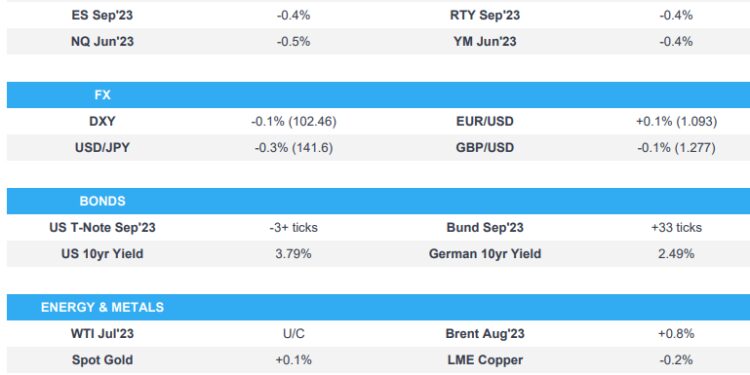

- European bourses & US futures are pressured ahead of the return of US participants and key Fed speakers

- DXY has drifted after a brief/small extension to 102.62, JPY rebounds though notes OpEx while AUD lags after RBA Minutes

- PBoC cut the LPRs as expected, though the 5yrs magnitude disappointed some expectations; Biden said relations are on the correct trail

- EGB benchmarks consolidation topped out near round figures with UTS paring losses in response though still underwater

- Crude benchmarks pare to near unchanged, spot gold rangebound while base metals languish on ongoing APAC economic concerns

- Looking ahead, highlights include US Building Permits & Housing Starts, Speeches from Fed’s Williams, Barr & Bullard, ECB’s de Guindos

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

JUNETEENTH RECAP

- Chinese President Xi said he hopes the visit by Secretary Blinken could make positive contributions to stabilizing US-China relations, made the position clear to Blinken. Adds, “very good” progress was made on US-China ties and China respects US interests and does not seek to challenge or displace the US; hopes to see a sound and steady China-US relationship.. Follows a meeting between Blinken and Yi/Gang, which was described as “good or not bad” by Hu Xijin.

- US Secretary of State Blinken says US is clear-eyed about the challenges that China poses; has had important conversations with Xi.

- US President Biden said he is hoping to meet with Chinese President Xi in the next several months. Prior to the above meeting occurring.

- Goldman Sachs cuts China’s GDP growth target for 2023 to 5.4% from 6.0% and cuts 2024 target to 4.5% from 4.6%, while it says China’s ongoing stimulus is incapable of generating a strong growth impulse. Nomura has recently reduced its Chinese 2023 GDP growth forecast to 5.1% from 5.5% and UBS also lowered its China 2023 growth forecast to 5.2% from 5.7%.

- ECB’s Lane says inflation will come down fairly quickly in next couple of years to the 2% target; another hike in July seems appropriate, and then we will see in September.

- ECB’s Schnabel says the fact that we underestimated inflation persistence last year raises the probability that we are underestimating inflation now; need to remain “highly data-dependent”, err on side of doing too much rather than too little.

- Mid-June Manheim wholesale used vehicle index at 217.2mln, down 3.2% M/M and down 9.4% Y/Y.

- UK average two-year fixed mortgage rate increased from 5.98% on Friday to 6.01% early on Monday, according to Moneyfacts.

EUROPEAN TRADE

EQUITIES

- European bourses are under pressure, Euro Stoxx 50 -0.4%, with broader macro updates somewhat light ahead of more Central Bank speak.

- Sectors are mainly in the red with Chemicals lagging after a Lanxess profit warning while Health Care outperforms after a favourable Sanofi litigation update.

- Stateside, futures are softer with pressure picking up as the European morning progresses and the ES moves below 4450, ES -0.4% ahead of Fed speak incl. voters Williams & Barr before Powell on Wednesday/Thursday.

- Adobe (ADBE) USD 20bln deal to acquire Figma is under threat from EU investigation, according to FT.

- Lockheed Martin (LMT) has raised concerns to the FTC and US DoD about L3harris’ (LXH) acquisition of Aerojet Rocktdyne (AJRD).

- Click here and here for a recap of the main European updates.

- Click here for more detail.

FX

- DXY drifts after a small extension of recovery rally to 102.620, but keeps sight of 102.500 as US markets return from the Juneteenth holiday.

- Yen rebounds sharply and swiftly after a false break below 142.00 vs Dollar where decent circa 2bln option expiry interest resides.

- Aussie loses 0.6800+ status against Greenback as RBA minutes reveal finely balanced 25bp June hike.

- Euro defends 1.0900 vs Buck again and probes Fib resistance, Pound pulls back from just over 1.2800 against Dollar on the eve of UK CPI data.

- Click here for notable OpEx for the NY Cut.

- Click here for more detail.

FIXED INCOME

- Bunds and Gilts bounce further from Monday’s lows in consolidative trade before topping out ahead of 133.00 and just over 94.50 respectively.

- US Treasuries pare catch-up losses in response as T-note hovers above worst levels within 112-23/113-07+ range.

- 2 and 5 year German and UK supply reasonably well received, but not snapped up given 3%+ and close to 5% respective yields.

- UK sells GBP 3.75bln 4.50% 2028 Gilt; b/c 2.39x, average yield 4.932% and tail 0.7bps.

- Germany sells EUR 4.488bln vs exp. EUR 5.5bln 2.80% 2025 Schatz: b/c 1.4x (prev. 1.30x), average yield 3.15% (prev. 2.82%) & retention 18.4% (prev. 18.52%)

- Click here for more detail.

COMMODITIES

- Crude benchmarks are essentially flat after paring opening losses which seemingly emanated from ongoing Chinese growth concerns with more desks downgrading their 2023 view while the PBoC cut its LPRs.

- WTI and Brent are currently in proximity to the USD 72.00/bbl and USD 77.00/bbl marks, towards the top-end of their respective ranges.

- Spot gold is relatively rangebound in-fitting with relatively contained action for the DXY thus far, with the 100-DMA in proximity at USD 1942/oz. Conversely, base metals remain subdued continuing APAC performance given economic concerns out of China and a shallower-than-expected 5yr LPR cut.

- Seaborne shipments of June-loading Russian Urals oil to China fell 50% for June 1st-19th M/M.

- Qatar is set to strike a second big LNG supply deal with China, according to FT.

- China 2023 Crude Oil demand is seen at 740mln metric tons, +3.5% Y/Y, according to CNPC Research. Diesel demand is seen reaching 98.9% of 2019 level. Kerosene demand around 95% of 2019 level. Gasoline demand seen up 0.8% vs 2019 level.

- Click here for more detail.

NOTABLE EUROPEAN HEADLINES

- ECB’s de Guindos said there is no doubt that inflation will ease but also noted the slowdown in core inflation may be limited, according to Bloomberg.

- ECB’s Stournaras said a further decrease in inflation is expected and they cannot exclude a further hike but cannot say now and decisions are data-driven. Furthermore, Stournaras responded that it might be six months or a year and it depends on the data when asked about keeping rates at the terminal and said they are definitely close to the end of rate hikes.

- EU is to focus on export controls and critical technology in its security plan, according to Bloomberg.

- EU countries failed to agree on a deal on power market reforms and talks will continue after Monday.

- NHC said Tropical Storm Bret is expected to strengthen and interests in the Lesser Antilles should monitor the system, while it added that Bret could become a hurricane in a couple of days and is about 1,210 miles east of the southern Windward Islands.

- The European Commission will today ask EU member countries to contribute “tens of billions of euros more” to top up the Union’s budget for 2024-2027, according to Politico.

NOTABLE DATA

- German Producer Prices YY (May) 1.0% vs. Exp. 1.7% (Prev. 4.1%); MM (May) -1.4% vs. Exp. -0.7% (Prev. 0.3%)

CRYPTO

- Coinbase (COIN) says PayPal (PYPL) sells or withdrawals are currently unavailable for UK/CA customers, according to its status page.

GEOPOLITICS

- Beijing plans a new training facility in Cuba which raises the prospect of Chinese troops on America’s doorstep, according to WSJ.

- Ukraine’s Deputy Defence Minister said the biggest blow in Ukraine’s offensive is yet to come, while he added that it is difficult to advance and Ukraine must prepare for a tough duel, according to Reuters.

- Kyiv is in talks with Western arms manufacturers to boost output and set up production in Ukraine, according to Reuters.

- EU is readying a EUR 50bln Ukraine package, according to Bloomberg,

- EU report on Ukraine’s membership bid said Kyiv has met 2 out of the 7 conditions to start formal accession talks, according to Reuters citing sources.

- US President Biden said the threat of Russian President Putin using tactical nuclear weapons is ‘real’, according to Reuters.

- Russian Defence Minister says Ukraine plans to hit Crimea with Himars and Storm Shadows, according to Tass; says the use of these weapons would mean full-scale involvement of the US and the UK in the Russia-Ukraine conflict.

APAC TRADE

- APAC stocks were mostly lower with risk appetite subdued in the absence of a lead from Wall St due to the Juneteenth holiday and as markets digested the PBoC’s cuts to its benchmark lending rates.

- ASX 200 was led higher by gains in the commodity-related sectors and following the RBA Minutes from the June meeting which noted that the arguments were “finely balanced” between a 25bps hike or keeping rates steady at the last meeting, while money markets are currently leaning towards rates being kept unchanged for next month.

- Nikkei 225 was negative although the losses were stemmed and the index held above the 33,000 level with several major Japanese trading houses dominating the list of best performers after Berkshire Hathaway lifted its stake in five of them.

- Hang Seng and Shanghai Comp. declined despite the PBoC’s liquidity boost and 10bp cuts to its benchmark Loan Prime Rates. This was widely expected for the 1-year LPR after similar cuts to short-term funding rates but disappointed those anticipating a deeper 15bps cut for the 5-year LPR which is viewed as the reference for mortgages and in turn, weighed on HK-listed mainland developers.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Jun) 3.55% vs. Exp. 3.55% (Prev. 3.65%)

- Chinese Loan Prime Rate 5Y (Jun) 4.20% vs. Exp. 4.15% (Prev. 4.30%)

- PBoC injected CNY 182bln via 7-day reverse repos with the rate at 1.90% for a CNY 180bln net injection.

- US President Biden said US-China relations are on the right trail, according to Reuters.

- US Secretary of State Blinken said he is deeply concerned about the three Americans wrongfully detained in China, according to CBS.

- Chinese Premier Li held talks with the German business sector on Monday in which the meeting discussed the economic situation in China and globally, technology development trends, and views on so-called “de-risking”, according to Global Times.

- Japan’s Foreign Ministry called on China to take seriously WTO findings that China’s anti-dumping measures on Japan’s stainless steel are inconsistent with the WTO agreement, according to Reuters.

- RBA Minutes from the June meeting stated that the Board considered a rate rise of 25bps or holding steady and reconsidering at a later meeting, while arguments were finely balanced but the Board decided the case for an immediate hike was stronger. RBA noted the increase would provide greater confidence that inflation would return to target over the period ahead, while it stated the balance of risks on inflation shifted to the upside compared with a month earlier and lags in the transmission of monetary policy meant there is a risk that past tightening could lead to a sharper economic slowdown.

Loading…

https://www.zerohedge.com/markets/equities-slip-aud-sinks-rba-minutes-pboc-disappoints-fed-speak-due-newsquawk-us-market-open