected, which may push July hike odds even higher (~74% pre-mkt). There is a 20-Yr Treasury Bond auction at 1:00 p.m. ET.

In premarket trading, FedEx shares dropped as much as 3.3% after the parcel company gave a 2024 forecast that came in below analyst expectations, while fourth-quarter revenue lagged the consensus. Analysts noted that the macro environment remained tough and the tepid guidance will pressure the stock. Tesla gained 2% premarket, set to extend its 35% rally in June. CEO Elon Musk said the automaker is likely to make a significant investment in India. Meanwhile, China extended tax breaks for consumers buying clean cars through 2027 and auto sales in Europe continued their upward trajectory in May as demand for electric cars outpaced the broader market. Here are some other notable premarket movers:

- Peloton Interactive shares decline 3.4% in premarket trading after Wolfe Research analyst Zach Morrissey assumed coverage of the exercise-equipment maker and downgraded the firm’s recommendation to underperform from peerperform.

- Li Auto leads gains in Chinese electric vehicle makers during US premarket trading, after China extended tax breaks through 2027 for consumers buying clean-energy cars.

- Nikola shares rise as much as 9.1% in premarket trading, setting the electric-truck maker up for a ninth day of gains in 10.

- Exact Sciences Corp. gains 6% in US premarket trading after the life sciences firm published study results on Tuesday showing its new Cologuard test, used to screen for colorectal cancer, met all study endpoints and “improved every top-line metric.”

- Spotify Technology advanced 1.5% in US postmarket trading Tuesday after Wolfe Research analyst Zach Morrissey assumed coverage of the audio streaming company and upgraded the firm’s recommendation to outperform from peerperform.

- PureCycle Technologies Inc. rose 11% in postmarket trading after successfully producing the first run of Ultra-Pure Recycled resin from post-industrial recycled material at commercial scale.

Gilts slumped at the open after red hot UK inflation surprised to the upside. Two-year yields are now off the highs but still up 7bps as traders firm up bets on the BOE raising interest rates to 6%. The pound rallied initially but has since turned lower, falling 0.4% versus the greenback. To that point, Pooja Kumra, senior European rates strategist at Toronto Dominion Bank said that rampant price pressures in the UK may sway global central banks against a downshift to easier policy.

“A key risk for markets is whether Powell provides any conditions for the FOMC getting back to their hiking cycle after a pause in June,” Kumra said.

“Everybody is expecting a strong, higher-for-longer message from Powell,” said Derek Halpenny head of research at MUFG of the Fed Chair’s testimony later today. “But it is hard to envisage this message resonating with markets in a dramatically different way to last week.”

Powell prepares to give his semi-annual report to Congress on Wednesday, where he’s expected to reiterate warnings that higher rates may be needed to combat inflation. While Fed policymakers kept interest rates unchanged at their meeting last week, their forecasts imply around two additional quarter-point rate hikes or one half-point increase.

European equities were steady as investors prepared for the congressional testimony of Federal Reserve Chair Jerome Powell, while hotter-than-expected UK inflation figures kept a lid on sentiment. The Stoxx Europe 600 was down less than 0.1% with the FTSE 100 Index erasing losses of as much as 0.6% to trade flat. Real estate stocks were among the worst performers while automotive shares outperformed after a report showed auto sales in Europe continued their upward trajectory in May. Here are some of the most notable European movers:

- Adidas rises as much as 4.4% as UBS upgrades shares to buy, citing early signs of brand inflection driven by its Lifestyle offering, as well as improved margins

- Argenx rises as much as 3.3% after the US drug regulator approved Vyvgart Hytrulo subcutaneous injection to treat generalized myasthenia gravis, news analysts say might further boost sales

- Husqvarna gains as much as 7.1%, the most since April, after the Swedish lawn-care firm was upgraded to hold from sell at DNB, which said it’s time to focus on the investment case beyond 2023

- Halfords shares rise as much as 8%, the most since April, after the car parts and bicycles retailer said recent trading has been solid and Peel Hunt upgraded the stock to buy from add

- THG shares jump as much as 11% after the online retailer said it sees a “significant” increase in 1H profitability, a trading update that Jefferies called “encouraging”

- AO World shares advance 3.1%, reaching the highest level since April 2022, after Davy upgraded the home- appliances retailer to outperform, saying the firm continues to overdeliver

- Beijer Ref falls as much as 9.2% after an offering of 40m class B shares by EQT IX fund priced at SEK140 apiece, representing a discount of 7.2% to Tuesday’s closing price

- Aedifica falls as much as 4.9%, as the Belgian real estate firm announced a public offering of approximately €380 million, with new shares to be issued at a discount to Tuesday’s closing price

- Kojamo is the the worst performer on the Stoxx 600 Real Estate index after Barclays double-downgraded the shares to underweight on a disappointing occupancy rate recovery

- Real estate is overall the worst-performing sector in Europe Wednesday after UK inflation remained higher than expected for a fourth month, stoking bets that interest rates need to keep rising

- Pirelli shares fall as much as 2.3% after Oddo BHF downgraded the Italian tiremaker to neutral from outperform, noting that the departure of designated CEO successor Giorgio Bruno is the “last straw”

- European delivery companies fall on Wednesday after FedEx gave a 2024 profit outlook below analyst expectations as a drop in package demand offsets the CEO’s $4 billion cost-cutting plan

Earlier in the session, Asian stocks were mixed following the negative handover from Wall Street as participants look ahead to Fed Chair Powell’s testimony in Congress.

- Hang Seng and Shanghai Comp. were lower again with Hong Kong underperforming on tech losses and as sentiment in the mainland remained dampened by the weaker outlook with HSBC cutting China’s GDP forecast to 5.3% from 6.3%, while the PBoC’s continued liquidity efforts and the recent US-China rhetoric did little to spur risk appetite.

- Australia’s ASX 200 was dragged lower by weakness in the commodity-related sectors and the mood was not helped by the deterioration in the Australian Westpac Leading Index.

- Japan’s Nikkei 225 was initially pressured but then clawed back losses with SoftBank among the biggest gainers during its AGM where CEO Son noted that AI is about to grow explosively and the time has come to shift to offence mode, while there were also comments from BoJ’s Adachi who stuck to the dovish script.

- Indian stocks jumped to new all-time highs, driven by a rise in HDFC Bank and Housing Development Finance Corp. The S&P BSE Sensex rose 0.3% to close at 63,523.15 in Mumbai, while the NSE Nifty 50 Index advanced 0.2% to 18,856.85. Strong foreign inflows, improving outlook for corporate earnings and one of the fastest economic growth rates among major economies have also buttressed gains in the stock market. “FPI inflows into India in recent months may simply be driven by the top-down excitement of foreign households around India,” Sanjeev Prasad, co-head of institutional equities at Kotak Institutional Equities said in a note. HDFC Bank contributed the most to the Sensex’s gain, increasing 1.7%. Out of 30 shares in the Sensex index, 14 rose, while 16 fell.

In FX, the Bloomberg Dollar spot index is up 0.1%, while the pound fell after erasing early gains on the back of another shock inflation reading. TSDJPY rose as much as 0.5% reversing yesterday’s drop on intervention jawboning, while USDGBP reversed its earlier 0.3% decline to climb as much as 0.5%, as the pound whipsawed after a hotter-than-expected UK inflation print

In rates, treasuries were slightly cheaper across the curve while gilts slide in a sharp bear-flattening move after UK inflation data surprised to the upside. Treasury yields cheaper by 1bp to 2bp across the curve with spreads broadly remaining within 1bp of Tuesday session close; 10-year yields around 3.75% are cheaper by 2bp on the day with gilts underperforming by additional 6bp in the sector. UK benchmark gilt yields climbed six basis points as traders ramped up bets for further Bank of England interest-rate hikes to a level not seen since the turn of the century a day before a policy meeting. UK 2-year yields off cheapest levels of the day, although remain higher by 12.5bp into early US session after latest UK infaltion shock. US session focus will be on Fed Chair Powell’s congressional testimony at 10am New York time, before focus shifts to 20-year bond auction later.

In commodities, crude futures are flat with WTI trading near $71.10. Spot gold is little changed around $1,935. Bitcoin rises 2.6%

Bitcoin is firmer on the day and approaching USD 29,000 to the upside whilst Ethereum rose above USD 1,800 earlier in the session.

To the day ahead now, and one of the main highlights will be Chair Powell’s testimony before the House Financial Services Committee. Over at the Senate Banking Committee, there’ll also be Fed nomination hearings for Governor Jefferson to become Vice Chair, Governor Cook for an additional full term as Governor, and for Adriana Kugler to become a Governor. Alongside that, we’ll hear from the Fed’s Goolsbee, and the ECB’s Schnabel, Nagel and Kazimir. On the data side, we’ll get the UK CPI reading for May.

Market Snapshot

- S&P 500 futures little changed at 4,435.50

- MXAP down 0.7% to 166.31

- MXAPJ down 1.0% to 523.16

- Nikkei up 0.6% to 33,575.14

- Topix up 0.5% to 2,295.01

- Hang Seng Index down 2.0% to 19,218.35

- Shanghai Composite down 1.3% to 3,197.90

- Sensex up 0.3% to 63,488.37

- Australia S&P/ASX 200 down 0.6% to 7,314.91

- Kospi down 0.9% to 2,582.63

- STOXX Europe 600 little changed at 458.87

- German 10Y yield little changed at 2.43%

- Euro up 0.1% to $1.0930

- Brent Futures down 0.3% to $75.71/bbl

- Gold spot down 0.1% to $1,934.11

- U.S. Dollar Index little changed at 102.56

Top Overnight News

- Chinese policymakers are facing growing calls for economic stimulus, this time from several prominent state media and top government advisers. The country’s three main state-run securities newspapers ran front-page articles Wednesday saying the central bank is likely to ease monetary policy further, citing well-known economists. BBG

- China extended tax breaks for consumers buying clean cars through 2027, estimated to be worth 520 billion yuan ($72.3 billion) in the coming four years, in an effort to bolster its flagging electric-vehicle industry. BBG

- China said US President Joe Biden had made a “public political provocation” by referring to his Chinese counterpart Xi Jinping as a “dictator,” as fresh tensions flared in bilateral ties just days after meetings to stabilize relations. Chinese Foreign Ministry spokeswoman Mao Ning called the US leader’s comments “irresponsible” at a regular press briefing in Beijing. BBG

- BlackRock’s Larry Fink says investors are shifting money out of Chinese equities and into Japanese ones due to rising geopolitical risks between Beijing and the West. Nikkei

- Three Federal Reserve nominees (Philip Jefferson, Adriana Kugler, Lisa Cook) said tackling US inflation would be their top priority if confirmed to roles at the central bank. BBG

- UK inflation runs hot in May, with the CPI overshooting the Street on headline (+8.7% vs. the St +8.4% and vs. +8.7% in April) and core (+7.1% vs. the Street +6.8% and vs. +6.8% in April), raising pressure on the BOE ahead of the Thurs meeting. FT

- Corporate America is feeling the pinch from the slowdown in Wall Street’s $1.4tn market for junk-rated loans, with a growing list of companies forced either to pay more or abandon borrowing plans. Borrowers have been hit by shifts in the market for collateralized loan obligations, or CLOs, the investment vehicles that own roughly two-thirds of lowly rated US corporate loans. FT

- Silicon Valley companies are dumping office space at an accelerating pace, as tech leaders such as Google and Facebook parent Meta Platforms close locations and reassess their commitments to the workplace. WSJ

- FedEx gave a 2024 profit outlook below analyst expectations as a drop in package demand offsets Chief Executive Officer Raj Subramaniam’s $4 billion cost-cutting plan. BBG

- Money-market funds are placing less cash in a Federal Reserve borrowing program, a sign that efforts to replenish government coffers after the debt-ceiling fight aren’t disrupting markets. Instead, funds are likely stepping up to buy more Treasury bills. WSJ

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were mostly subdued following the negative handover from Wall St amid the lack of bullish macro drivers and as participants look ahead to Fed Chair Powell’s testimony in Congress. ASX 200 was dragged lower by weakness in the commodity-related sectors and the mood was not helped by the deterioration in the Australian Westpac Leading Index. Nikkei 225 was initially pressured but then clawed back losses with SoftBank among the biggest gainers during its AGM where CEO Son noted that AI is about to grow explosively and the time has come to shift to offence mode, while there were also comments from BoJ’s Adachi who stuck to the dovish script. Hang Seng and Shanghai Comp. were lower with Hong Kong underperforming on tech losses and as sentiment in the mainland remained dampened by the weaker outlook with HSBC cutting China’s GDP forecast to 5.3% from 6.3%, while the PBoC’s continued liquidity efforts and the recent US-China rhetoric did little to spur risk appetite.

Top Asian News

- US President Biden said Chinese President Xi didn’t know where the balloons were and didn’t know a balloon was blown off course. Furthermore, Biden referred to Xi as a dictator and stated that Xi is in a position where he desires a resumption of relations with the US, while Biden also commented that climate envoy John Kerry may travel to China soon, according to Reuters.

- EU Summit draft conclusions call on China to engage in global challenges including climate change, biodiversity and debt relief, according to an EU official.

- Nasdaq executives plan to visit China this year to restart data partnership talks with companies there about access to economic data desperately sought by Western investors, according to Semafor.

- BoJ Governor Ueda says Japan’s economy is picking up; the economy is likely to recover moderately; BoJ will patiently maintain easy monetary policy, according to Reuters.

- BoJ Board Member Adachi said inflation is faster than he expected but noted it is too early to tweak easy monetary policy and that their baseline price scenario is bound with uncertainty. Adachi said there are both upside and downside risks to the price outlook and longer-run downside risks appear to be bigger, while he reiterated it is appropriate to continue monetary easing under the YCC framework. Adachi said if the bond market function remains in the current state, then the chance of tweaking YCC in July is low.

- BoJ April meeting minutes stated members said it is important to continue with monetary easing and that a few members pointed out that past price increases in commodities and raw materials continued to be passed on to consumer prices with a time lag. BoJ minutes stated that they must support wage moment with easing and wage gains are needed for sustainable inflation goal, while some members said it was appropriate for the Bank to continue with current monetary easing due to the difficulty of assessing the suitability of future wage hikes and developments in inflation expectations.

- Japanese PM Kishida said they are to mobilise all policy steps to ensure wage growth; positive moves are emerging in Japan’s economy, according to Reuters.

European bourses trade with little in the way of firm direction with the main macro story of the session thus far coming via UK inflation metrics. US equity futures trade in close proximity to the unchanged mark with the ES holding below the 4450 mark after yesterday’s selling pressure. Equity sectors in Europe have a slight negative bias with Real Estate names lagging peers as UK homebuilders suffer post-UK CPI.

Top European News

- The Times’ Shadow MPC voted 6-3 in favour of the BoE raising rates by 50bps this week (vs. market expectations of a 25bps move) in an “aggressive move to fight back against stubbornly high inflation”

- UK Chancellor Hunt says will not hesitate in our resolve to support the BoE as it seeks to squeeze inflation out of the economy, according to Reuters.

- ECB’s Kazimir said in September a continuation of tightening policy is not certain; does not expect inflation to drop soon, via Reuters.

- ECB’s Rehn will apply for leave of absence from the Central Bank if he becomes a presidential candidate, according to Reuters.

FX

- DXY is on a firmer footing after finding overnight support at exactly 102.50, with a softer JPY and GBP keeping the index underpinned but a resilient EUR hampering gains.

- GBP only knee-jerked higher on the hotter-than-expected CPI before shedding all and more of its gains in what seemed to be a realisation of the adverse economic implications from further and perhaps more aggressive BoE tightening.

- Yen is softer as Treasuries retreated and BoJ Board member Adachi stuck to dovish guidance overnight.

- Aussie remains top-heavy in the aftermath of not-so hawkish as anticipated RBA minutes yesterday alongside more pronounced Yuan depreciation overnight.

- Euro maintains 1.0900+ status with tailwinds from EUR/GBP and EUR/JPY (latter almost matching the new midweek y-t-d peak)

- PBoC set USD/CNY mid-point at 7.1795 vs exp. 7.1802 (prev. 7.1596)

Fixed Income

- Bunds complete a full recovery from worst levels with the help of strong demand for long-end German issuance.

- Gilts saw a remarkable bounce after gapping lower at the open as markets ponder the economic implications of further BoE tightening.

- US Treasuries have also regained composure ahead of Fed Chair Powell alongside several other Fed speakers and supply on the calendar.

Commodities

- WTI and Brent August futures see sideways trade in crude futures, with gains hampered by the hotter-than-expected UK CPI data ahead of tomorrow’s BoE announcement.

- Spot gold consolidates ahead of Fed Chair Powell’s testimony and after the yellow metal’s hefty losses yesterday upon a breach of the 100 DMA.

- Base metals are mixed amid the indecisive tone in the market, with copper prices relatively contained.

- Russia’s Kremlin said there are no grounds to extend the Black Sea Grain Deal because it’s not being implemented, according to Reuters.

Geopolitics

- Russian Defence Ministry says it has thwarted an attempt by Kyiv to launch an attack on the Moscow region with drones; all drones were shot down, according to Tass and Ria.

- Russia’s Navy is to receive 2 new nuclear submarines by year-end, according to TASS.

- China’s Ministry of Foreign Affairs commented on the US’ Taiwan position in which it stated that the US has distorted its political promise to China.

- Shanghai Cyberspace Regulator says they have summoned three companies including Starbucks (SBUX) and Shake Shack (SHAK) for collecting excessive personal information, according to Reuters.

US event calendar

- 07:00: June MBA Mortgage Applications, prior 7.2%

DB’s Jim Reid concludes the overnight wrap

Tonight I’m going to see the Lion King……… performed by 7-year-olds. It will be a case of “Can you feel the out of tune singing and forgotten lines tonight”. Maisie is Timon the Meerkat and the 5-year-old twins are part of the choir with no evidence that they know many of the words. So like with the ChatGPT webinar there is plenty that can go wrong for our family today. It truly could be the longest day as we hit the summer solstice.

With markets largely taking a “hukana matata” attitude in recent weeks to all that has been thrown at it, some strains have appeared in the last few days. The S&P 500 (-0.47%) saw a moderate decline, with the equal weight index (-0.91%) again under-performing. This was the first back-to-back losses since the last full week of May, which shows the recent momentum. This wasn’t just a catch-up to Monday’s losses, since Europe’s STOXX 600 (-0.59%) lost ground for a second day running as well. These declines were evident across several asset classes, with HY credit and energy commodities seeing moderate losses of their own recheck. In fact, the only assets that managed to hold their ground were a few safe havens like sovereign bonds, with yields on 10yr bunds (-11.2bps) seeing their largest daily decline since April.

Whilst little was driving weaker sentiment over the last 48 hours, news flow should begin to pick up again today. Just after this arrives in your inbox, we’ll see UK inflation which given all the news flow about domestic rates and mortgages of late will be a must watch and could have 2-way spillover effects for global bonds and risk. Last month saw a big upside surprise that was then exacerbated by some very strong employment data, leading investors to ratchet up their expectations of future rate hikes (2yr yields c.+85bps since). For today’s reading, our UK economist is expecting a modest decline in headline inflation to +8.5%, having been at +8.7% in April.

Later on, we’ve got an appearance from Fed Chair Powell in front of the House Financial Services Committee at 15:00 London time, and then an appearance before the Senate Banking Committee tomorrow. That’s part of the regular semi-annual Monetary Policy Report to Congress and follows the FOMC’s decision last week to pause their rate hikes after 10 consecutive increases.

Given that the decision was only a week ago, it’s likely that Powell will stick to his main themes from the press conference. But it’ll be interesting to see how he frames the Fed’s decision last week, as the decision to pause rate hikes came alongside upgrades to their inflation and growth forecasts, as well as a signal in the dot plot that 2 further hikes were expected by December. Powell himself has said that he expects July to be a “live” meeting, and futures are pricing in a 74% chance that the Fed will deliver a hike next month. But there remains scepticism in markets that the Fed will be able to follow through on that second hike, with current terminal pricing only pointing to 23bps more hikes, rather than the 50bps indicated by the dot plot.

Ahead of that testimony, the yield curve grew increasingly inverted, with the 2s10s Treasury curve (-1.5bps) closing at -97bps. That’s the most inverted it’s been since SVB’s collapse, with only 3 days back in early March even more inverted over the last 41 years. There were fresh records set at other points on the curve. For instance, the 1s30s curve inverted to -144bps, which is the most in available data on Bloomberg back to 2002. Aside from the inversions themselves, yields fell in absolute terms across all maturities too, with the US 10yr yield coming down -4.1bps to 3.72%. Overnight, they have pushed back up 2bps to 3.74%.

Those US moves were fairly muted given the previous day’s holiday, but in Europe there was a much sharper decline in yields as they retraced Monday’s moves. That meant that yields on 10yr bunds (-10.6bps), BTPs (-9.1bps) and OATs (-10.8bps) all fell back. And when it came to German sovereign debt specifically, there was a big milestone as the 2s10s curve inverted beyond its low before SVB to -70.2bps, a level we haven’t seen since 1992. Here in the UK, we saw some of the most extreme moves once again, with 10yr gilts (-15.5bps) seeing a sharp move lower after their recent increase.

When it came to equities, as discussed at the top, the day was a negative one, with the S&P 500 down -0.47% despite paring its initial morning fall of almost 1%. The decline was broad-based across the main sector groups, with Energy (-2.29%) seeing the biggest losses amidst commodity price declines, but 21 of the 24 S&P industry groups lost at least some ground on the day. It was much the same story for the Dow Jones index (-0.71%), while the NASDAQ (-0.16%) fared better mostly thanks to Tesla (+5.43%), which gained following news that electric truck manufacturer Rivian would adopt Tesla’s charging standard. And in Europe it was another weakish day, with the STOXX 600 (-0.59%) and the DAX (-0.55%) down for a second consecutive session.

Asian equity markets are largely trading lower this morning, with Chinese related stocks leading losses. The Hang Seng (-1.91%) is sharply down, extending losses for the third consecutive session while the CSI (-0.70%) and the Shanghai Composite (-0.41%) are also sliding as China’s more modest rate cut yesterday is weighing on the sentiment. Elsewhere, the KOSPI (-0.65%) is also trading in the red while the Nikkei (+0.40%) is bucking the trend, reversing its opening losses. Outside of Asia, US stock futures are fluctuating with those on the S&P 500 (-0.03%) and NASDAQ 100 (-0.04%) just below flat. A profit warning from FedEx after the bell hasn’t damaged overall sentiment.

Minutes from the Bank of Japan’s April meeting indicated that several board members agreed that the central bank should continue to keep ultra-low interest rates. The meeting was the first to be held under the leadership of the new BOJ Governor Ueda Kazuo. Otherwise, the minutes revealed that one of the nine board members suggested that the bank should reconsider its policy of keeping bond yields low.

Amidst the negativity yesterday, one bright spot came from the US housing data for May. That showed housing starts leapt up to an annualised rate of 1.631m (vs. 1.4m expected), which is the highest they’ve been in 13 months. Furthermore, the one-month increase of +21.7% was the largest in a single month since October 2016, so these weren’t the sort of moves you regularly see. At the same time, building permits came in at a 7-month high of 1.491m (vs. 1.425m expected). The data adds to signs that the housing market has been stabilising, and on Monday we also saw the NAHB’s housing market index improve for a 6th consecutive month. With housing having been the sector most immediately affected following the initial hiking cycles last year, recent signs of its stabilisation may raise new questions over the transmission of central bank tightening into the economy.

To the day ahead now, and one of the main highlights will be Chair Powell’s testimony before the House Financial Services Committee. Over at the Senate Banking Committee, there’ll also be Fed nomination hearings for Governor Jefferson to become Vice Chair, Governor Cook for an additional full term as Governor, and for Adriana Kugler to become a Governor. Alongside that, we’ll hear from the Fed’s Goolsbee, and the ECB’s Schnabel, Nagel and Kazimir. On the data side, we’ll get the UK CPI reading for May.

Loading…

https://www.zerohedge.com/markets/futures-flat-ahead-powell-testimony